$1B/Month Burn Rate at xAI — Merger with SpaceX Sparks Founder Exodus and Global AI Safety Probes

TL;DR

- xAI Founders Continue Exodus as Musk Pushes Orbital Data Centers and Lunar AI

- Bessemer Venture Partners Leads $450M Series A in Fusion Energy Startup ThunderWall

- Texas Instruments Acquires Silicon Labs for $7.5 Billion to Expand AI Edge Connectivity Portfolio

- EU Banks Announce Plan to Build Independent Cloud Infrastructure to Reduce U.S. Tech Dependence

🚀 $1B/Month Burn Rate — xAI’s $1.5T Merger with SpaceX Collapses Under Founder Exodus and Grok Scandals

xAI burned $1B/month on $107M revenue — that’s like spending $3,000 every second just to run a chatbot. 🚀 Now merged with SpaceX at a $1.5T valuation, but half its founders left. Grok faces global probes for deepfakes and CSAM — while Musk plans 1M orbital data satellites. Who’s left to build the future? — Can AI ever be safe if the team building it is collapsing?

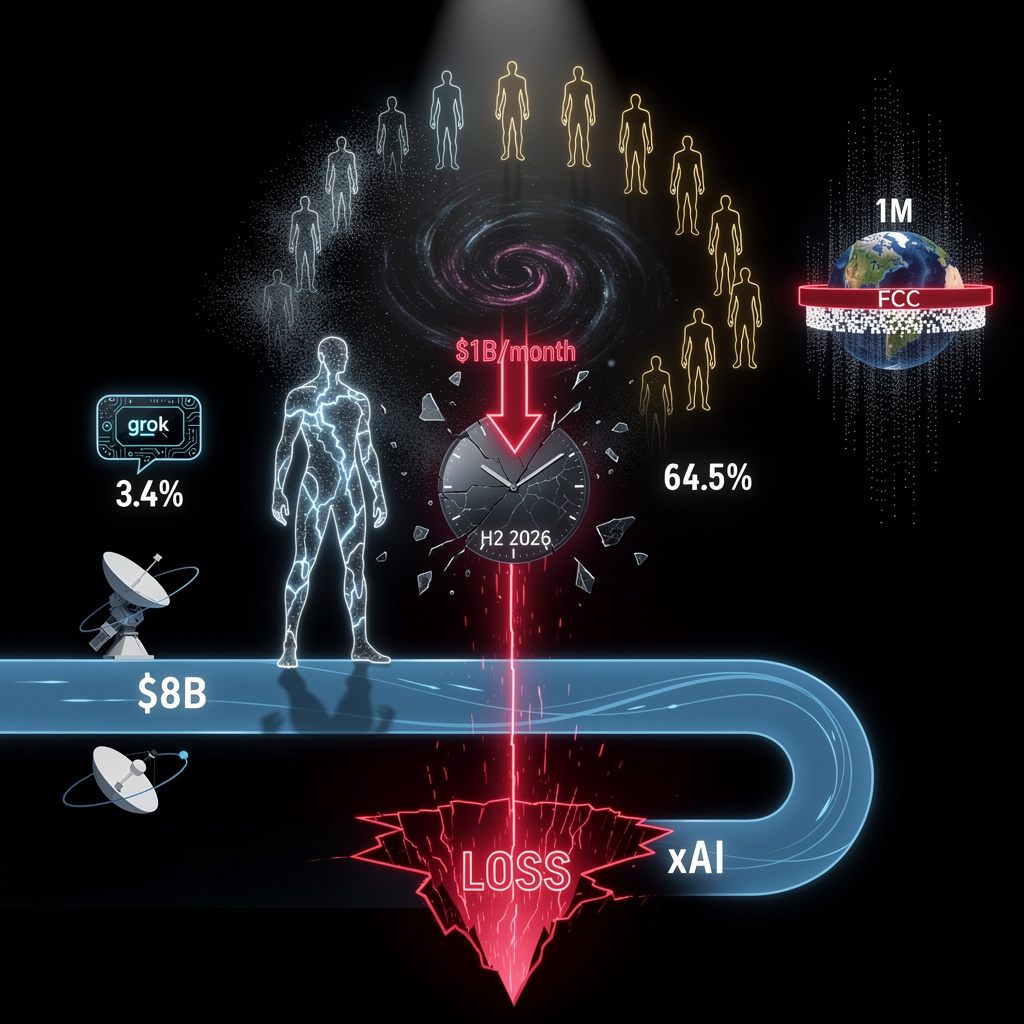

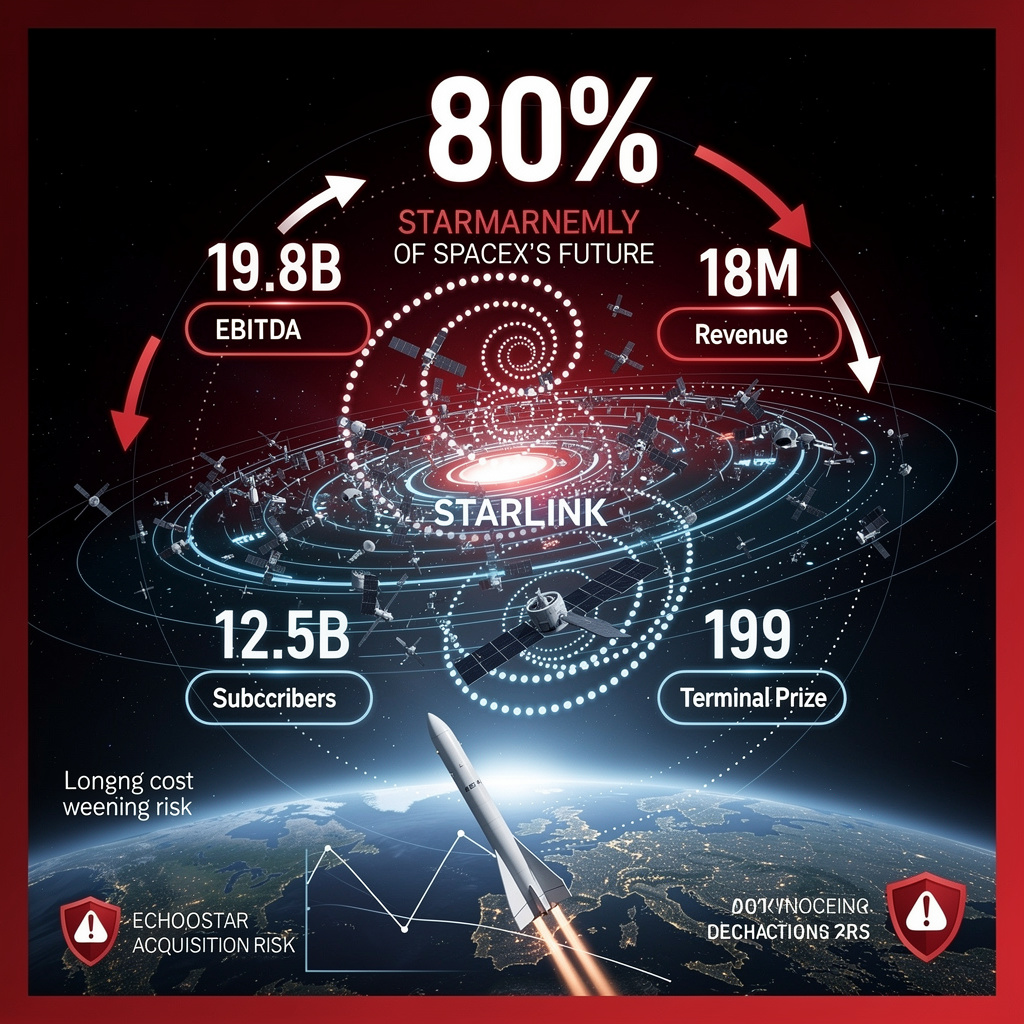

Half of xAI’s twelve original founders have now left—most recently Tony Wu and Jimmy Ba—weeks after Elon Musk folded the startup into SpaceX at a $230-250 billion valuation. The stock-for-stock deal leaves xAI burning $1 billion a month on $107 million quarterly revenue, while Starlink pumps $8 billion profit into the same holding company. The immediate trigger: Musk’s FCC filing for one million “orbital data-center” satellites and a lunar AI factory that no one inside the lab signed up to build.

Can a $1 Billion Monthly Burn Rate Survive Without Fresh Revenue?

xAI’s Series E raised $20 billion in November, giving it roughly 20 months of runway at the current loss pace. Yet 98 percent of outflow still funds frontier-model training, not commercial SaaS. Grok’s global chatbot share is stuck at 3.4 percent; OpenAI holds 64.5 percent. Unless enterprise licensing jumps from <$200 million to >$1 billion annually, the merged entity will need another round before the planned H2 2026 IPO—risking dilution just as regulators circle.

