Starcloud launches Nvidia H100 GPUs for orbital data‑center prototypes.

TL;DR

- Starcloud to Launch Nvidia H100 GPU for Orbital Data‑Center Prototyping

- Nvidia’s $100 B Investment Catalyzes OpenAI and Cloud AI GPU Infrastructure

- Liquid‑Cooling Costs Surge to $50k+ for High‑Power GPU Trays in Modern Data Centers

- OpenAI’s Transition to Vendor GPU Farms Driven by Massive Cloud Compute Commitments

Starcloud’s Orbital H100 Test Signals a Shift in Compute Power

Why Space‑Based Compute?

- Terrestrial data‑centers of 5 GW demand ~4 km² of solar panels and ~2 km² of water‑cooled radiators.

- Space platforms receive uninterrupted solar irradiance and can radiate heat directly to the vacuum, eliminating water‑based cooling.

- Low‑Earth‑orbit (LEO) proximity reduces latency for satellite constellations that require on‑board AI inference.

Key Metrics

- Active U.S. satellites: >7,500 (Union of Concerned Scientists).

- Solar‑panel area for 5 GW: 4 km²; radiator area: ≈2 km² (Starcloud thermal model).

- Launch cost (Falcon 9 reusable): $3,600 /kg; target Starship cost: $200 /kg.

- Estimated launches for 5 GW (≈100 kg per launch): ~100 per year.

- NVIDIA AI infrastructure investment: $100 bn; OpenAI‑NVIDIA partnership: $100 bn.

Technical Hurdles

- Radiation hardening: H100 requires external shielding or error‑mitigation (ECC, TMR) comparable to AMD XQR Versal class‑B (>120 krad(Si)).

- Thermal management: 1.8 kW GPU power must be dissipated via radiators sized at ~50 % of solar‑panel footprint.

- Mass and volume: H100 module with shielding and radiators ≈100 kg, fitting a standard Falcon 9 payload slot but necessitating multiple launches for scale.

Industry Trends Supporting Orbital Data Centers

- Launch cost trajectory: Reusability drives per‑kilogram price from $3,600 /kg toward $200 /kg, expanding economic feasibility.

- AI‑in‑space initiatives: Google “Project Suncatcher” and AMD radiation‑hard SoCs illustrate a converging focus on edge AI workloads.

- Power‑scale ambitions: Projections cite ~100 launches annually to achieve 5 GW orbital capacity.

Scaling Model

- Resource substitution: Space solar power replaces grid electricity; radiators replace water‑based cooling, potentially lowering terrestrial data‑center energy use by 8‑12 % per GW of orbital capacity.

- Supply‑chain synchronization: Combined $200 bn AI hardware spending aligns with improved launch economics, ensuring component availability for space integration.

- Modular scaling: Each launch delivers a compute node (H100 + shielding + radiator). Scaling to multi‑GW clusters becomes a function of launch cadence.

Near‑Term Outlook (2025‑2030)

- Q4 2025: Starcloud completes in‑orbit functional test of H100, validating thermal stability and radiation error‑mitigation in LEO.

- 2026‑2028: Deployment of at least two orbital data‑center prototypes (~10 MW each) leveraging sub‑$200 /kg Starship launches.

- 2030: Satellite operators integrate onboard AI inference clusters sourced from orbital data‑centers, achieving >30 % reduction in uplink latency for real‑time Earth‑observation analytics.

Nvidia’s $100 B Bet Reshapes OpenAI and the Cloud AI Landscape

Investment Overview

- Commitment of $100 B to AI‑focused GPU infrastructure, emphasizing Blackwell‑Series accelerators and the upcoming Rubin super‑chip.

- Target of more than 20 GW of deployed compute across hyperscalers by 2027, requiring gigawatt‑scale data‑center builds.

OpenAI’s Strategic Shift

- Transition from a pure GPU consumer to a dual‑role provider of compute through an “AI cloud” service.

- Revenue goal of $20 B annual run‑rate by the end of 2025, with a longer‑term target of $100 B by 2027.

