AWS, OpenAI, NVIDIA Secure $38B GPU Deployment Deal

TL;DR

- AWS and OpenAI secure $38 billion agreement, deploying hundreds of thousands of NVIDIA GPUs for cloud‑based AI training.

- Multi‑cloud hybrid infrastructures rise, enabling workload portability and reducing single‑provider failure risk across enterprise data centers.

- U.S. data centers consume 4 % of national electricity, projections show a near‑tripling of energy demand by 2028.

AWS‑OpenAI Deal Signals a New Era of Power‑Hungry, Multi‑Cloud AI

GPU Scale‑Out Sets a New Benchmark

- Hundreds of thousands of NVIDIA GB200/GB300 accelerators will be installed by the end of 2026, roughly 90 000 GPUs per year.

- At an average cost of $60 000 per GPU‑year, the $38 B, seven‑year contract translates to a per‑GPU price that will reshape AWS’s pricing tiers for enterprise AI.

- This rollout dwarfs the combined 2023‑2024 AWS GPU fleet, representing a 150 % increase in capacity.

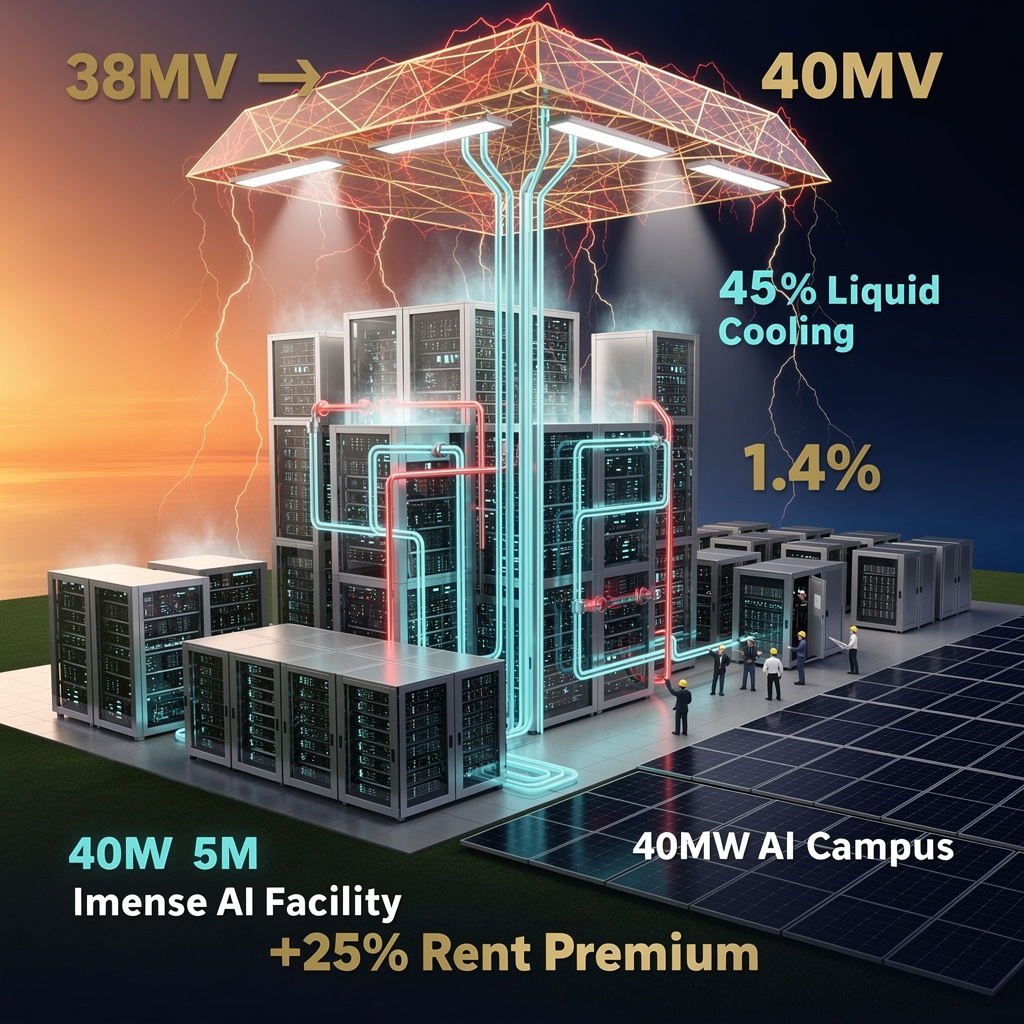

Power and Cooling Become Strategic Assets

- The plan calls for 30 GW of dedicated compute power—enough to supply 25 million U.S. homes—by December 2026.

- An additional $1.4 T earmarked for data‑center expansion will fund power, cooling, and custom EC2 UltraServers, pushing total AI‑specific consumption to an estimated 40 GW by 2028 when AMD and Oracle resources come online.

- Renewable‑energy contracts and ultra‑efficiency cooling systems will be required to keep carbon intensity below 0.05 tCO₂ / kWh, aligning with AWS’s sustainability targets.

