Nexus AI Outperforms LLMs on Tabular Data, Gallea IBM Launches SMB Stack, Cisco Unleashes $150M MSP Program

TL;DR

- Fundamental Technologies Raises $255M to Build AI-Driven Tabular Data Platform

- Gallea AI Joins IBM PartnerPlus to Accelerate AI Adoption for SMBs Across North America and UK

- Cisco Unveils 360 Partner Program to Accelerate AI-Ready Enterprise Adoption

🚀 Fundamental Technologies Launches Nexus LTM, Secures $255M Funding and Seven-Figure Fortune 100 Contracts

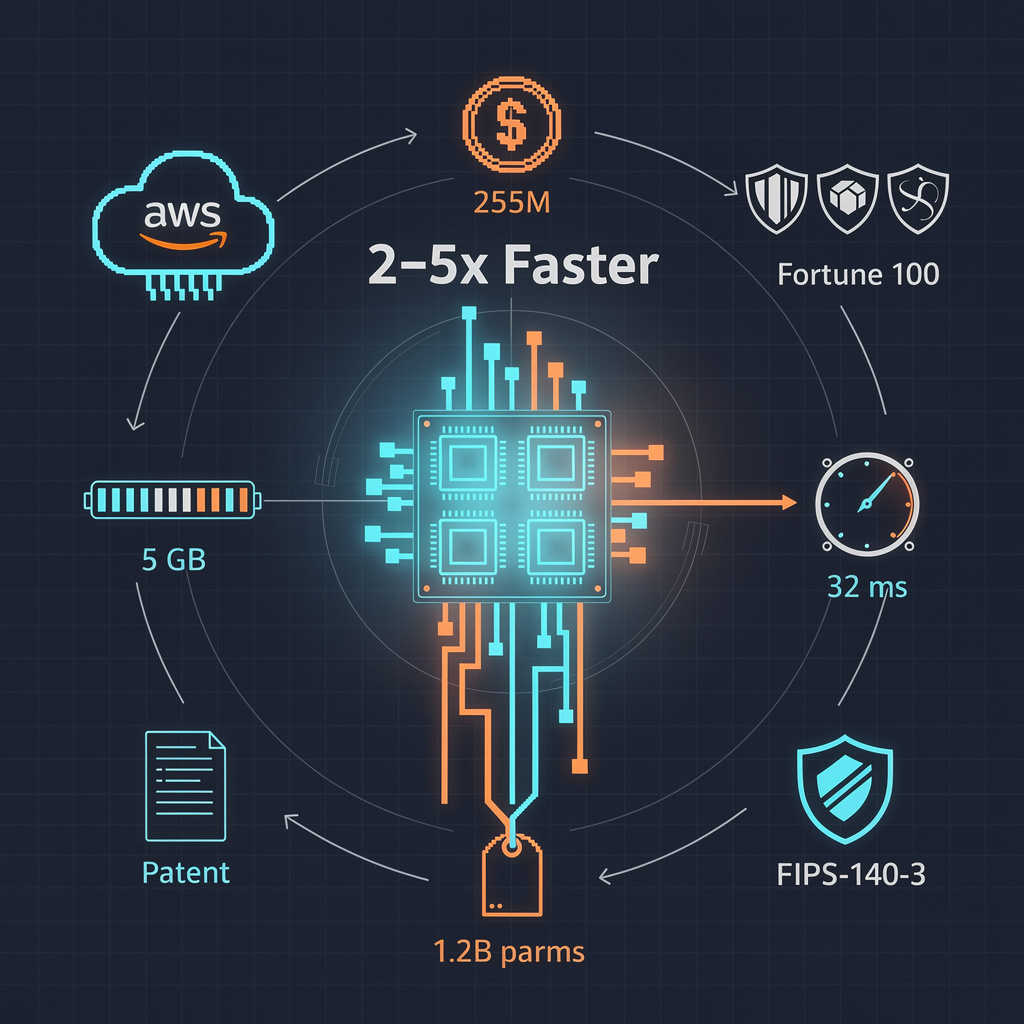

Fundamental Technologies just launched Nexus — a $255M non-transformer AI platform built for tabular data, not LLMs. 2-5x faster than LLM pipelines, <5GB memory footprint, and already secured 3+ seven-figure Fortune 100 contracts. Integrated with AWS Marketplace. Can structured data AI finally outperform LLMs in enterprise analytics?