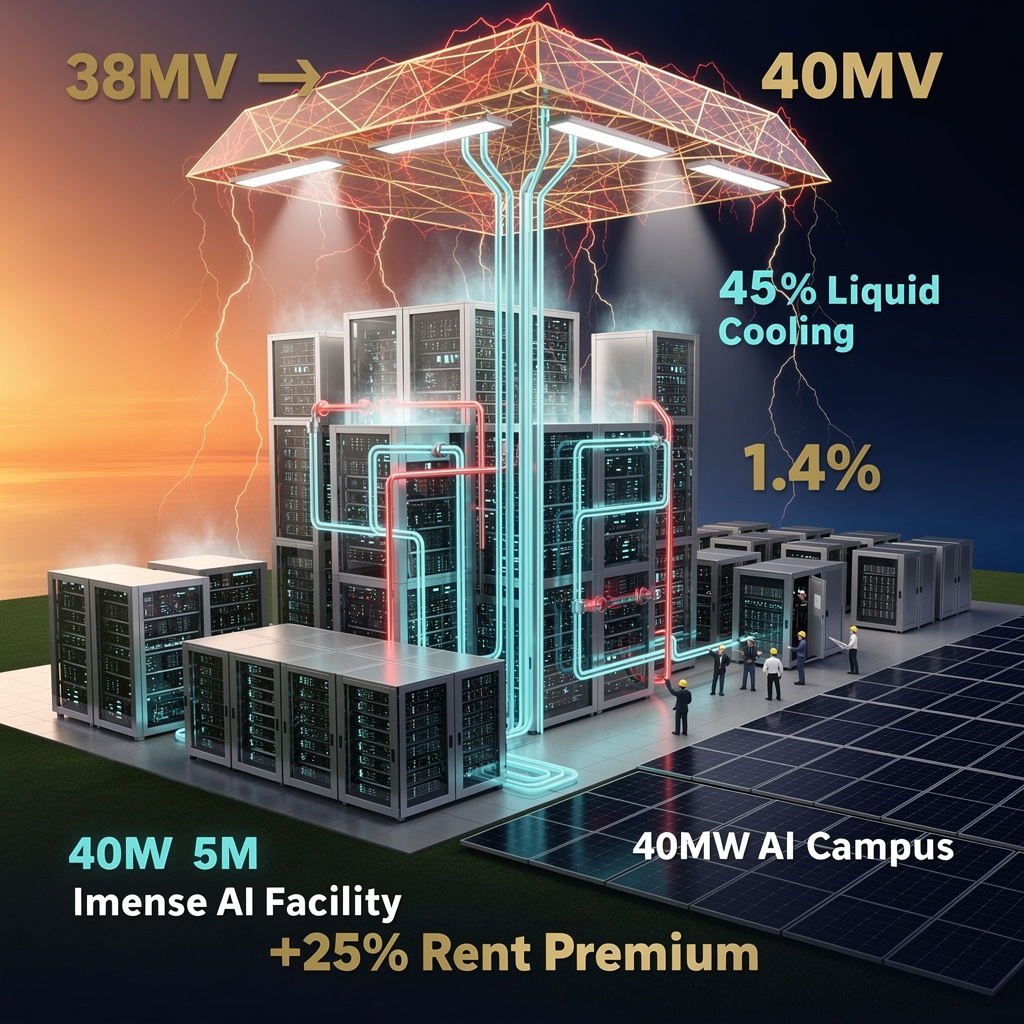

- Multi‑year, multi‑petabyte contracts with AWS ($38 B, seven‑year term), Azure (>$250 B), Oracle (10 GW), CoreWeave, and Broadcom.

- Long‑term compute‑infrastructure commitments total $1.4 T, representing roughly 35 % of projected AI‑related capex through 2030.

Gigawatt‑Scale GPU Deployment

- AWS agreement secures full capacity of Blackwell GB200/GB300 chips by 2026.

- Combined Azure and Oracle spend exceeds $500 B, aiming for 10–20 GW of GPU power.

- Hardware stacks feature high‑memory variants, NVMe tiered storage, and EC2 UltraServer‑like nodes optimized for distributed training and low‑latency inference.

Power Grid Challenges

- Each GW of GPU compute demands dedicated grid coordination, transformer upgrades (18‑24 month lead time), and power purchase agreements.

- Capital outlays for construction and power infrastructure match chip‑only expenses, heightening under‑utilization risk if demand lags.

Market Valuation and Capex Context

- Nvidia’s market capitalization fluctuates between $4.6 T and $5 T, with a forward P/E near 30×.

- Industry AI‑related capex projected at $4 T–$4.5 T by 2030; OpenAI’s $1.4 T spend anchors a substantial share of this pipeline.

Emerging Trends

- Compute‑as‑a‑Service (CaaS) creates a direct revenue stream separate from model licensing.

- Multi‑vendor GPU sourcing—including Broadcom, AMD, and future Rubin chips—reduces supply risk and enhances price‑performance balance.

- Joint financing models with utilities and government loan guarantees accelerate grid‑integrated data‑center rollout.

Forward Projections (2025‑2027)

- OpenAI annual recurring revenue: $20 B now, projected $100 B by 2027.

