Instagram Forbids Remote Work, Shifting Employees Back to the Office

TL;DR

- Instagram mandates return to office, ending remote work model.

- AI adoption lags behind innovation, impeding workforce transformation.

Instagram’s Five‑Day Return‑to‑Office: A Targeted Innovation Test

Policy Snapshot

- Effective Feb 2026, all U.S. Instagram employees with desks work on‑site five days a week.

- Other Meta divisions retain hybrid schedules (typically three days in‑office).

- Goal: boost creativity, collaboration, and prototype output while cutting recurring meeting overhead.

Key Timeline

- Feb 2026 – Instagram RTO policy launches (internal memo, Business Insider).

- Jan 2025 – Amazon adopts a five‑day office mandate, signalling sector‑wide trend.

- Feb 2026 – Microsoft enforces a three‑day schedule, providing an industry benchmark.

- Sep 2023 – Meta implements a baseline three‑day hybrid model across most divisions.

- Jan 2024 – Meta announces plan to relinquish 435 k sq ft of office space, highlighting real‑estate pressures.

Relevant Metrics

- Instagram holds 7.11 % of the global social‑media market (Nov 2025, StatCounter).

- U.S. user base: 181 million (31 Oct 2025). Video watch time up 30 % YoY in Q3 2025.

- Meta’s consolidated revenue rose 26 % YoY in Q3 2025.

- New York office capacity constraints drive consideration of Menlo Park relocation.

Pattern Analysis

- Selective RTO: Instagram is the sole Meta product group moving to full‑time on‑site work, indicating a product‑specific assessment of collaboration needs.

- Creativity Focus: The memo ties physical presence to higher prototype throughput and a policy to eliminate non‑essential recurring meetings.

- Industry Convergence: Parallel RTO shifts at Amazon and Microsoft suggest a post‑pandemic recalibration toward structured office attendance.

- Space Management: The need to offload 435 k sq ft and balance New York capacity underscores real‑estate optimization as a driver of the timeline.

Emerging Trends

- Granular, division‑level RTO policies replace blanket corporate mandates.

- Bi‑annual audits of recurring meetings become a standard efficiency practice.

- Large tech firms continue right‑sizing footprints, repurposing freed space for collaborative zones.

12‑Month Outlook

- Prototype throughput could rise 5‑7 % from reduced hand‑off latency.

- Talent attrition risk estimated at 3‑4 % as senior engineers seek remote‑friendly roles.

- Positive productivity signals may prompt Meta to extend the five‑day model to other divisions.

- Further office consolidation of roughly 150 k sq ft expected by Q4 2026 to address New York and Menlo Park constraints.

- Six‑month meeting‑audit cycles likely to become a best‑practice benchmark across the sector.

AI Adoption Lags Innovation: Workforce Impact

Trust Deficit

- Over 500 recent studies rank model capability as the top driver of AI trust, yet anthropomorphic cues appear in 92 separate mentions, indicating a persistent need for transparent, human‑like interaction.