Multi‑Cloud Diversification Redefines Competition

- With Microsoft’s right‑of‑first refusal expired, OpenAI can now distribute workloads across AWS, Azure, and Google Cloud, creating a true hybrid model.

- Microsoft retains a 27 % equity stake in OpenAI and continues a massive Azure spend, while Google pursues a 32 % YoY growth in AI services, cementing a “tri‑hyperscaler” race.

- The combined compute commitments of the three giants now exceed $2 T, indicating that sheer horsepower—not just service breadth—will be the decisive market factor.

Market Impact and Forecasts

- AWS’s AI‑specific cloud market share is projected to climb from ~22 % in 2023 to roughly 35 % by 2028, buoyed by the $38 B deal.

- Annual GPU capacity growth is expected to average +170 % YoY, while power consumption will rise from 30 GW in 2026 to about 40 GW by 2028.

- The contract’s $5.4 B yearly value represents a clear signal that hyperscalers are moving from service‑level competition to a capital‑intensive “compute‑first” strategy.

Why This Matters

- The scale of investment underscores a shift in AI economics: infrastructure costs will dominate over software licensing, compelling customers to negotiate bulk compute agreements.

Why Multi‑Cloud Hybrid Isn’t a Trend Anymore—It’s the New Baseline

The Wake‑Up Call From Recent Outages

When AWS lost service for two weeks in October 2025 and Azure suffered a global degradation later that month, the impact was immediate: >2 000 digital services stalled, and over 8 million Windows endpoints went offline during the CrowdStrike incident. Companies that had already spread workloads across providers saw a 40 % drop in interruption rates because traffic could be rerouted to Azure or on‑premise capacity.

Hard Numbers on Adoption

- 71 % of enterprises still run on a single cloud (2024 market survey).

- 29 % now use two or more clouds, yet 95 % of that spend remains with a primary provider.

- Forecasts project ≥45 % of workloads will be multi‑cloud‑enabled by mid‑2027, shifting budget splits toward a 60/40 primary/secondary balance.

Technology That Makes It Viable

- Kubernetes + KubeVirt: Provides a unified control plane for containers and VMs, eliminating the need to refactor applications for each cloud.

- Data‑Mobility Platforms: Cloudera Data Platform, Azure Arc, and Google Anthos enable seamless replication and migration of datasets across environments.

- Nokia SR‑Linux & EDA: Digital‑twin validation cuts configuration‑related downtime by 96 %, delivering 23.9× higher reliability.

- Cisco Hybrid‑Mesh Firewall: Centralizes policy enforcement, achieving ≥99.5 % threat detection across mixed‑cloud traffic and reducing incident response by two hours on average.

- Infrastructure‑as‑Code & GitOps: Terraform, Pulumi, and declarative pipelines keep drift under control, simplifying multi‑cloud provisioning.

Cost and Risk Payoff

Enterprises leveraging Nokia’s EDA reported annual savings of $3–5 M by avoiding configuration errors. The same groups experienced a 40 % lower outage exposure during the AWS incident, directly protecting revenue streams. Security postures improve as unified firewalls maintain consistent controls, while AI‑intensive workloads benefit from the recent OpenAI‑AWS $38 B compute deal that encourages diversification of GPU resources across providers.

What’s Next?

- Standardised portability APIs (CNCF Multi‑Cloud Service API) are expected to reach 70 % adoption among Fortune‑500 IT teams by 2026.

- Hybrid edge data centers, especially in the Asia‑Pacific, will integrate with public clouds to meet latency‑critical AI demands.

- By Q4 2026, at least three major AI‑heavy SaaS vendors will secure multi‑cloud compute contracts, following OpenAI’s diversification.

Bottom Line

The convergence of resilience, cost optimization, and workload portability has turned multi‑cloud hybrid architectures from an experimental option into the operational default. Companies that continue to depend on a single provider risk repeated disruption, higher spend, and reduced agility. Embracing the mature orchestration stack—Kubernetes, data‑mobility tools, automated network validation, and unified security—will be decisive for organizations aiming to keep pace in the next wave of enterprise IT.

U.S. Data‑Center Energy Surge Threatens Grid Stability

Rising Power Demand

- Peak electricity use by data centers reached ~60 GW in Oct 2024, about 4 % of national consumption.

- Utility forecasts for the Southeast and Pacific Northwest project 171‑219 GW by 2028, a near‑tripling of current load.

- Planned utility capacity additions total 32.6 GW (2025‑2028); roughly 64 % of this growth is attributed to data‑center demand.

