Floating Data Centers and AI Power Challenges: Energy, GPU Deals and Quantum Secure

TL;DR

- Floating Data Centers Above Clouds Aim to Cut Energy Use

- US Power Shortage Threatens 10% of Data Center Demand by 2030

- 30% Power Demand Growth Forecasts for Data Centers

- OpenAI's $1.4 Trillion Compute Commitment

- Quantum Security Moves Toward Post-Quantum Infrastructure

Floating Data Centers: A Viable Path to Sustainable AI Compute

Why Altitude Matters

Placing server platforms at 20‑30 km altitude captures up to 15 % more solar irradiance than sea‑level installations, according to standard atmospheric attenuation models. Ambient temperatures near –50 °C improve the coefficient of performance for any residual active cooling, while the thin air reduces convective heat load on equipment. These conditions enable a hybrid power‑cooling approach that directly addresses the projected AI‑driven electricity demand surge—estimated at 7‑12 % of national consumption by 2030 and a 45 GW supply gap by 2028.

Energy Advantages

The “Floating Cloud” concept combines on‑site solar arrays with Neptune liquid‑cooling, which extracts roughly 98 % of system heat. By diverting heat straight to a circulating coolant, the design cuts reliance on conventional chillers and lowers Power Usage Effectiveness (PUE) by up to 30 % (from a typical 1.5 to around 1.2). Continuous solar generation coupled with on‑site Li‑ion storage sustains 24‑hour operation for up to 5 GW per platform—about 11 % of the anticipated shortfall.

- Solar gain increase: +15 % vs. ground level

- Heat removal efficiency: 98 %

- PUE reduction: up to 30 %

- On‑site capacity per unit: 5 GW

Cost and Deployment Compared with Alternatives

Floating platforms occupy a middle ground between high‑cost orbital centers and land‑bound farms. Capital expenditure focuses on buoyancy structures and solar PV, comparable to large offshore wind projects, while avoiding the launch expenses of space‑based modules (≈ $10 kg⁻¹). Underground bunkers repurpose existing civil works, offering lower CAPEX but depend on site‑specific retrofits and do not generate power intrinsically. Regulatory clearance for 30 km airspace is emerging in the EU, streamlining deployment timelines to under two years for pilot units.

- Floating Cloud: moderate CAPEX; intrinsic renewable generation

- Space Data Center: high CAPEX; launch logistics limit scale

- Underground Bunker: low‑to‑moderate CAPEX; grid‑dependent power

Future Outlook (2026‑2030)

Pilot installations of 0.5 GW are slated for Europe in 2026–2027, targeting measured PUE ≈ 1.2. By 2028 cumulative floating capacity should reach 5 GW, offsetting roughly 11 % of the projected 45 GW deficit. Expansion across North America and Asia‑Pacific is expected as regulatory frameworks mature, with total installed altitude capacity approaching 15 GW by 2030—contributing about 30 % of the renewable‑only AI compute supply.

- 2026‑27: 0.5 GW pilots, PUE ≈ 1.2

- 2028: 5 GW cumulative, 11 % gap mitigation

- 2029‑30: 15 GW installed, 30 % of renewable AI compute

Implications for Sustainable Compute

Floating data centers leverage altitude‑enhanced solar input and near‑complete liquid cooling to deliver a mid‑cost, scalable solution for the looming AI energy shortfall. Their ability to generate power on‑site, reduce cooling demand, and avoid land‑use constraints positions them as a strategic complement to terrestrial farms and a lower‑risk alternative to orbital platforms. Continued investment, supportive airspace policy, and liquid‑cooling commercialization will be decisive in achieving a 10‑15 % share of AI compute from altitude platforms by 2030.

Power Shortage Threatens U.S. Data‑Center Growth by 2030

Data‑Center Energy Share Is Accelerating

Industry forecasts show electricity use for data centers climbing from 4 % of total U.S. consumption in 2024 to a range of 7‑12 % by 2030. AI‑intensive workloads alone are expected to consume roughly 500 TWh, driving a projected $144 B AI spend with a compound annual growth rate exceeding 30 %.

