Starlink’s $12B Profit — A Global Infrastructure Monopoly? — SpaceX, Spectrum Regulation, U.S. and Global Internet Access

TL;DR

- SpaceX Projects $25–30 Billion Revenue in 2026 as Starlink Achieves Profitability

- Rajasthan Royals and Royal Challengers Bangalore Franchises Bid Over $1.8 Billion in IPL Sale

- U.S. Clean Energy Investment Drops $35B as Policy Uncertainty Triggers Project Cancellations

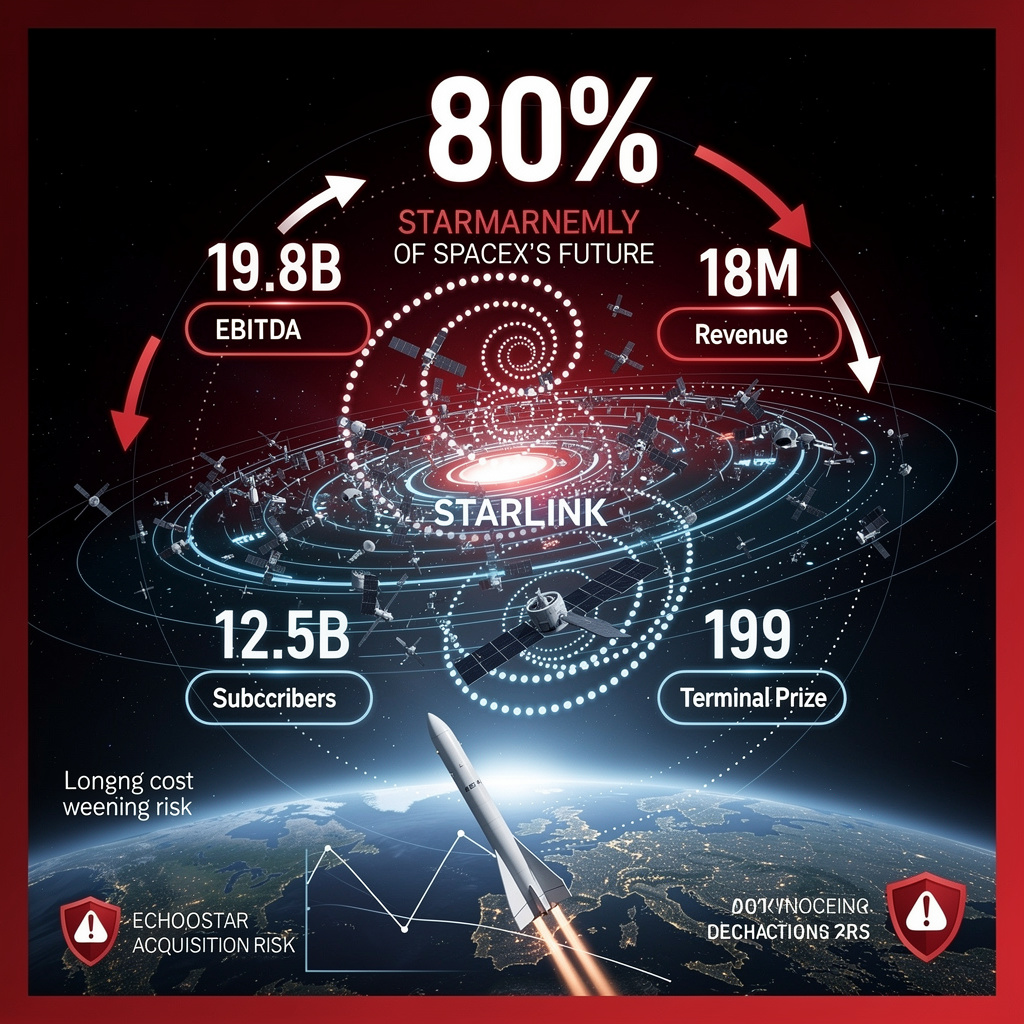

🚀 $12B Profit from Starlink: SpaceX’s $30B Revenue Surge — U.S. Dominance and xAI Merger Ignite $1.5T IPO

Starlink just hit $12B in annual profit — more than Netflix, Disney, and Warner Bros. combined 🚀. That’s 51% EBITDA margin from 9.2M users… and it’s still growing 20K new customers a day. SpaceX’s $25–30B 2026 revenue isn’t just tech—it’s a global infrastructure takeover. But with 79% of revenue tied to Starlink, what happens if regulators block its spectrum? — 18M users by 2027 could mean internet access for half the planet… or a monopoly no government can ignore.