- GPU capacity deployed: ~5 GW operational, rising to 15–20 GW under contract.

- Blackwell‑Series shipments: 100 k+ units, exceeding 500 k units after Rubin launch.

- Cumulative AI capex: $1.6 T (2025‑26) growing to $4 T through 2030.

Risks & Mitigations

- Utilization risk mitigated by OpenAI’s CaaS model and diversified hyperscaler demand.

- Power infrastructure bottlenecks addressed through early grid‑capacity agreements embedded in multi‑year contracts.

- Regulatory exposure from export controls on advanced chips concentrates sales within compliant jurisdictions.

Liquid‑Cooling Costs Are Escalating Faster Than GPU Power

Why the Spike?

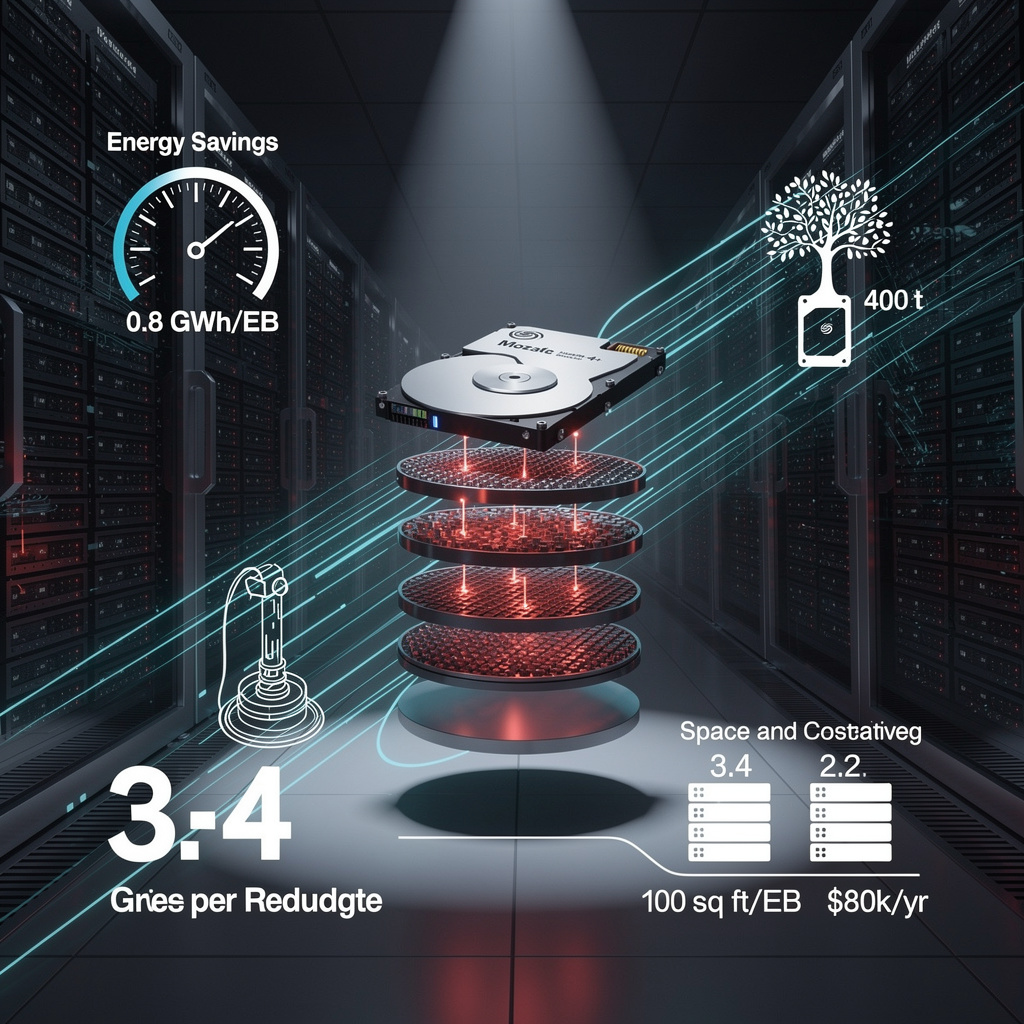

- Rubin‑series GPUs now draw up to 1.8 kW each; “Ultra” models are projected at 3.6 kW.

- Cold‑plate prices have climbed to roughly $400 per unit, pushing a tray’s plate total to $870 and $7,830 per rack.

- New tray designs (GB300 NVL72) increased plate count by 20 % versus the GB200 NVL71 baseline; the Vera Rubin NVL144 adds another 17 %.