Grid Capacity Lags Demand

Utility reports identify a 45 GW power shortfall by 2028, up from a 30 GW deficit in 2023. The gap puts 33 million households at risk and would restrict about 10 % of the electricity needed for data‑center operations in 2030. Even with $480 B of announced industry investment, the expected annual addition of 11 GW (2025‑2028) falls short of the 15‑20 GW flexible generation needed to meet projected demand.

Emerging Technical Responses

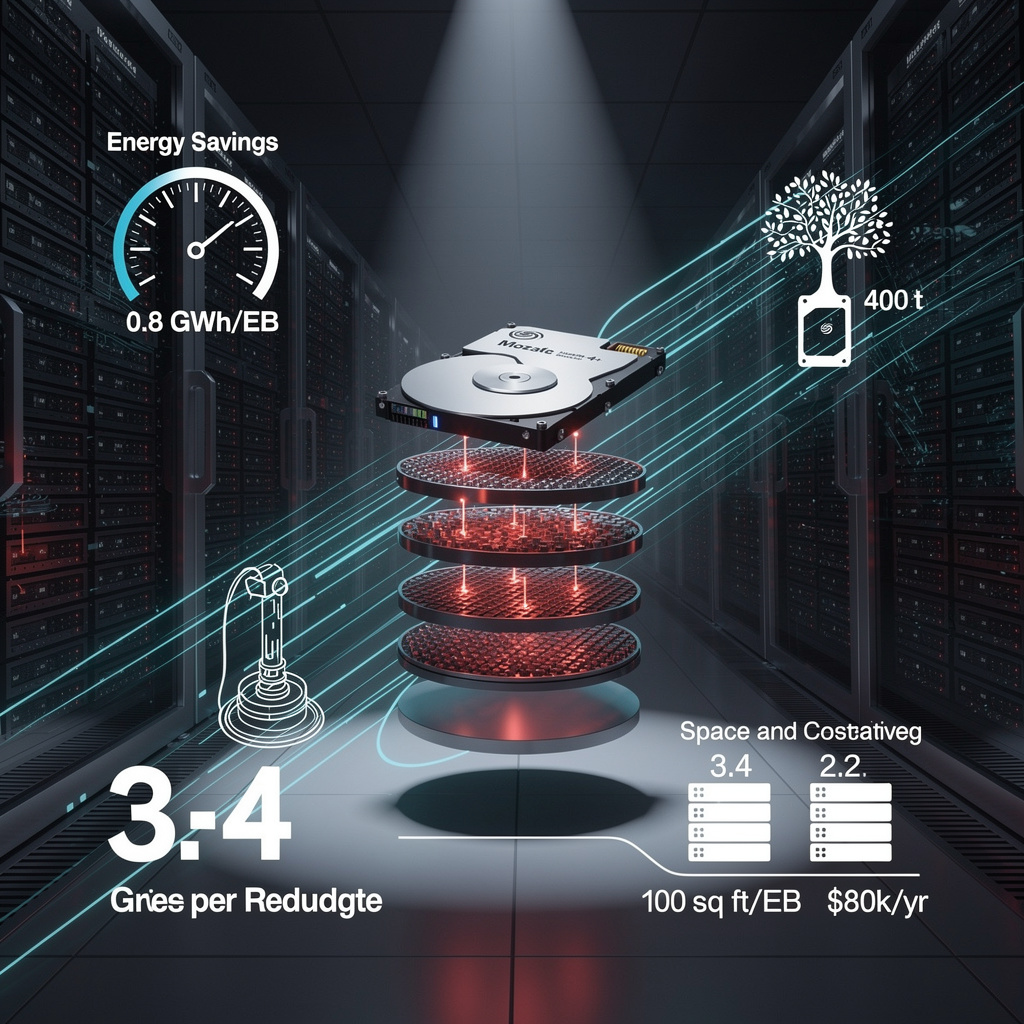

- Renewable‑backed silicon backbone – solar farms and high‑altitude floating‑cloud arrays aim to cut reliance on fossil‑fuel peakers, yet current generation capacity remains limited.

- Underground “data‑spa” bunkers – geothermal sites improve power‑usage effectiveness (PUE) by 30‑40 % through high‑efficiency liquid cooling, without adding generation.

- Space‑based data centers – orbital clusters powered by dedicated solar arrays could supply 5 GW per 4 km², but launch logistics introduce new supply constraints.