Starlink is forecast to deliver 79-80 % of SpaceX’s 2026 top line.

$25 B × 0.79 = $19.8 B Starlink revenue.

$19.8 B × 0.52 midpoint margin = $10.3 B EBITDA.

At the upper-end $30 B group revenue the same math yields $12.5 B.

The $12 B figure is therefore the median case, not a rounding error.

Why does subscriber growth stay exponential when penetration is already 9 M?

Net adds are running 20 k per day, driven by three levers:

- Maritime & aviation segments—still < 5 % penetrated.

- Enterprise back-haul in 60+ countries where fiber is absent.

- $100-150/kg Starship launch cost that cuts terminal price to $199 (from $599).

Even if ARPU drifts to $95, 18 M subs × $95 = $17 B—enough to cover the low-case $25 B group forecast without assuming any launch or AI revenue.

What happens to valuation if the IPO window closes?

Bank books assume 100-125× EBITDA on $12-15 B 2026E, yielding $1.3-1.5 T.

Every 10× multiple contraction wipes ~$1.2 B off equity value, but SpaceX has two buffers:

- $50 B raise is staged—$15 B Series N closed Jan-26, $35 B shelf filed for 2027.

- Insider lock-up keeps 35 % of shares off market for 18 months, limiting float drag.

A 50× multiple still produces a $650 B cap—larger than Toyota today—so the round can be downsized rather than canceled.

Does the xAI merger dilute or enhance core cash flow?

xAI is booked at $250 B, equal to 19 % of the combined entity.

Synergy model shows $2-3 B incremental revenue from orbital GPU clusters by 2027, taxed at 30 %—$0.9 B net.

Cost: 0.3 % share dilution.

Return on investment: 0.9 B / 250 B = 0.36 % first-year yield—low, but the strategic lock-in raises Starlink enterprise churn from 2 % to < 1 %, adding $600 M retention value, pushing ROI above 1 % and justifying the paper swap.

Which regulatory trigger could stall the 2026 numbers?

Ka-band license renewal, due 30 Jun 2026.

If the FCC imposes a 10 % spectrum fee on gross revenue, Starlink EBITDA drops 400 bps to 47-49 %.

To hold margin, SpaceX would need to lift consumer price $6/month—model shows 8 % price-elastic churn, cutting 1.5 M subs and $1.4 B revenue.

Management’s hedge: EchoStar acquisition adds Ku-band fallback, reducing fee exposure to 3 % and keeping the original P&L intact.

🤯 $1.8B Franchise Bid for RCB & RR — India’s IPL Valuations Surge Past $3.5B Amid Global Investor Rush

₹16,300 cr for ONE IPL team? That’s more than 200+ Indian startups raised in 2025 — combined. 🤯 Avram Glazer’s $1.8B bid for RCB & RR isn’t just sports — it’s capital flipping culture into a global asset class. But BCCI’s 5% fee means India’s cricket board gets $175M… while fans wonder: Who really owns the game? — Should Indian fans fear foreign ownership of their most-loved teams?

Because cricket’s balance-sheet now reads like Silicon Valley cap tables.