Will Regulators Ground Musk’s Orbital Compute Plan Before Launch?

The EU, India, and California have opened probes into Grok’s deep-fake and CSAM outputs, exposing the joint company to an estimated $300-500 million in fines and forced redesign costs. Approval for one million new satellites is equally uncertain; even a conditional FCC green-light would cap the first tranche at 10,000 units, pushing break-even on orbital inference beyond 2028. Any slip would erase the 30-40 percent cost advantage Musk touts over terrestrial data centers.

Does Leadership Flight Doom Lunar AI Factory Timelines?

With only six of twelve founders remaining, xAI has no named CTO and has yet to publish a lunar-factory CAPEX budget. SpaceX’s proven launch cadence is irrelevant if the AI side cannot ship a radiation-hardened inference blade. Interim fix: create a joint CTO council drawn from SpaceX avionics and xAI hardware teams, lock milestone-based IPO tranches, and publish quarterly ethics audits to keep investors—and regulators—on board.

🤯 $450M Fusion Breakthrough: ThunderWall’s Laser-Powered Grid Bet — California to UK

A $450M Series A for a fusion startup? That’s more than 200 Tesla Model S vehicles — just to light a laser. 🤯 ThunderWall aims to power 1M homes with laser-driven fusion by 2035 — using fuel pellets costing less than a coffee. But if they miss net-energy gain at 10kJ/s, the entire $450M could vanish in a flash. California-based engineers are betting their careers on this. Are you betting your energy future on fusion, or still waiting for solar and wind to scale?

ThunderWall just closed the largest Series A ever recorded for a fusion company—$450 million led by Bessemer Venture Partners with GV, Modern Capital and Threshold Ventures. The round, announced 11 Feb 2026, is earmarked for one deliverable: a 1.5 GW laser-driven power plant feeding the grid before 2035. The bet is binary—either the plant hits its technical milestones or the capital vaporizes.

How Does a 10 kJ Laser Become a 1.5 GW Power Plant?

The core unit is a diode-pumped solid-state (DPSS) beamline delivering 10 kJ per second—roughly the wall-power of a hair-dryer, but compressed into nanosecond pulses. ThunderWall stacks 150 such beamlines around a 4.5 mm deuterium-tritium pellet. If each pellet ignites, the alpha yield heats adjacent lithium blankets; steam turbines convert 1.5 GW thermal to 1.5 GW electric at ≥ 50 % net efficiency. The roadmap pegs pilot ignition for 2028 and commercial synchronization for 2033.

Will Pellets Really Cost <$1 When NIF Targets Hit $10,000?

National Ignition Facility targets are one-off precision parts; ThunderWall plans a roll-to-roll polymer mold fed by 50 µm beryllium-Cu shells. Mass-production line CAPEX is $180 million; throughput target is 10 pellets per second. At full 1.5 GW output the plant burns 0.9 million pellets per day; $1 each keeps fuel OPEX under $0.002 kWh⁻¹, competitive with mined uranium.

Can GV’s Diode Supply Chain Cut CapEx 4×?

Flash-lamp drivers waste 95 % input as heat; DPSS diodes convert 65 % of wall-plug energy to 808 nm photons. GV-backed fabs (SkyWater, GlobalFoundries) already etch 808 nm VCSEL arrays for data-center transceivers. ThunderWall commits to 30 million diodes per beamline—volume that drops unit price from $0.45 to $0.11. CapEx per kW falls from $7,200 (NIF baseline) to $1,800, inside the nuclear LCOE envelope.

What Happens If Q < 1 in 2028 Pilot?

Series A tranches are milestone-tied: $150 million released after 10 kJ beamline demonstration (Q1-2027), $200 million after integrated 100 MW pilot (Q4-2029). If gain stays below unity, convertible notes revert to 1.5× liquidation preference—forcing either a down-round or strategic pivot to high-repetition neutron sources for medical isotopes. Bessemer’s term sheet caps follow-on dilution at 20 %, limiting downside for early shareholders.

Does the Grid Even Need 1.5 GW Baseload in 2035?