- AI‑optimized hardware – Nvidia H100 GPUs and QLC NAND SSDs raise compute per watt, yet total demand continues to rise.

Policy and Investment Priorities

- Accelerate permitting for utility‑scale renewables and prioritize grid‑scale storage to smooth AI workload peaks.

- Allocate at least 30 % of capital to dispatchable clean resources such as advanced gas‑turbine hybrids and utility‑scale batteries.

- Scale high‑efficiency liquid cooling systems (e.g., Neptune) to reduce cooling load by up to 40 % per megawatt.

- Support pilot floating‑cloud solar installations and underground cooling sites to diversify supply, acknowledging their long lead times.

Bottom Line

The convergence of a growing data‑center electricity share and a projected 45 GW grid shortfall creates a tangible risk of curtailing up to one‑tenth of U.S. data‑center demand by 2030. Coordinated regulatory action, targeted investment in flexible clean generation, and rapid deployment of efficient cooling technologies are essential to safeguard both household power reliability and the AI‑driven growth trajectory.

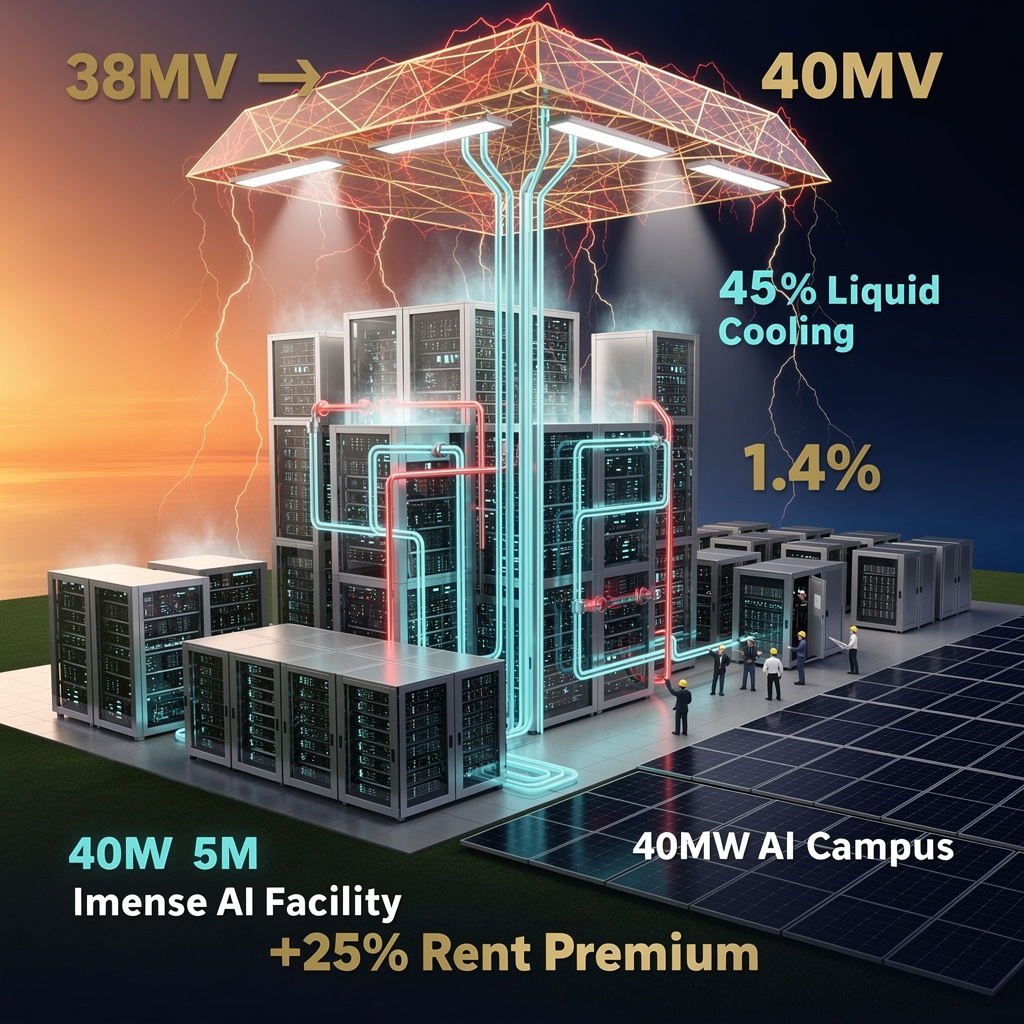

Power Crunch: AI‑Driven 30 % Surge in Data‑Center Energy Demand

Current Power Landscape

- EMEA delivered 850 MW in 2025 – 11 % below 2024, yet live capacity rose 12 % as new take‑up added 845 MW.

