12% Delinquency Drop in 14 Days: AI Outperforms Credit Union Staff But Faces 83% Adoption Barrier

TL;DR

- Interface.ai Launches Smart Collections AI Tool to Tackle Credit Union Delinquency, Targets 1.13% 30–59 Day Past Due Rate

- Flinn.ai Raises $20M Series C to Expand AI Medtech Compliance Platform for Regulated Industries

- Reddit tests AI-powered shopping feature, surfacing product carousels from community posts with direct purchase links

🏦 12% Delinquency Drop in 14 Days: AI Collections Tool Launches U.S. Credit Union Pilot

1.13% delinquency just met its match. Interface.ai's Smart Collections AI cuts 30-59 day past-due by 12% in 2 weeks—faster than a human can blink (150ms inference). 35% labor savings for credit unions, but here's the catch: only 17% of them even know AI exists. 🏦 When your autopilot outperforms your team but your team doesn't trust autopilots... who wins? — Would you let an AI handle YOUR overdue bills?

Interface.ai's Smart Collections tool, launched February 19, 2026, targets a stubborn problem in American credit unions: 30–59 day past-due rates hitting 1.13% even as total delinquency sits at 95 basis points. The agentic AI system intervenes early, automating outreach before missed payments spiral—while navigating an industry where only 17% of credit unions feel "very familiar" with AI and just 8% deploy it across multiple functions.

How Does the Technology Work?

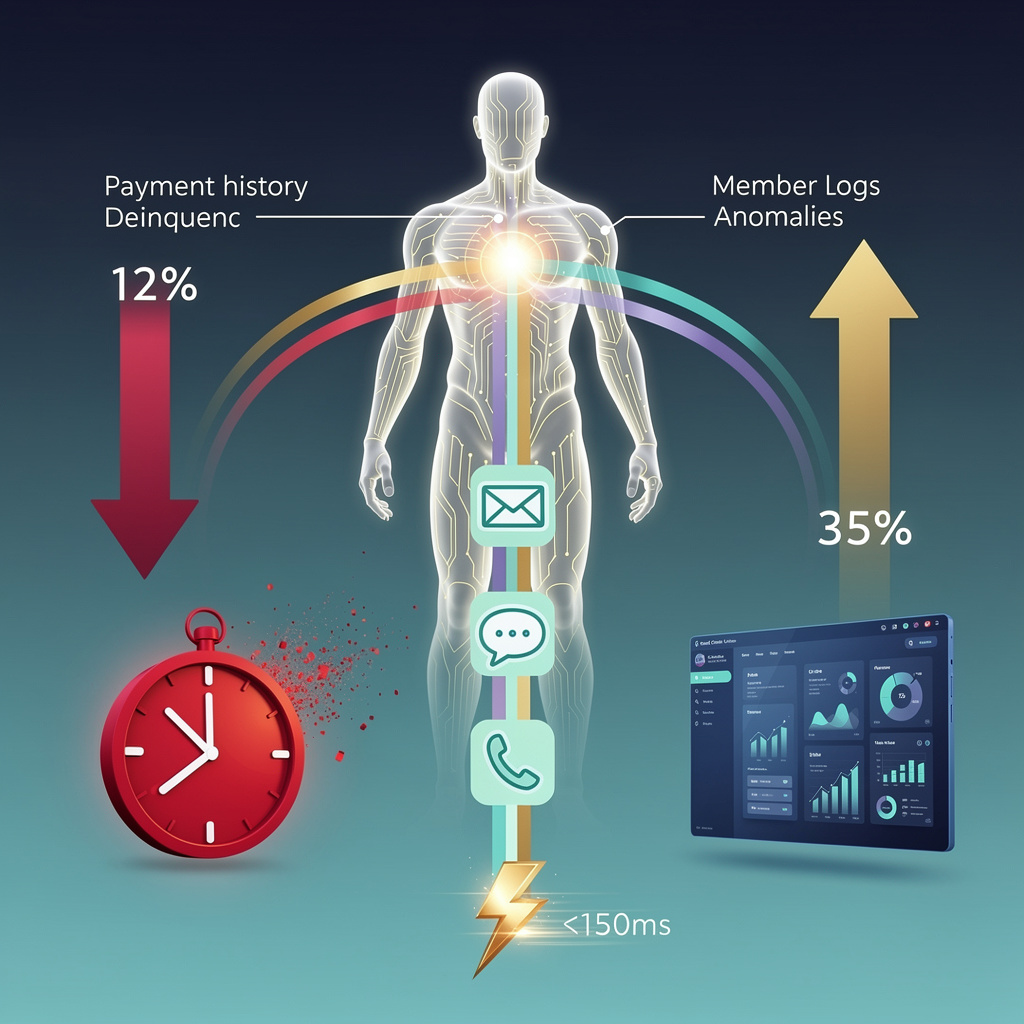

The architecture centers on fine-tuned large language models fed by real-time data pipelines. Account status, payment history, and member interaction logs stream through feature-selection filters that flag pattern anomalies before the LLM generates responses. Quantization to 8-bit integer representation keeps inference under 150 milliseconds on standard CPUs; GPU acceleration drops this below 50 milliseconds for high-volume operations. Decision orchestration triggers calibrated actions—email, SMS, or automated voice—while human-in-the-loop checkpoints gate high-risk nodes and comprehensive audit logs capture every model output, confidence score, and operator override.