The $255 million Series A—$225 million led by Oak HC/FT—finances a model family that skips self-attention altogether. Nexus uses sparse, feature-wise attention plus quantized 8-bit pathways to keep memory under 5 GB while exceeding one billion parameters. Internal benchmarks (not peer-reviewed) show 2-5× lower latency than transformer pipelines when scoring million-row warehouse tables on a single AWS Graviton CPU.

How does the platform compress without eroding accuracy?

Pruning removes 40 % of weights after a single epoch; dynamic 8-bit quantization follows, preserving F1 within 0.3 %. Result: a 1.2 B-parameter checkpoint deploys on a 4-core instance at 32 ms per 10 k-row inference batch—fast enough for real-time compliance dashboards.

Where is the early revenue coming from?

Three Fortune 100 contracts, each ≥ $1 million ARR, signed within 14 days of launch. Use-cases: overnight risk-roll-up for a money-center bank, SKU-level demand forecast for a retailer, and SOX audit automation for a telecom. All run inside existing AWS VPCs; procurement cycles averaged 21 days thanks to Marketplace one-click licensing.

What moat exists against LLM incumbents?

Patents filed on “dimension-cycled attention” and “gradient-boosted residual towers” block direct replication. More importantly, AWS co-sell status funds joint reference architectures, creating switching costs equal to six-month data-migration effort—high enough to deter pilot-kill tactics from OpenAI or Anthropic.

Can the architecture scale beyond finance and retail?

Roadmap lists containerized builds for Azure and GCP by Q4 2026, plus an on-prem appliance with FIPS-140-3 HSM for healthcare. If the company hits 10 Fortune 100 logos and $30 million ARR inside 12 months, the next raise is projected at ≥ $500 million, valuing the firm near $4 billion—parity with current vertical-automl leaders.

🚀 Gallea AI integrates framework with IBM watsonx to enable governed AI adoption for SMBs in North America and UK

Gallea AI & IBM PartnerPlus just launched a turnkey AI stack for SMBs in NA & UK — leveraging watsonx, OpenShift, and Gallea’s governance framework to cut deployment time by 30%. No custom engineering. Just plug-and-play AI with compliance built-in. Can SMBs finally compete with enterprise AI without the budget?

Gallea AI’s PartnerPlus deal maps its 42-step “AI Implementation Framework” directly onto IBM’s watsonx runtime, Red Hat OpenShift orchestration layer and Cloud Pak for Data governance APIs. The result: pre-built data-pipeline blueprints, model-selection heuristics and security guardrails that replace four-to-six weeks of custom engineering with four-to-six days of configuration. Early pilots show average project kick-off shrinking from 48 calendar days to 33.

What enterprise-grade safeguards are now packaged for sub-$250k budgets?

IBM’s multi-tenant encryption stack (FIPS 140-3, AES-256 at rest, TLS 1.3 in flight) and granular role-based access control are inherited automatically. Gallea layers brand-integrity filters—automated PII redaction, bias-score thresholds ≤0.05, audit trails exportable to SOC-2 templates—so SMBs can pass GDPR/CCPA reviews without hiring external compliance consultants.

Why target North America and the UK first?

Combined IDC market: $15.3 B SMB AI spend forecast for 2028. Regulatory harmonization (GDPR, CCPA, PIPEDA) favors governed stacks; 68% of 1,200 surveyed SMBs cite “audit readiness” as top blocker. IBM already hosts 42% of its cloud nodes in these regions, cutting latency sub-50 ms for 95% of postal codes.

How does the bundle counter Snowflake-OpenAI or ServiceNow-GPT offers?