- Q3 2025 occupancy held at 91 %, showing tight utilization of existing assets.

AI and HPC Fuel Demand

- IDC forecasts AI spending at US$144.6 bn by 2030, a 30 % CAGR, translating to ~500 TWh of global electricity for AI‑optimized servers.

- High‑performance computing and QLC NAND SSD adoption add pressure; QLC capacity is booked through 2026 and NAND prices have risen 50 %.

- Combined, these drivers underpin an annualized 30 % power‑demand growth projection for the sector through 2030.

Regional Grid Bottlenecks

- U.S. data centres could consume 7‑12 % of national electricity by 2030 (up from 4 % today); Dominion Energy’s order book shows 40 GW of demand against 47 GW of capacity.

- Two‑in‑five EMEA facilities may encounter power constraints by 2027.

- Emerging markets (Poland, Saudi Arabia, Vietnam) face construction costs of US$7.3‑13.3 M per MW due to labour and supply‑chain shortages.

- Forecasts predict a 45 GW shortfall by 2028, up from a 30 GW gap cited for 2023, highlighting a widening supply‑demand mismatch.

Policy Levers and Emerging Designs

- FERC’s load‑flexibility rulemaking (RM26‑4) suggests that 0.5 % demand‑response could free ≈100 GW of headroom – enough to cover the projected gap.

- U.S. utilities filed >US$34 bn in rate‑increase requests for Q1 2025; residential bills climbed to US$175/month in Georgia, signalling broader cost pressures.

- Architectural experiments include solar‑powered floating platforms at 20‑30 km altitude, underground “data bunkers” in abandoned tunnels, and space‑based facilities requiring 5 GW each (≈100 launches annually).

Strategic Path Forward

- Prioritise capital in low‑cost, renewable‑rich regions (e.g., Scandinavia) to mitigate construction and rate‑increase exposure.

- Deploy liquid‑cooling solutions that achieve up to 98 % heat removal, reducing grid draw.

- Accelerate load‑flexibility programs to unlock the ~100 GW safety net identified by regulators.

- Blend traditional grid expansion with high‑altitude solar platforms to diversify supply sources and alleviate land constraints.

OpenAI’s $1.4 Trillion Compute Bet: A New Era of AI Infrastructure

Commitment Overview

- Oracle will build roughly $300 bn of datacenters across Texas, New Mexico, Michigan, and Wisconsin.

- GPU procurement centers on Nvidia’s Blackwell/GB200 accelerators, with CoreWeave handling multi‑vendor sourcing.

- OpenAI will launch an “AI cloud” service (Stargate) and sell direct compute capacity to enterprises.

- Multi‑year contracts with Microsoft (Azure), Amazon (AWS), SoftBank and others add hundreds of billions in guaranteed spend.

Financial Projections

- 2025 revenue run‑rate estimated at $15 bn; CAPEX for the first tranche reaches $1.4 tn.

- Analyst target of $100 bn revenue by 2027, with cumulative outlays of $2.5 tn.

- OpenAI projects breakeven in early 2032, assuming a 40 % annual decline in price‑per‑intelligence‑unit.

- Current revenue mix: 75 % from ChatGPT subscriptions (800 M weekly users) and 1 M enterprise API customers.

Infrastructure & Partnerships

- Oracle’s gigawatt‑scale datacenters slated for 2025‑2027 rollout under the Stargate program.

- Nvidia cash payments secure a dedicated tier of Blackwell GPUs.

- Azure and AWS contracts embed OpenAI’s AI cloud within global hyperscaler footprints.

- SoftBank capital accelerates chip access and market reach.

Funding Landscape

- OpenAI has not pursued federal loans but is lobbying for expanded Chip Act tax credits to lower financing costs.

- Analysts split between viewing the compute outlay as a strategic inflection point and questioning the need for governmental guarantees given the scale.