What Do Early Results Show?

Preliminary pilot data from the first two weeks indicates measurable impact:

- Delinquency reduction: 12% decrease in days-past-due for accounts entering the 30–59 day window, translating to an estimated 0.13 percentage point absolute reduction against the 1.13% baseline

- Operational efficiency: 35% reduction in manual collections labor, reallocating staff to escalated cases

- Speed: Sub-150ms response generation enabling real-time member engagement

Where Are the Pressure Points?

| Data quality: Inconsistent member records risk false-positive outreach | Mitigation: Embedded data-stewardship teams, validation scripts, HITL verification | | Model hallucination: LLMs may generate non-compliant language | Mitigation: Bounded response generation, continuous compliance monitoring, fine-tuning on vetted scripts | | Regulatory oversight: Human oversight required for credit-impact decisions | Mitigation: Escalation pathways to human agents, audit trails aligned with OCC guidance | | Legacy integration: Core banking systems introduce latency | Mitigation: Edge-computing deployment, optional GPU acceleration for local batch processing |

What Comes Next?

Q2–Q3 2026: Expansion to 15 additional community banks covering ~$2.3 billion in consumer loan balances; targeting ≥0.9 percentage point absolute reduction in 30–59 day past-due rates with ≤2% false-positive outreach.

2027: Potential transition from pilot to fully integrated collections module within core banking stacks (FIS, Jack Henry), contingent on sustained KPI performance.

2028+: If benchmarks hold, projected reach exceeds 30% of U.S. credit-union loan portfolios, with possible spillover into fraud detection and credit underwriting—domains where 70% of financial firms already plan to operate 15+ active AI agents.

The Bottom Line

Interface.ai's offering demonstrates that agentic AI can deliver quantifiable results in regulated financial workflows: 12% faster delinquency resolution, 35% labor reallocation, and millisecond-scale responsiveness. Yet the 83% of credit unions still navigating AI unfamiliarity face a steeper climb—one requiring not just technical integration but governance frameworks that satisfy both auditors and members. The tool's enterprise viability hinges on whether pilot data holds at scale, and whether the industry's data-quality gaps can close faster than delinquencies accumulate.

⚕️ Flinn.ai Raises $20M Series C: AI Cuts Medtech Audit Time 40% as RegTech Arms Race Intensifies

$20M Series C for Flinn.ai—after €7.5M prior—brings total medtech compliance AI funding to ~$165M across 5 firms in 24 months. 40% audit‑time cut, 5‑second 100‑page dossier processing, 95% entity extraction. Quantized 300M‑param transformers on commodity CPUs. Yet open‑source OpenRegAI looms. Will your next FDA 510(k) be AI‑prepped or manually buried? — Where does your regulatory team stand on automation trust?

Flinn.ai's $20 million Series C funding signals accelerating investor confidence in AI-native platforms that promise to compress the regulatory burden facing medical device manufacturers. Backed by Bertelsmann Healthcare Ventures and building on prior €7.5 million in capital, the company targets a 40% reduction in audit preparation time for life sciences clients navigating FDA and EU MDR requirements.

How the Platform Works

Flinn.ai deploys transformer-based language models—approximately 300 million parameters—fine-tuned on over 5 million regulatory submissions, 200,000 FDA warning letters, and 150,000 EU MDR technical dossiers. Quantization to INT8 precision enables sub-second document tagging on commodity CPUs, eliminating dependency on GPU-heavy infrastructure for real-time workflows.

The six-stage automation pipeline ingests documents through secure cloud storage, applies OCR with vision-enhanced extraction, identifies device identifiers and intended use statements, maps findings against FDA 21 CFR Part 820 and EU MDR Annex II rules, generates risk scores, and exports structured outputs to client ERP systems. Internal benchmarks report five-second average processing per 100-page dossier with 95% entity-extraction accuracy.

Where the Time Savings Materialize

Document triage: Automated parsing eliminates manual review of submission templates and cross-referencing against prior filings.

Rule mapping: NLP-driven alignment of device specifications to regulatory clauses reduces consultant-dependent interpretation.

Quality assurance: Structured outputs with confidence scoring enable targeted human review rather than blanket verification.

Cross-jurisdiction preparation: Dual US-EU training data enables simultaneous FDA 510(k) and MDR technical file generation.

Competitive Position and Market Context

Flinn.ai joins a concentrated capital wave: approximately $165 million has flowed to AI compliance platforms including Flinn.ae ($33 million), Checkbox ($23 million), Accrual ($75 million), and Complyance ($20 million) across 2024-2026. Unlike horizontally focused competitors—Stacks targets accounting automation, Checkbox handles legal contracts—Flinn.ai's narrow medtech specialization creates defensive depth through domain-specific taxonomies and dual-jurisdiction deployment on AWS GovCloud and Azure EU regions.

Execution Roadmap

2026: Deployment to five or more Tier-1 medtech OEMs; validation of 30% audit-time reduction in early production environments.