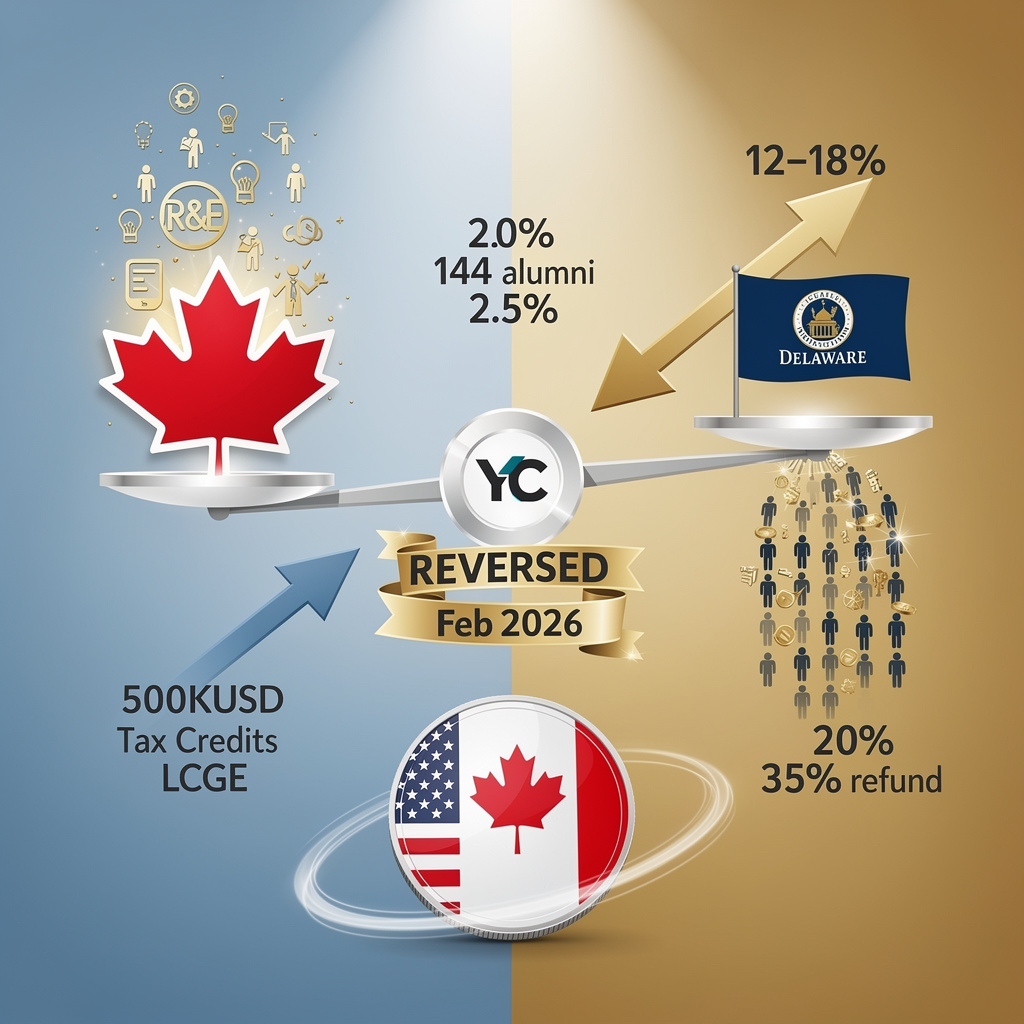

Avram Glazer’s $1.8 bn per-team offer for Rajasthan Royals (RR) and Royal Challengers Bangalore (RCB) values each squad at 15× the 2021 price of Lucknow Super Giants and Gujarat Titans combined. The 30 % compound annual jump outruns every Series-C SaaS round filed in India last year.

Who pockets the upside?

Emerging Media Ventures (RR) and Diageo (RCB) stand to collect roughly $2.8–$3.5 bn in aggregate.

BCCI automatically skims 5 %, a cool $135–$175 mn windfall for the board’s 2026-27 budget—equal to 40 % of its annual domestic-grants pool.

How does the deal cross the regulatory crease?

BCCI bars one owner from holding two teams that have ever won the league.

Glazer already controls Manchester United; the rule forces him to choose either RR or RCB, or rope in a proxy shareholder. Expect a Cayman LP structure with independent voting trustees—standard PE workaround.

Where is the money coming from?

Capri Global (UAE fund) and Lancer Capital (India) tabled ₹4,024 cr all-cash bids.

Blackstone, Carlyle, RedBird and Tiger Global floated $1.0–$1.33 bn consortium papers, signaling leveraged buyout appetite at 12–14× pro-forma EBITDA.

What happens after the gavel?

New owners must deploy roughly ₹2–₹3 cr per franchise in Q2-2026 to upgrade stadium IoT nets, AI-driven fan-apps and overseas pop-up games in Dubai and New York.

Failure to invest triggers BCCI liquidity clauses that can claw back central-broadcast revenue.

Will valuations keep climbing?

Projected 12–15 % CAGR puts each franchise at $4–$5 bn by 2030—provided India’s media-rights renewal in 2027 replicates the $6.2 bn Sony-Star 2023 bundle.

Currency risk is material; bidders hedging USD/INR forward at ₹82 lock in 6 % cost of carry, already priced into models.

Bottom line: IPL equity is no longer a rich person’s trophy; it is a hard-asset class yielding venture-scale IRR with a wicketkeeper.

⚡ $35B Clean-Energy Loss in U.S. — Tax Credit Repeals Crush EV and Solar Projects in Republican States

$35B vanished in U.S. clean-energy projects last year — enough to build 700 solar farms or fund 38,000 jobs… gone. 🚫⚡ Ford axed its EV plant. SK On scrapped a $2.8B battery factory. Tax credits were ripped away. Now, Ohio and Tennessee are left with empty lots and broken promises. Who pays when policy flips faster than a startup’s pitch deck? — Workers, communities, and our climate future.