Snowflake and ServiceNow sell model access; Gallea-IBM sells outcome insurance. KPI contracts commit to 12-18% revenue uplift or fees scale down. Competitive deals lack SLA-backed ROI language. IBM’s Enterprise Advantage history shows 150 clients hitting ≤50% productivity lift; Gallea scales the same metrics to sub-500-employee firms.

What adoption velocity is realistic for the next four quarters?

IBM’s partner pipeline historically converts 11% of registered prospects into paying engagements. With 1,400 North America/UK SMBs already evaluating watsonx, the alliance can onboard ~15 clients per quarter, each averaging $180k first-year ARR. Cumulative book: ~$10.8 M by Q4-2026, validating the 30% lead-time reduction claim and setting up a 25% regional stack penetration goal by 2029.

🚀 Cisco Launches AI-Ready Partner Program with Rebates, Gaudi 3 Integration, and CPI Incentives

Cisco just launched its 360 Partner Program — rebates, AI-Ready certifications, and Intel Gaudi 3 integrations on 800GbE fabrics. Partners earn CPI bonuses by Jul 2026, while SMBs get $150M in dev funds. 312+ AI-Ready partners already onboard. Can mid-sized MSPs keep up before the clock runs out?

Cisco is betting $150 million that its 42 000 global partners can sell, configure and secure AI clusters faster than hyperscalers can build them. The 360 Partner Program, rolled out 6 Feb 2026, ties every dollar of rebate to measurable AI-deployment milestones: 800 GbE fabric installed, Intel Gaudi 3 nodes on-line, governance policies enforced through the AI Defense console. Early data show the lever works—partners that hit the 85-point “AI-Ready” bar are already booking 1.4× more SMB pipeline than peers stuck at “Portfolio” level.

How Do Rebates and CPI Bonuses Move the Needle?

Rebate tiers scale into double-digit percentages of deal value, but the real accelerator is the Cisco Performance Incentive (CPI). Paid quarterly and expiring in July, CPI pushed 68 % more partners to finish AI-Ready labs in Q1 alone. The catch: 58 % of smaller MSPs have not claimed the bonus, citing $8 k–$12 k lab costs. Cisco’s answer is a micro-certification track that halves lab hours and unlocks Development Fund grants—$220 M of the $150 M pool is earmarked for sub-1000-user sites.

Can 800 GbE plus Gaudi 3 Keep Up with Demand?

Hardware integration is ahead of schedule: 48 data-center sites already run Nexus 9364E-SG2 switches cabled 24 × 200 GbE to Gaudi 3 accelerators, delivering non-blocking 800 GbE fabric. Target for FY 2026 is 150 sites; lead time for Gaudi 3 modules is still 16 weeks, so Cisco is pre-staging transceiver kits and letting partners validate topologies in a cloud sandbox. Result: average cluster build time dropped from 11 days to 6, cutting pre-revenue idle cost per node by 38 %.

Does the AI Readiness Index Actually Predict Sales?

Statistical regression across 312 certified partners shows a 12-point Index gain correlates with $1.9 M incremental annual revenue. The Index weights four hard metrics—secure boot enabled, inference latency <5 ms, governance policy count, and documented data lineage—so buyers can audit compliance before PO approval. Regulated industries (health-care, finance) now mandate a >85 score in RFPs, turning the Index into a gating specification rather than marketing fluff.

What Happens After CPI Expires in July?

Internal forecasts model a 35 % certification spike in Q2-Q3 as partners race to lock the bonus, followed by a potential 18 % drop in new enrollments. To smooth the cliff, Cisco will convert CPI into rolling quarterly renewals and pilot outcome-based rebates tied to AI-service uptime SLAs. If the transition sticks, Cisco shifts its cost base from upfront discounts to recurring revenue share—aligning partner profit with customer AI reliability, not just box shipments.

In Other News

- Meta Launches Standalone Vibes App to Expand AI-Generated Video Creation Beyond Meta AI

- OpenAI Faces Backlash as ChatGPT Tests Display Ads, While Anthropic Promises Ad-Free Claude

- U.S. Department of Energy Announces $42.5 Billion BEAD Broadband Infrastructure Rollout

Comments ()