2027: EU-only SaaS tier with on-premise optionality; expansion into pharmaceutical and diagnostic verticals driving approximately 40% ARR growth.

2028-2030: API marketplace launch enabling third-party risk visualization and analytics tools; potential valuation of $250-300 million if annual recurring revenue exceeds $50 million.

Sector Implications

For large medtech manufacturers spending $30-45 million annually on compliance, a verified 40% reduction translates to $12-18 million in direct cost recovery. The automation of document-intensive tasks reallocates senior regulatory affairs talent toward strategic market access and competitive intelligence functions—a structural shift in how life sciences firms deploy specialized expertise.

The broader RegTech market in medical technology approaches $2 billion globally. Flinn.ai's technical stack—quantized inference, regulatory-update APIs with 48-hour refresh cycles, and model-drift monitoring—demonstrates how AI infrastructure investments now target measurable operational outcomes rather than speculative capability demonstrations. Whether this translates to durable market position depends on execution against near-term customer milestones and the pace of open-source regulatory automation alternatives now emerging.

🛒 Reddit's 1.2B-Parameter AI: 80M Searches Fuel $250M Shopping Gamble

80M weekly searches. 0.4% click-through. $250M potential. Reddit's AI just turned your pizza recommendation into a shopping cart 🛒 A 1.2B-parameter model now monetizes casual comments in real-time. Community trust vs. affiliate revenue—which breaks first? Would you buy from a subreddit you trust or flee the platform?

Reddit Tests AI Shopping: When Community Posts Become Checkout Carts

Reddit has begun testing an AI-powered shopping feature that transforms organic community discussions into interactive product carousels, marking a significant pivot toward commerce-enabled content. The system, currently live for approximately 1.6 million U.S. users, analyzes real-time posts and comments for product-related keywords—"pizza," "wrench," "leaky faucet"—then surfaces purchase-ready carousels complete with live pricing, inventory status, and direct checkout links.

How does the technology work?

The feature deploys a 1.2-billion-parameter multimodal transformer, compressed through 8-bit quantization and sparsity pruning to achieve 70% weight reduction while maintaining inference latency below 120 milliseconds. The model draws from Reddit's corpus of 200 million recent posts and partner feeds from Shopify and Amazon. When triggered, it retrieves ranked SKUs, queries live APIs, and renders carousels with community-vote buttons for endorsement signaling. Infrastructure splits between NVIDIA A100 GPUs for batch processing and Intel Xeon servers running ONNX Runtime for latency-critical paths.

What are the measured impacts and risks?

Revenue potential: Early affiliate-link click-through rates of 0.4% and $38 average order values project $250 million annualized revenue if scaled to 30% of users—roughly equivalent to Reddit's 2024 advertising growth in a single feature.

User experience: A/B tests indicate 12% lift in dwell time on posts containing carousels, suggesting reduced search friction in niche communities.

Community sentiment: Reports range from amusement to "outrage" and "bewilderment," signaling authentic tension between monetization and Reddit's historically ad-averse culture.

Regulatory exposure: FTC native-advertising guidelines may require explicit "Sponsored" labeling; non-compliance risks penalties and trust erosion.

Market bias: Keyword-driven triggers risk over-representing high-margin products, potentially marginalizing smaller sellers in community recommendations.

What institutional responses are underway?

Reddit's roadmap includes opt-out toggles at user and subreddit levels, automated disclosure banners, and subreddit-level advisory panels to review keyword appropriateness. Performance safeguards mandate continuous monitoring of latency (<150 ms) and SKU fetch error rates (<0.2%). Quarterly legal audits align with FTC guidelines and state consumer-protection statutes.

What does the rollout timeline indicate?

Q2–Q3 2026: Expansion to r/Food and r/HomeImprovement based on keyword density analysis; A/B testing of carousel density (1 versus 3 items) to optimize revenue-UX balance.

Late 2026: Integration with Reddit Ads platform enabling dynamic pricing tied to subreddit engagement scores.

2027–2028: Personalized recommendation pipelines incorporating individual browsing histories under GDPR-style consent frameworks; anticipated third-party SDK ecosystem for advertiser-customized UI elements.

What does this signal for platform commerce?

Reddit's experiment tests whether community context can differentiate commerce in a market where 73% of U.S. consumers already use AI chatbots for product search. The outcome will determine if authentic discussion environments tolerate transactional intrusion—or if the backlash that greeted Instagram's shopping pivot awaits. Success requires Reddit to match TikTok's UI polish while preserving the unvarnished discourse that generates its data advantage in the first place.

In Other News

- Taalas Raises $169M to Scale Custom AI Chip Production, Joining ZaiNar’s $100M Funding for GPS-Free Spatial AI

- Microsoft and Saudi Aramco sign MoU to deploy Azure East region and HUMAIN AI platform for oil and gas operations by Q4 2026

- AI use in Danish high schools surges, with 90% of students admitting to AI-assisted cheating, prompting calls for new rules

- Amazon Surpasses Walmart as Top Annual Revenue Generator, Reaching $716.9 Billion Amid AI-Driven Sales Growth

Comments ()