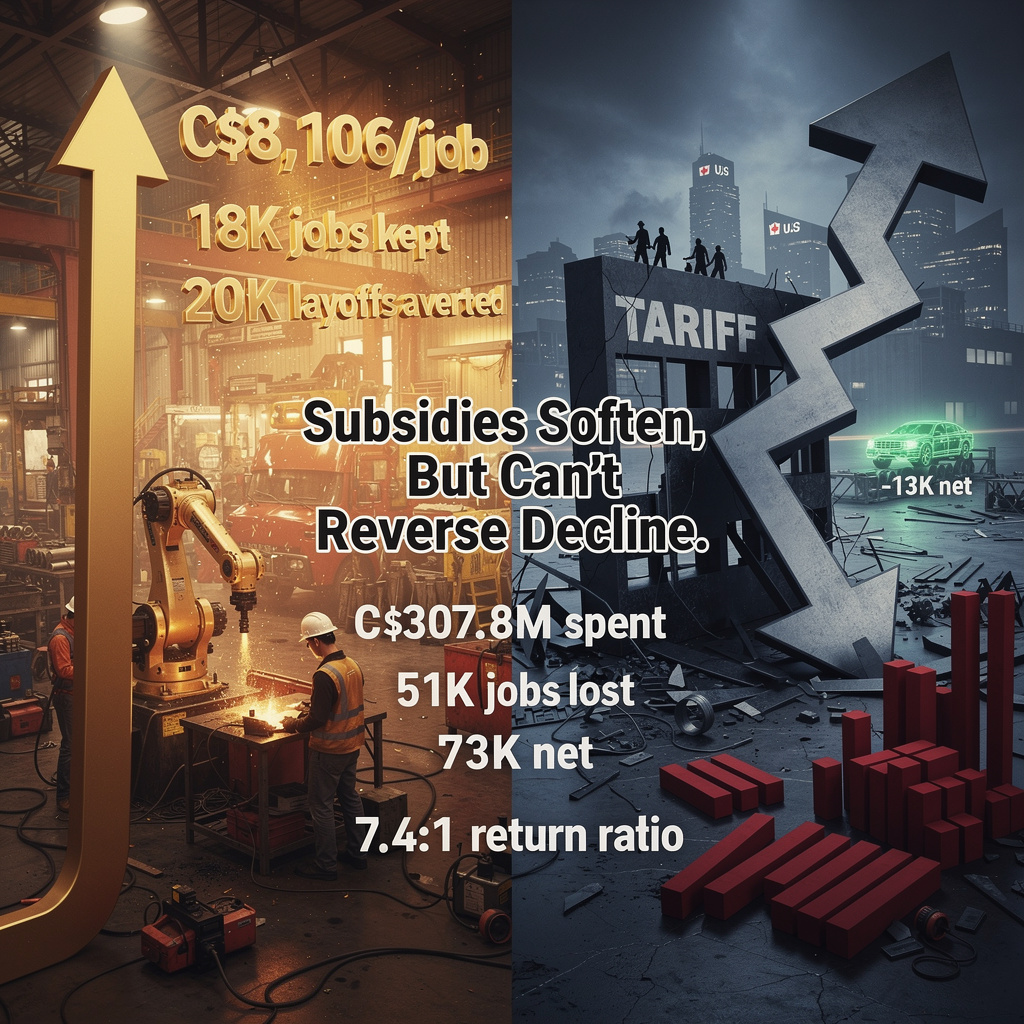

C$307.8M Spent to Save Jobs—But 13,000 Still Lost: GM’s $10B Profits Contrast with Ontario Factory Cuts

🇨🇦 C$307.8M Subsidy Saves 38,000 Jobs in Canada—But Manufacturing Still Loses 13,000 Amid U.S. Tariffs

C$307.8M spent to save 38,000 manufacturing jobs 🇨🇦—but 13,000 jobs still vanished anyway. For every job preserved, taxpayers paid over $8,100. Meanwhile, GM made $10B in North American profits while cutting shifts in Oshawa. Who bears the real cost of trade wars—workers, taxpayers, or corporate balance sheets? — Ontario manufacturing families, are you seeing the return on this investment?

Prime Minister Mark Carney’s team spent C$307.8 million in the past year to keep 18,000 steel, aluminum, and auto workers on payroll and to stop 20,000 more from receiving pink slips. Yet tariff-sensitive manufacturing still shed 51,000 positions, leaving a net hole of 13,000 jobs and a clear message: subsidies can soften the blow, but they don’t reverse structural decline.

How the rescue worked

Ottawa approved 1,450 employer agreements covering 48,979 employees. Firms reduced hours instead of head-counts; the state topped up wages. The average cost per protected or averted job: C$8,106—about two weeks of payroll for a C$60,000 position. First-time employment-insurance claims in the targeted sectors stayed low at 8,360, confirming the program reached its immediate goal.

Impacts at a glance

- Payroll preserved: C$2.28 billion in annual wages → household spending stability in Oshawa, Ingersoll, and B.C. interior towns.

- Layoffs averted: 20,000 workers kept benefits and seniority → reduced EI outlays and retraining demand.

- Net employment: –13,000 after accounting for 51,000 broader losses → tariff headwinds outweigh subsidy shield.

- Fiscal ratio: 7.4-to-1 first-year return if measured by wages saved versus cash spent, falling as support tapers.

Response & gaps

Observed: Work-sharing agreements and rapid cash flow prevented plant closures this winter.

Missing: No parallel requirement for firms to invest in automation or EV lines; no earmarked funds for worker up-skilling.

Risk: GM and Ford continue shifting next-generation assembly to U.S. sites to sidestep 25 % auto-content tariffs, limiting Ottawa’s leverage.

Outlook

2026-2027: Program likely extended; 18,000 protected jobs held steady, but quarterly EI claims expected to rise by ~1,000 as temporary measures expire.

Q3 2028: If Canada-U.S. duty talks fail, baseline manufacturing could lose another 30,000 roles despite subsidies.

2029-2030: Green-steel and battery-supply projects may add 5,000-7,000 positions—only if paired with R&D grants and trade-deal relief.

Bottom line

The $308 million lifeline bought time for 38,000 families, yet the sector’s employment curve still points downward. Long-term security will hinge less on cheque-book diplomacy and more on faster tariff resolution, aggressive upskilling, and capital attraction into future-proof plants.

In Other News

- U.S. Job Market Shows Flat Growth as AI Cited in 7,624 January Layoffs

- Foursquare Flattens Org Structure, Eliminates Manager Roles to Boost Engineering Autonomy

Comments ()