Tesla Misses FSD Hardware Commitment, Amazon Sends Rivian e-Cargo Fleets

TL;DR

- Tesla Faces New Autonomy Challenges: Ending FSD Hardware Commitments, Revising Sensor Systems, and Grappling with Safety-Report Scrutiny

- Amazon and Rivian Launch Electric Delivery Fleet: Partners Deliver e-Cargo Quads to 70+ US and European Hubs, Supporting Low-Emission Logistics

Tesla’s Software‑First Autonomy Gamble

Hardware Decoupling

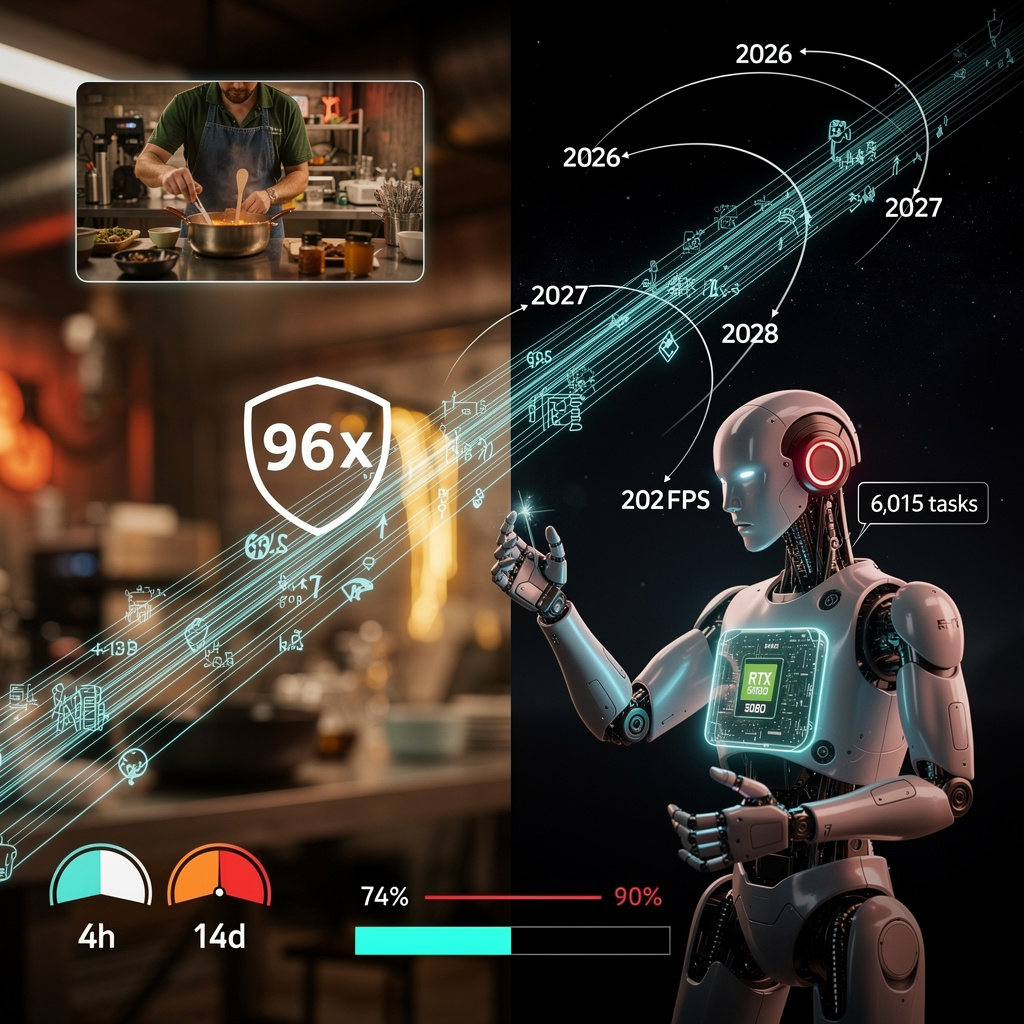

Quarter‑three 2025 shows Tesla’s gross profit up 81 % YoY to $1.1 B, while R&D expense surged 57 % to $1.6 B. The boost comes from “V14 Lite,” a software update that adds construction‑zone handling and emergency‑vehicle response without any new hardware. HW3 vehicles continue running FSD V12.6–V13 “lite,” despite Musk’s 2016 promise of HW4‑ready platforms. Ashok Ellaswamy confirms HW4 will not ship until AI5—projected with up to 144 GB RAM—arrives in late‑2026. Tesla is thus betting on software to deliver autonomy while postponing costly hardware refreshes.