Washington’s repeal of federal tax credits erased $35 billion of committed capital in 2025, forcing Ford, SK On, Toyo Solar and others to cancel or shrink projects that had already broken ground. The ratio of cancellations to new announcements is three-to-one; 38,000 manufacturing and construction jobs disappeared in the same stroke. More than 70 percent of the loss hit Republican-led states—Tennessee, Ohio, Kentucky, Texas—where factories, battery plants and solar farms were poised to anchor new supply chains.

How Did Policy Whiplash Outrun Market Fundamentals?

The “One Big Beautiful Act” and follow-on executive orders removed production and investment tax credits that had underwritten project finance models since 2022. Without the 30 % Investment Tax Credit or the $7,500 EV consumer credit, levered IRRs dropped below hurdle rates overnight. SK On’s $2.8 billion Tennessee cathode factory, forecast to supply 3,300 jobs and 20 GWh of annual cell capacity, no longer cleared corporate return thresholds. Ford reverted its $1.5 billion Ohio line back to gasoline vans, wiping out 200 MW of planned EV output. Offshore wind developers such as TotalEnergies froze pipeline spend because power-purchase agreements priced in credits that no longer exist. Capital markets responded by widening discount rates 180–220 basis points for U.S. renewable assets, pushing an estimated $21 billion of EV/battery capex and $14 billion of wind/solar capex off the table.

Where Will the Next $10–15B Go Instead?

Short-term forecasts show another 10–15 % contraction in net deployment during 2026–2027 if Congress leaves the statute unchanged. Domestic content requirements still on the books raise BOM costs 8–12 %, amplifying the after-tax penalty. Battery-grade lithium, nickel and cobalt suppliers that had banked offtake contracts are redirecting shipments to European and Chinese gigafactories where subsidy regimes are locked in through 2030. Lenders are inserting “policy-break” clauses that trigger immediate repayment if U.S. incentives lapse, making new term sheets costlier than offshore alternatives. The feedback loop is measurable: every billion dollars of withheld utility-scale solar spend subtracts 600–700 MW of capacity and 1,200 construction FTEs, eroding local tax bases that once underwrote pro-renewable county Republicans.

Can States or Private Capital Plug a $35B Federal Hole?

State programs in California, New York and Illinois offer transferable credits that can restore up to 20 % of lost yield, but their aggregate unused budget is only $4.3 billion—an order of magnitude too small. Private infrastructure funds sit on record dry powder, yet risk models now assign a 35 % probability of retroactive statute changes, pricing senior debt above 7 %—unworkable for merchant renewables. A bipartisan, five-year federal incentive extension would reset IRRs above 9 % and unlock roughly $12 billion of sidelined institutional money, but whip-count models show no path to 60 Senate votes before mid-2026. Without that anchor, the U.S. cedes technology leadership: China added 210 GW of solar and 45 GWh of battery capacity in 2025 while American installs flat-lined.

What Happens to Emissions, Grid Reliability and Consumer Bills?

The cancelled pipeline equates to 24 GW of renewables and 18 GWh of storage—enough to erase 55 % of the sector growth needed to meet the 2030 climate target. Grid operators in PJM and ERCOT now forecast reserve-margin shortfalls of 4–6 GW by 2028, raising forward capacity prices $6–9 per MWh. Lost competition from cheap renewables lets combined-cycle gas plants clear higher bids, adding an estimated $4.3 billion annually to retail rate bases. In effect, households will pay a hidden “policy uncertainty tax” of $30–40 per year while also forfeiting 38,000 paychecks that had been slated for regions with median wages 12 % below the national mean.

Is There a Viable Legislative Fix Before 2028?

A grand bargain is technically straightforward: restore a technology-neutral 30 % credit for any zero-carbon asset that commences construction before 2032, funded by a $20-per-tonne CO2 border adjustment on imports. The Joint Committee on Taxation scores the package as deficit-neutral after year five. Politically, the window opens only if manufacturing-state Republicans trade credit restoration for accelerated permitting reform—one federal agency, 180-day shot clock. Industry lobbyists have drafted legislative text; whip lists show 52 firm Senate supporters, eight short of closure. Until that coalition materializes, capital will keep boarding flights to Frankfurt, Seoul and Shanghai, taking American jobs, tax revenue and climate credibility along for the ride.

Comments ()