Tesla expands robotaxi to SF & Austin; GM drops CarPlay, launches Gemini AI

TL;DR

- Tesla Expands Robotaxi Service Amid Regulatory and Operational Hurdles

- Tesla Faces Legal Challenges Over Delayed FSD Hardware Rollouts

- GM Phases Out CarPlay/Android Auto, Launching Gemini‑Powered AI Assistant

Tesla’s FSD Hardware Delays Spark Legal Action and Market Pressure

Legal Landscape

| Issue | Parties | Status (22 Oct 2025) | Key Data |

|---|---|---|---|

| Class‑action lawsuits | HW3 owners vs. Tesla | Filed in U.S. federal court; claims of misrepresentation of “FSD‑ready” promise | ~2 M HW3 vehicles potentially excluded from upcoming FSD V14 |

| NHTSA investigation | NHTSA vs. Tesla | Ongoing; covers ~2.9 M Teslas with FSD software, focusing on crash‑reporting compliance | 58 complaints, 14 crashes cited |

| EU approval delay | European Commission vs. Tesla | EU approval of FSD software pending hardware compatibility (HW3) | HW3 owners “losing ground to HW4” |

| Consumer‑rights complaints | State AGs (CA, TX, NY) vs. Tesla | Requests for clearer retrofit pathways for HW3 owners | No formal recall; paid upgrades only |

Technical Evolution of FSD Hardware

| Generation | Launch | Primary Specs | Availability |

|---|---|---|---|

| HW2 (2016) | – | Limited compute, no dedicated neural‑net accelerator | Retrofitted in early Model S/X |

| HW2.5 (2017) | – | Added second camera, modest GPU | Deployed on Model 3/Y 2018‑2020 |

| HW3 (2020) | – | Full‑self‑driving computer, 144 TOPS | Basis for most 2020‑2024 deliveries |

| HW4 / AI‑4 (2023‑2024) | – | 300 TOPS, on‑board training accelerator | Standard on 2024‑2025 Model Y/3 |

| HW5 / AI‑5 (planned 2026) | – | 1 PFLOP, modular plug‑in | Not yet in production |

HW3’s 144 TOPS ceiling cannot execute the latest FSD V14 algorithms, creating a hardware‑centric upgrade requirement. Tesla currently offers paid, non‑retrofit “AI‑5 kits” for legacy vehicles.

Market and Financial Impact

- Q3‑2025 deliveries: 497 099 vehicles; revenue $28.1 B (+12 % YoY).

- Profitability: GAAP EPS $0.39 (miss) – 37 % YoY decline; operating expenses up 50 % due to hardware rollout and restructuring.

- FSD subscription uptake: 23 % of new owners opted for the 12‑month $199 plan; churn among HW3 owners estimated at 35 % after six months.

- Pricing strategy: Lease rates reduced 15‑23 % across Model 3/Y to maintain volume before the U.S. EV tax credit expires on 30 Sept 2025.

- Analyst sentiment: Over 30 % of analysts have downgraded Tesla, citing “autonomy litigation risk.”

Observations

- U.S. hardware distribution: 58 % HW3, 30 % HW4, 12 % prototypes (2025‑2026).

- FSD V14 activation: 1.1 M vehicles (primarily HW4) as of 22 Oct 2025; HW3 receives limited FSD modes only.

- Regulatory timeline: EU automotive safety body expects final hardware‑compatibility guidelines by Q2 2026; NHTSA anticipates a final report by Q4 2025.

Trends and Predictions

| Trend | Likelihood | 12‑Month Outlook |

|---|---|---|

| Mandated retrofit kits (modular AI‑5) | High | Tesla announces optional $4 500 HW3 retrofit; adoption ~10 % of affected fleet. |

| Increased class‑action settlements | Medium‑High | Estimated settlement pool $200‑300 M, linked to future hardware roadmap. |

| Shift to subscription‑only FSD | High | New orders will include baseline HW5; legacy HW3 owners limited to software‑only plans. |

| Accelerated EU hardware approval | Medium | EU may approve FSD V14 only for HW4+; HW3 owners barred from autonomous operation in Europe. |

| Stock volatility tied to litigation updates | High | Anticipated 5‑8 % price swing after major court filings. |

Projections suggest that by Q4 2026 Tesla will standardize HW5 across all new production and cease HW3 sales. Legal settlements and regulatory mandates are likely to create a premium retrofit pathway, affecting total cost of ownership for early‑adopter vehicles.

GM’s Bold Shift: From Phone Projection to Gemini‑Powered In‑Vehicle AI

Phase‑out of CarPlay and Android Auto

| Milestone | Status |

|---|---|

| Initial removal announcement (2023) | Applied to new gasoline models |

| Current rollout | >40 GM models, gas and EVs |

| Full discontinuation target | “Over the next few years” per Barra & Anderson |

Gemini AI Assistant Rollout

| Feature | Details |

|---|---|

| OTA launch FY 2026 | Buick, Chevrolet, Cadillac, GMC |

| Integration point | OnStar (model year ≥ 2015) |

| Core functions | Maintenance alerts, route planning, vehicle‑feature explanations, personalized preferences |

| Internal build identifier | 181249237 |

Gemini serves as the default conversational interface, leveraging Google’s large‑language model while remaining distinct from the public Gemini API. OTA capability enables continuous feature expansion without hardware recalls.