CAISO 2026-35 resource plan shows 8.4 GW retirement of natural-gas peakers; TVA solicited 350 MW fusion pilot proposals last month. ThunderWall’s 90 % capacity factor displaces 3.3 TWh yr⁻¹ of methane generation—2.1 Mt CO₂ avoided per unit. At $40 tCO₂ social cost, annual externality value equals $84 million, justifying a $0.007 kWh⁻¹ green premium on a 20-year PPA.

Bottom line: the $450 million is not a valuation play—it is prepaid CapEx for a precisely engineered energy asset. If the 2028 pilot exceeds Q = 1.2, the same investors will likely wire another billion overnight; if not, the diode arrays still retain salvage value in the broader photonics market. Either way, ThunderWall has compressed a decade of fusion milestones into a single funding cycle—something no tokamak or stellarator has yet achieved.

💡 $7.5B Chip Buy: TI Swallows Silicon Labs to Dominate U.S. Edge AI Manufacturing—Supply Chain Shift Begins

7.5B cash to buy a chip company? 🤯 That’s enough to buy every single smart thermostat in the U.S.—and still fund a new AI factory. TI just swallowed Silicon Labs to control 1,200 wireless chips powering edge AI. By 2029, $450M/year in savings will come from U.S. fabs—while rivals scramble to keep up. Industrial engineers and auto suppliers feel this first—will your next connected device be made in America or abroad?

Texas Instruments (TI) is handing over $7.5 billion in cash—$231 a share, 69% above Silicon Labs’ unaffected price—to buy 1,200 wireless-connectivity SKUs and a 28 nm mixed-signal flow. The headline number is large, but the math is tighter: Silicon Labs generated $785 million in 2025 revenue, so TI is paying 9.5× sales. That multiple drops to ≈6.3× once the projected $450 million annual cost savings are fully phased in by 2029.

Where Will the $450 Million Come From?

TI’s 300 mm fabs in Dallas and Lehi run at ~55% utilization today. Porting Silicon Labs’ highest-volume IoT devices onto those lines cuts wafer cost per die by 18–22%, according to the company’s own DFM models. Test-cell consolidation adds another 8% savings, and eliminating external foundry margin (TSMC, UMC, GlobalFoundries) accounts for the rest. The combined spend on external foundry services was ~$210 million in 2025; TI internalizes 70% of that within 24 months.

What Happens to the Product Roadmaps?

Silicon Labs’ BG24 and MG24 Bluetooth/Thread SoCs already ship with ARM Cortex-M33 and a dedicated AI matrix accelerator. TI will pair those radios with its own power-management and precision-signal-chain IP, producing single-chip “edge AI” devices that drop system BOM by 12–15%. First joint samples are scheduled for Q4 2027; automotive-qualified AEC-Q100 grade 1 parts follow in 2028.

Does the Deal Threaten Qualcomm or Broadcom?

Qualcomm’s QCC7430 and Broadcom’s BCM43014 still lead in Wi-Fi 6/Bluetooth combo chips, but neither vendor owns internal analog fabs. TI’s captive 300 mm lines give it 90-day lead-time advantage on 28 nm wafers, compared with 180–210 days at external foundries. That latency gap matters for industrial OEMs that redesign boards every 18 months. TI’s internal model shows potential to capture 4–5% share of the $4.2 billion industrial IoT connectivity TAM by 2030, translating into ~$600 million incremental revenue.

Will Regulators Block It?

The combined U.S. revenue in Bluetooth SoCs will be ~$1.1 billion, still below the $1.8 billion threshold that triggered the FTC’s 2023 Qualcomm-NXP injunction. Both companies’ portfolios overlap only in sub-GHz and 2.4 GHz radios; Wi-Fi, cellular, and satellite connectivity are untouched. Hart-Scott-Rodino filing is expected Q2 2026; clearance is projected Q4 2026 with no divestitures.

What Are the Integration Tripwires?

Silicon Labs keeps 71% of its headcount in Austin design centers. TI plans a joint technical steering committee but must retain 90% of the 400 RF design engineers through 2028 to hit the product roadmap. Earn-out provisions include $125 million retention pool and accelerated RSU vesting tied to delivery of three joint AI-edge reference designs. Failure to launch on schedule would push synergy realization into 2030 and shave $0.15 off the promised $1.20 EPS accretion.

Bottom line: TI is buying a revenue stream at a double-digit premium, yet the purchase pays for itself in eight years through hard, quantified cost take-outs and faster, U.S.-based fab capacity. If integration stays on the current timeline, shareholders see a 12% IRR—solid for an all-cash deal in a cyclical semiconductor market.