AI and Hyperscale Expansion

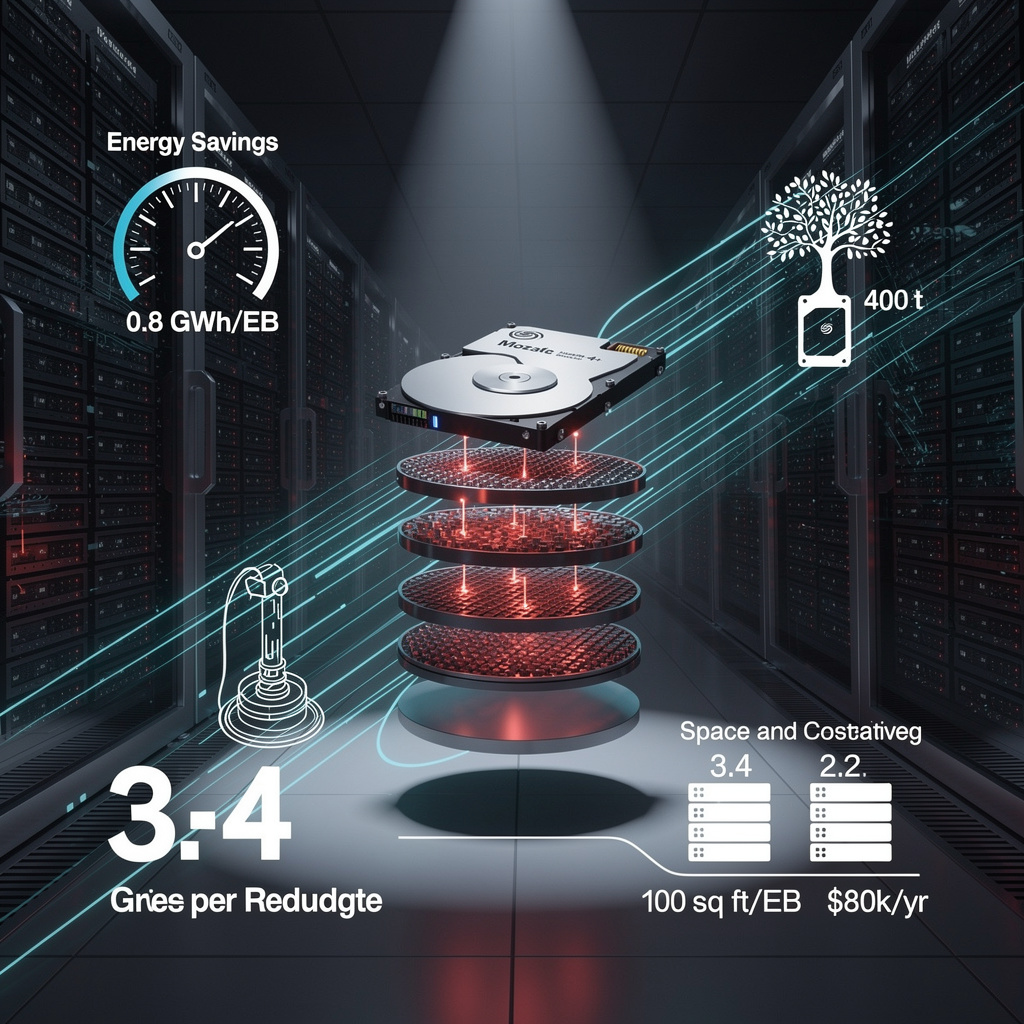

- Annual AI‑related hardware spend climbs from $6 B (2025) to $173 B (2029), driving the deployment of >10 GW of dedicated AI acceleration capacity by 2026.

- Contracts for 47 GW of hyperscale capacity (Sept 2025) concentrate in North Carolina, South Carolina, Georgia, Virginia, and Oregon.

- OpenAI, Amazon, Microsoft and Nvidia collectively announce >$1.1 trillion in hardware/cloud investment through 2035, reinforcing the baseload nature of data‑centre power use.

Infrastructure Strain

- Transmission corridors in Indiana and Tennessee approach overload thresholds, requiring accelerated upgrades to the 32.6 GW planned expansion.

- Baseline stress on the grid raises outage risk during summer peaks; battery energy storage systems and advanced demand‑response platforms are essential buffers.

- Cooling demands can exceed 5 M gal/day per site; dry‑cooling and liquid‑cooling technologies, coupled with water‑reuse schemes, mitigate water‑resource impacts.

Policy Gaps

- Texas Senate Bill 6 enables utility cost recovery for data‑center upgrades, but similar mechanisms are absent in other high‑growth states.

- Virginia’s vetoed data‑center regulatory bill highlights emerging state‑level resistance without coordinated federal guidance.

- Potential rollback of Inflation Reduction Act tax credits would increase capital costs for renewable PPAs, slowing clean‑energy adoption in the sector.

Path Forward

- Scale renewable‑energy PPAs to secure at least 10 GW of new solar and wind contracts annually, matching incremental demand.

- Adopt ASHRAE 90.1‑2024 efficiency standards for all new constructions; incentivize retrofits to liquid‑cooling systems.

- Establish a federal Data‑Centre Grid Task Force to synchronize utility planning, tax policy, and renewable targets, publishing annual capacity‑gap assessments.

- Prioritize transmission upgrades along high‑density data‑center corridors to prevent bottlenecks and maintain reliability.

Comments ()