Centralized Computing Platform

- Unified “Google built‑in” OS for all GM platforms

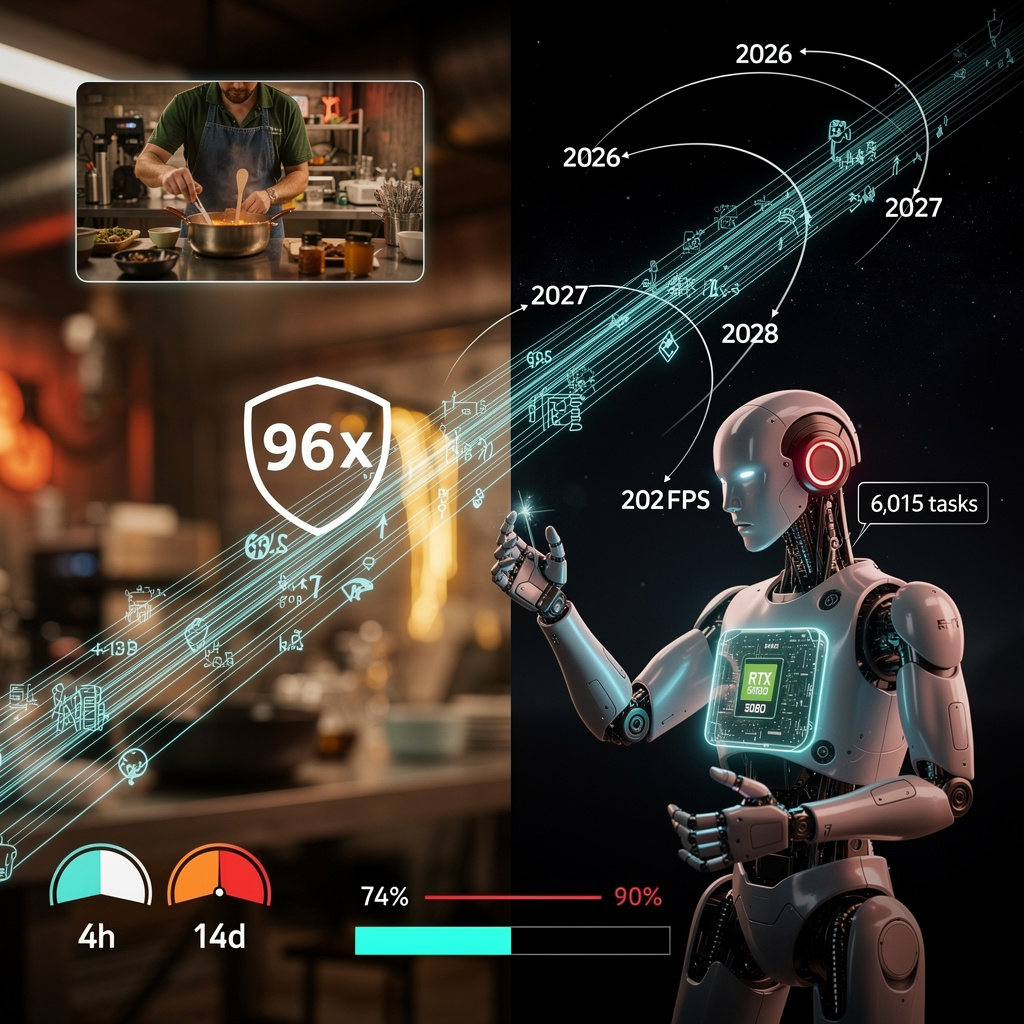

- Compute core: Nvidia Drive AGX Thor

- Target launch: 2028

- Projected OTA bandwidth increase: ×1,000

- AI compute capacity increase: ×35

The hardware consolidation prepares the fleet for real‑time AI inference, supporting both Gemini‑driven infotainment and advanced driver‑assistance functions.

Super Cruise Evolution Toward Eyes‑Off Driving

- Mapped hands‑free roads: 600 k miles (current)

- Logged hands‑free miles: 700 M with zero crashes

- Eyes‑off mode rollout:

- Cadillac Escalade IQ – 2028

- Extended to 23 models – 2029

The safety record and expanded mapping support the transition from “hands‑on” to “eyes‑off” operation once the centralized compute platform is online.

Regulatory Landscape

- FTC enforcement: 5‑year ban on OnStar data sales

- GM must source driver data exclusively from on‑vehicle sensors

- Implication: increased reliance on on‑device learning and federated‑learning pipelines

Data‑privacy constraints shape the AI training pipeline, limiting external data enrichment but encouraging on‑device model refinement.