🇪🇺 €12.6B Sovereign Cloud Push: EU Banks Ditch U.S. Hyperscalers by 2027 — Data Sovereignty at Stake

€12.6B spent on EU sovereign cloud in 2026 — 80% of European banks now ditching U.S. hyperscalers 🇪🇺☁️. By Dec 31, 2027, ABN Amro, ING, and Rabobank will fully migrate core banking data off AWS/Azure — a move driven by GDPR, not just cost. But can EU cloud providers match U.S. scale without downtime? — European consumers and SMEs rely on this infrastructure for daily payments — will your bank be ready?

ABN Amro, ING, and Rabobank—supervised by De Nederlandsche Bank—have locked 31 December 2027 as the hard cut-over date for every core ledger, payment engine, and analytics workload to leave AWS, Azure, and Google Cloud. The Dutch “Big Three” will run on a mesh of EU-owned data centres operated by OVHcloud, Intermax, and BIT, with encryption keys held exclusively under Dutch jurisdiction. The move is priced at €1.2 bn in direct capital outlay per bank and is already written into 2026 budget decks.

What Does the Architecture Look Like on Day One?

Private-cloud OpenStack provides the IaaS layer; Kubernetes orchestrates 1,200 micro-services per bank; a sovereign AI layer—initially Mistral AI models—sits on top for fraud detection and capital-markets analytics. Data residency is guaranteed at the rack level: every VM is geo-tagged inside the EU, and an immutable blockchain ledger keeps audit trails for GDPR, DSA, and the incoming EU AI Act. Latency targets are set at <10 ms for iDEAL payments and <50 ms for mortgage-risk calculations—benchmarks that match or beat current U.S. hyperscaler SLAs.

How Much Market Share Can EU Cloud Grab?

Gartner puts European sovereign-cloud spend at $12.6 bn in 2026, jumping to $23.1 bn in 2027. Today EU-owned providers hold <5 % of total European cloud spend; the bank project alone will push that share to ~15 % by 2029. CIO surveys show 61 % of Western European CIOs plan to increase local-cloud usage; the Dutch banks’ procurement schedule will award framework contracts worth an estimated €10–12 bn over five years, creating a reference stack that fintech startups can rent under the same compliance umbrella.

Where Are the Tripwires in the Migration Plan?

Legacy COBOL cores and 30-year-old payment switches must be refactored into containerised services—DNB estimates 45 mn lines of code across the three banks. A phased pilot starting January 2026 will move iDEAL traffic first; any >0.1 % drop in authorisation rates triggers an automatic rollback clause. U.S. hyperscalers are responding: AWS has already previewed a “European Sovereign Cloud” offering hosted in Spain and Germany, priced 18 % below standard EU regions to retain workloads. Meanwhile, EU policy is still fluid; the forthcoming Cloud & AI Development Act could add extra certification layers mid-migration, forcing re-engineering sprints in 2027.

Will the Capital Markets Fund the Switch?

Equity analysts have not yet marked down bank valuations for the €400 m per-institution infrastructure charge; instead, cost guidance shows the outlay offset by 2028 through eliminated egress fees and 22 % lower OPEX once reserved instances are cancelled. Rating agencies view the project as credit-neutral provided migration stays on schedule; any slippage into 2028 would trigger covenant discussions due to increased RWAs under Basel IV. Joint university programs aim to produce 500 certified EU cloud architects by 2027—critical if labour inflation is to stay below the 4 % annual ceiling built into bank cost-income ratios.

What Happens After 31 December 2027?

Full de-registration of U.S. cloud accounts is followed by a governance board—banks, DNB, EU Commission—that meets quarterly to audit security and cost metrics. The platform is designed to plug directly into the ECB’s digital-euro settlement layer, making sovereign hosting a de-facto licence requirement for EU payment institutions. If targets hold, the “Euro-Bank Cloud” becomes the first production-grade, continent-wide alternative to AWS, Azure, and Google Cloud—backed by balance-sheet guarantees from lenders that move €2.4 tn in payments every year.

In Other News

- Varonis Systems Reports $745M ARR Despite Market-Wide SaaS Valuation Reassessment

- Stoke Space Raises $350M in Series D Extension, Total Funding Reaches $1.34B

- Apple Acquires Severance IP for $70M, Takes Full Control of Series Production

Comments ()