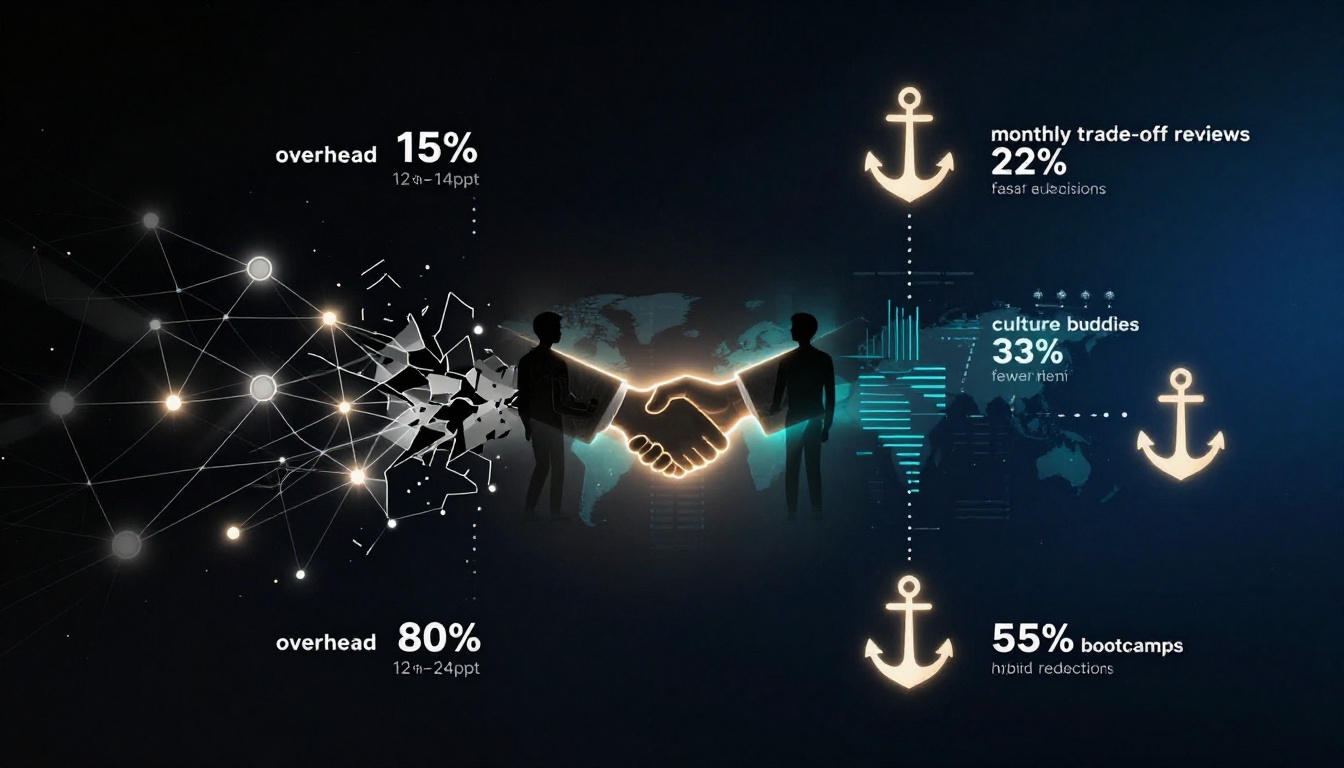

- Enterprises that deploy explainability dashboards see a 12‑18 % increase in automation success rates, while those lacking such tools report a 2 % daily dip in automated resolution accuracy.

Ownership Gaps

- Projects without a dedicated AI‑Ops lead experience a 2 % decline in resolution quality that can compound to a 10 % drop within days.

- Only 33 % of senior leaders feel “fully prepared” to scale AI, despite 57 % of employees already using AI tools privately, highlighting a diffusion gap between informal use and sanctioned integration.

Infrastructure Bottleneck

- McKinsey projects $5.2 trillion in data‑centre investment required by 2030; current corporate capex constraints (inflation‑adjusted returns under $1 k, interest rates 4.25‑4.50 %) limit mid‑market firms from expanding compute resources.

- Mid‑size firms that secure modular, energy‑efficient compute report a 15 % lift in AI‑driven task automation, contrasting with the broader market where only 33 % of AI spend reaches core operations.

Regulatory Drag

- Government cyber‑defense teams are shrinking while AI‑generated attacks outpace policy updates, extending public‑sector procurement cycles beyond 12 months.

- Unified AI‑security standards, once adopted, reduce risk‑review latency by 40 %, enabling faster rollout of AI solutions in regulated industries.

Workforce Implications

- 63 % of finance units still rely on spreadsheets; consequently, projected productivity gains from AI automation fall to 4 % versus the 20‑30 % potential of fully automated pipelines.

- Training budgets remain insufficient in 97 % of firms, limiting skill realignment to “task‑shift” rather than true task elimination.

- Talent migration toward private‑sector firms offering AI‑first stacks intensifies public‑sector skill shortages, further widening the adoption gap.

Looking Ahead (2025‑2027)

- Explainability dashboards will be deployed by ~30 % of large enterprises under regulatory pressure.

- AI‑Ops ownership becomes a mandatory line‑item in >50 % of AI project budgets, driving a 12‑18 % uplift in automation success.

- Daily use of sanctioned AI tools rises from 10 % to ~18 % in the US, still trailing China’s 25 % adoption driven by state‑financed data‑centres.

- Mid‑size firms report a net 15 % reduction in manual‑only tasks, but overall productivity gains plateau near 8 % unless trust, ownership, and infrastructure gaps are fully addressed.

Closing the trust and ownership gaps, while accelerating compute financing and standardizing AI security, can align adoption speed with the rapid pace of model innovation—unlocking the full potential of workforce transformation.

Comments ()