Industry Trends Reflected in GM’s Strategy

- AI‑centric cabins across OEMs (e.g., Stellantis‑Mistral, Mercedes‑ChatGPT, Tesla‑Grok)

- Consolidated high‑performance compute mirrors aerospace and data‑center designs

- Regulatory pressure drives on‑device learning architectures

- OTA bandwidth growth enables rapid AI feature delivery

Projected Outcomes (2026‑2029)

| Metric | Projection |

|---|---|

| CarPlay/Android Auto removal | Complete by Q4 2027 |

| Gemini assistant coverage of vehicle functions | 95 % by end‑2028 |

| Eyes‑off Super Cruise availability | 75 % of GM fleet by 2029 |

| Operational federated‑learning pipeline | 2028 |

| Premium infotainment market share | >20 % by 2029 |

These projections derive directly from current rollout velocities, hardware readiness, and regulatory constraints.

Strategic Implication

GM’s coordinated de‑platforming of third‑party phone projection combined with a Gemini‑powered AI assistant establishes a proprietary, data‑secure in‑vehicle ecosystem. The approach aligns hardware, software, and compliance vectors, positioning GM to capture a leading share of the premium AI‑infotainment market and to expand eyes‑off autonomous capabilities ahead of many competitors.

Tesla’s Robotaxi Push: Scaling Up Amid Tightening Rules

Expansion Trajectory

Since the June 2024 launch in Austin, Texas, Tesla has rolled out three expansion waves, adding hundreds of thousands of miles to its robotaxi log. The Bay Area debut in October 2025 marks the second metropolitan market, and the company now targets eight to ten metros by the end of 2025, expanding to 16 by year‑end. Cumulative robotaxi mileage across active regions reached approximately 2.5 million miles in Q3 2025, with Austin alone exceeding one million miles.

Regulatory & Safety Landscape

| Issue | Current Status | Quantitative Indicator |

|---|---|---|

| Safety‑driver removal | Deadline moved to end‑2025 (Austin) and early‑2026 (Bay Area) | Projected 0 safety drivers in Austin by Q4 2025; 1‑2 monitors remain in Bay Area |

| Federal investigations | Probe covering 2.9 M Teslas with FSD | 58 formal complaints; 14 crashes/incidents cited |

| Crash‑rate performance | Autopilot/FSD 1 crash per 6.36 M miles vs. human 1 per 0.702 M miles | Q3 2025 average crash interval ≈ 6.7 M miles (down from 7.0 M in Q2) |

| Legislative changes | Federal EV‑tax credit expired 30 Sep 2025 | Q3 deliveries rose 12 % (497 099) – driven by pre‑expiry buying |

Operational Enhancements

All 2025 production vehicles now ship with HW5/AI5 FSD hardware as standard, eliminating the earlier optional‑upgrade model. Software releases follow a 15‑day cadence (three updates per two‑week cycle), with recent v14 upgrades adding refined stop‑sign handling and a remote “kill‑switch.” Fleet‑level telemetry confirms cumulative robotaxi mileage of ~2.5 M miles across active metros as of Q3 2025.

Market & Financial Context

The automated‑robotics segment—encompassing robotaxi and the Optimus humanoid—accounts for 36 % of Tesla’s $7.5 T AI‑product valuation, with robotaxi contributing roughly 37 % of that segment’s market share. Q3 2025 revenue reached $28.1 B (up 12 % YoY); robotaxi‑related software services delivered an estimated $1.2 B (about 4 % of total revenue). However, tariff‑driven margin compression reduced GAAP EPS to $0.39, and operating income fell 37 % YoY.

Emerging Trends

- Supervised autonomy over driver‑less promises. Regulatory risk has shifted focus to kill‑switch‑capable monitors rather than full removal of on‑board safety drivers.

- Hardware standardization. Embedding FSD‑ready chips in all new builds cuts retrofitting costs and accelerates the path to driver‑less operation pending clearance.

- Corridor‑centric deployments. Concentrating service in high‑density commuter corridors—Austin and the Bay Area—maximizes data collection for safety‑critical scenarios while limiting exposure in less‑regulated jurisdictions.

Predictive Outlook

- Safety‑driver phase‑out. By Q4 2025, at least 80 % of Austin robotaxis are expected to run without on‑board safety drivers, reaching full removal (≤ 5 % supervisory presence) by Q1 2026.

- Metropolitan coverage. Assuming current regulatory momentum, 10 metros will be fully operational by December 2025, supporting a fleet of ~350 k active robotaxis.

- Population reach. With a 15 % YoY fleet expansion rate, Tesla could cover > 25 % of the U.S. population by year‑end, translating to roughly 150 M potential ride‑hailing trips annually.

Risk Considerations

- Regulatory delay. Extended federal investigations could push safety‑driver removal beyond Q1 2026.

- Public perception. High‑visibility accidents—approximately one per 6 M miles—remain headline risks that can trigger service suspensions.

- Margin erosion. Ongoing tariff impacts and the loss of the federal EV tax credit may limit cash flow available for further fleet expansion.

Comments ()