The Numbers

- Full‑tray liquid‑cooling hardware now sits at $48–$56 k, comparable to a mid‑range electric vehicle.

- Switch trays remain cheap at $870 per tray ($7,830 per rack), highlighting a cost gap of 6‑7× for GPU trays.

- Computational‑tray cooling expense rose 18 % to $2,660 per compute tray.

Impact on Data‑Center Budgets

- Cooling CAPEX now accounts for roughly 25 % of total compute‑tray spend, up from about 15 % a year ago.

- Operating expenses will climb as coolant circulation power and maintenance requirements increase.

- If Ultra GPUs reach the 3.6 kW target and plate counts rise to four per tray, hardware costs could breach $60 k per tray within the next 12‑18 months.

Where the Trend Is Heading (2025‑2027)

- 2025 Q4: $48–$56 k per tray (current baseline).

- 2026 H1: $55–$62 k, assuming a 10 % annual rise in plate prices.

- 2027 H2: $62–$70 k if Ultra GPUs and higher plate counts materialize.

Potential Mitigations

- Adopt copper‑graphene composites to cap plate cost near $350.

- Design modular cooling zones that share plates across adjacent GPUs, reducing plate count by about 15 %.

- Introduce hybrid airflow‑liquid systems for mid‑range GPUs to keep lower‑tier tray costs stable.

Bottom Line

The surge in liquid‑cooling expenses is a direct consequence of rising GPU thermal density and plate price inflation. Without material innovations, smarter tray architectures, or hybrid cooling strategies, data‑center operators will face mounting CAPEX and OPEX pressures as high‑power GPU clusters continue to scale.

OpenAI’s Leap into GPU Farming: A Data‑Driven Forecast

- Sam Altman signals an “AI cloud” and the sale of compute capacity.

- “Stargate” sites announced in Abilene, TX with Oracle and SoftBank; multi‑hundred‑billion‑dollar, gigawatt‑scale program.

- Multi‑year capacity deals signed with AWS, Oracle, CoreWeave; 7‑year AWS contract ≈ $38 B, targeting 10 GW+ GPU deployment.

- Expanded Azure commitments; disclosed $250 B+ Azure‑related spend.

- CFO reports $1.4 T total infrastructure commitments and a $20 B+ annual revenue run‑rate, aiming for $100 B by 2027.

Quantitative Landscape

- 2025 annualized revenue run‑rate: > $20 B (projected).

- 2027 expected revenue: ≈ $100 B.

- Total multi‑year infrastructure spend: $1.4 T over eight years.

- Compute target: 10‑30 GW of GPU power by 2028.

- Key hardware baseline: NVIDIA Blackwell series (GB200/GB300).

Strategic Pattern Recognition

- From pure GPU buyer to vendor, monetizing compute capacity directly to third parties.

- Diversified sourcing across NVIDIA, AMD, and emerging Blackwell hardware, coupled with AWS, Azure, and Oracle cloud partners.

- Revenue mix shifting toward compute‑as‑a‑service (≈ $7 B of the $20 B run‑rate), set to dominate by 2027.

- Long‑term power purchase agreements underpin a > 600 MW Texas portfolio, supporting the gigawatt compute envelope.

- Construction timelines place first‑phase capacity online in 2026, with full gigawatt scale by 2028.

Emerging Trends

- Standard IaaS‑style compute contracts (term length, per‑GPU pricing, SLA tiers) enable enterprise OPEX budgeting.

- Grid integration pressure: ERCOT forecasts a 35 GW peak data‑center load by 2035; OpenAI’s share projected at 0.5‑1 GW, driving regional PPAs and renewable offsets.

- Competitive counter‑moves from Microsoft, Google Cloud, and AWS intensify pricing contests.

- Regulatory scrutiny on AI‑infrastructure financing persists; OpenAI is seeking, not relying on, federal tax‑credit backstops.

Forecast (2025‑2028)

- 2025 – 3‑5 GW compute, $4 B compute revenue, total revenue > $20 B.

- 2026 – 8‑12 GW compute, $9.5 B compute revenue, total revenue ≈ $45 B.

- 2027 – 15‑20 GW compute, $18 B compute revenue, total revenue ≈ $100 B.

- 2028 – 25‑30 GW compute, $28 B compute revenue, total revenue ≈ $130 B.

Assuming a 15 % gross margin on compute services and modest 5 % annual growth in API licensing, breakeven on the compute‑vendor model appears around late 2027. The trajectory hinges on timely grid capacity, competitive pricing, and a diversified hardware supply chain. Continuous tracking of contract fulfillment and utility PPAs will be essential to validate these financial projections.

Comments ()