Market Dynamics

- Investor sentiment has steadied after OpenAI secured multi‑year contracts and outlined a clear revenue path.

- Gigawatt‑scale datacenters increase electricity pricing pressures; state subsidies are being leveraged to offset costs.

- Price per intelligence unit continues to fall roughly 40 % annually, turning compute from a cost‑center to a profit‑center.

Emerging Trends

- Compute‑as‑Product: OpenAI’s AI cloud commoditizes GPU capacity for external customers.

- Patient Capital: The multi‑trillion spend horizon aligns with sovereign or institutional investors rather than short‑term venture capital.

- Regulatory Alignment: Advocacy for Chip Act extensions signals a growing policy‑industry nexus to sustain U.S. AI hardware leadership.

Outlook

- Run‑rate could exceed $30 bn by 2028 and surpass $100 bn by 2029 if enterprise adoption expands beyond the current 40 % share.

- Breakeven timing hinges on maintaining the 40 % annual cost decline; a slowdown would push breakeven to 2034.

- By 2030 OpenAI is poised to rank among the top three AI platform operators in compute capacity and recurring revenue.

Why the World Is Betting on a Hybrid Quantum‑Resilient Internet

The Double‑Layer Defense That Makes Sense Today

European telecoms are rolling out quantum‑key‑distribution (QKD) alongside post‑quantum (PQ) algorithms such as ML‑DSA. The result is a “store‑now‑decrypt‑later” model where QKD handles low‑latency key exchange on existing fiber, while PQ protects data at rest. This hybrid approach buys time until fault‑tolerant quantum computers appear, yet it already thwarts the most realistic quantum attacks projected within the next three to five years.

Performance‑Neutral PKI: Merkle Tree Certificates in Action

Cloudflare’s Merkle Tree Certificates (MTCs) have been submitted to the IETF and are now enabled in Chrome. By allowing clients to pre‑fetch inclusion proofs, MTCs add roughly 1 kB to a TLS handshake—far less than the 10–30 kB overhead of raw PQ key‑exchange. Early adoption suggests a pragmatic migration path that preserves latency for the bulk of web traffic.

Satellite Entanglement Is No Longer Science‑Fiction

Recent uplink experiments from ground stations in France and Australia to low‑Earth‑orbit satellites (≈ 500 km altitude) achieved photon‑pair fidelity above 0.8, peaking at 0.97 under optimal conditions. Modeling shows that a satellite with ≤ 10 kW optical payload can sustain entanglement distribution if ground stations provide at least 1 GW of supporting power. This validates a global QKD overlay for regions where fiber rollout is impractical.

Cost Trends and Infrastructure Spread

- Fiber‑based QKD channels cost €180 k–€250 k per 100 km (2024 pricing); economies of scale are already pulling prices downward.

- Signature sizes for ML‑DSA‑44 sit at 2,420 bytes versus 64 bytes for ECDSA‑P256, and public‑key footprints follow the same pattern.

- Quantinuum’s Helios quantum computer in Singapore provides local access to high‑performance quantum resources, reducing the geographic concentration of quantum‑computing capability.

Standardization and Market Momentum

Both the IETF’s MTC discussions and Europe’s QKD inter‑operability drafts are converging on common specifications. This shared framework eases cross‑border certification and drives hardware manufacturers to mass‑produce low‑loss quantum repeaters, further compressing costs.

Looking Ahead: A Timeline for a Quantum‑Secure Internet

- 2029‑2030: France–Germany QKD backbone operational, extending beyond 1,000 km; first low‑Earth‑orbit constellations delivering continuous global QKD coverage.

- 2035: Over 70 % of TLS‑enabled services in the U.S. and Europe run on PQ‑compatible certificates, thanks to MTC adoption and incremental hardware upgrades.

- Beyond 2035: Full migration away from RSA/ECDSA as quantum computers capable of breaking these schemes become a practical threat.

Bottom Line

The convergence of fiber‑based QKD, post‑quantum cryptography, and satellite‑assisted entanglement forms a layered security fabric that is already viable and cost‑effective. Continued standardization, cross‑regional collaboration, and the steady drop in component prices will make a globally quantum‑resilient communications infrastructure a reality within the next decade—well before quantum computers can jeopardize today’s cryptographic foundations.

Comments ()