Sensor Strategy Gap

HW3 relies on an 8‑camera array and eschews radar or LiDAR. Musk’s public dismissal of LiDAR leaves Tesla without the sensor redundancy demanded by EU and Chinese regulators. Safety‑related recalls illustrate the risk: NHTSA pulled roughly 63 k Cybertrucks for overly bright front lights, and it has opened 58 FSD incidents for investigation. The lack of hardware diversification forces Tesla to rely on perception improvements alone, a stance that threatens market entry where multi‑modal sensing is mandated.

Safety‑Risk Premium

In a single week, FSD logged over 6 billion miles, but only 12 % of the fleet carries an active FSD subscription, limiting exposure. Still, the Cybertruck recall coincided with a 37 % earnings drop, slashing Q3 net income to $1.39 B and EPS to $0.39. The data suggest a >20 % probability that further regulatory actions will dent Q4‑2025 results, eroding the margin gains from software‑only upgrades.

Integrated Outlook

Regional rollout gaps are emerging: North America can proceed with camera‑only stacks, while the EU and China likely face 12‑18‑month delays for full FSD features. R&D spend is set to rise >60 % YoY through 2026, focused on AI5 compute and Optimus V3 rather than new sensor hardware. By the end of 2026, AI5‑based HW4 vehicles may finally appear, but “unsupervised” FSD will remain constrained outside the U.S. until sensor‑validation hurdles are cleared.

Strategic Recommendation

To bridge the regulatory divide, Tesla should develop a modular sensor add‑on—such as a compact radar unit—that can be retrofitted to existing HW3 platforms for non‑U.S. markets. Simultaneously, allocating a safety‑audit budget proportional to the projected 6 billion‑mile FSD exposure will help anticipate and mitigate future recalls or fines, preserving the financial upside of its software‑first roadmap.

Amazon‑Rivian EV Fleet Accelerates Logistics Decarbonization

Scale and Scope

Amazon’s partnership with Rivian, formalized in 2019, targets a 100 000‑vehicle electric delivery fleet by 2030. As of 23 Oct 2025, more than 35 000 Rivian electric delivery vehicles (EDVs) operate across the United States, Europe, and Canada. The latest launch adds 50 custom vans in Greater Vancouver, bringing the global count to over 35 000 units and supporting 1.5 bn packages delivered by EVs.

- Custom EDVs in Greater Vancouver 50 units

- Total Rivian EDVs worldwide>35 000

- Packages delivered by EVs1.5 bn

- Planned fleet size (2030)100 000 units

Carbon Impact

Preliminary data from the Canadian pilot show a 10–12 % reduction in metric tons CO₂e per million packages. Rivian’s 200 mi range battery packs cut per‑delivery energy use by roughly 30 % compared with diesel vans. Integrated telematics raise vehicle utilization by 15 %, optimizing routing and charging schedules.

Infrastructure and Standardization

Amazon is installing fast‑charging stations at over 70 hubs, aligning with Rivian’s 200 kW charger rollout. Harmonized vehicle specifications across North America and Europe streamline maintenance and enable a unified service network. This cross‑regional standardization underpins the accelerated scaling observed—a five‑fold increase in monthly rollout speed compared with 2024.

Future Outlook

Assuming a linear deployment trajectory, the combined fleet is projected to exceed 70 000 units by the end of 2027 and meet the 100 000‑unit target by 2030. With a 20 % annual growth in EV‑handled package volume, deliveries could reach 3.5 bn packages by 2030. Cumulative CO₂e savings are expected to surpass 15 Mt, representing roughly 2 % of Amazon’s 2023 logistics emissions baseline.

Strategic Implications

The Vancouver rollout demonstrates that large‑scale electrification of last‑mile logistics is achievable within existing operational frameworks. Continued investment in charging infrastructure, coupled with vehicle standardization, will be critical to delivering Amazon’s 2040 net‑zero logistics pledge. The momentum of the Amazon‑Rivian partnership offers a replicable model for other logistics firms seeking rapid decarbonization.

Comments ()