12 Sovereign AI Models, 58K GPUs: India's $200B Bet on Data Sovereignty

TL;DR

- India Launches 12 Indigenous AI Models at AI Impact Summit 2026, Targets Sovereign AI

- U.S. Treasury Releases Six AI Governance Resources for Financial Sector

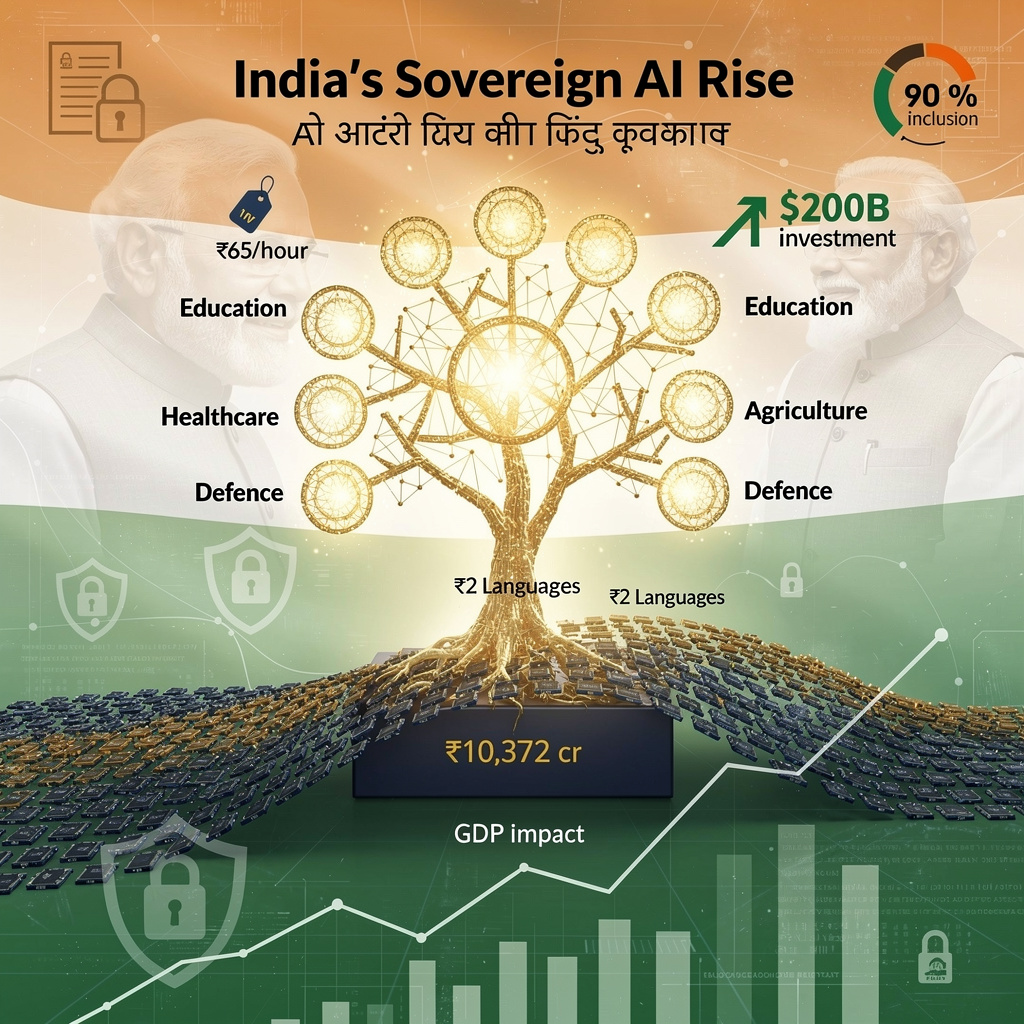

🚀 India's 12‑Language AI Fleet: 58,000 GPUs, Rs 65/Hour Compute & $200B Investment Wave

🇮🇳 India just launched 12 sovereign AI models covering 22 languages, backed by 58,000 GPUs at Rs 65/hour! That's like giving every Indian startup the compute power of a small nation. A $200B investment wave could add $1T to GDP by 2031—but will data sovereignty fuel innovation or limit it?

Prime Minister Narendra Modi’s unveiling of twelve indigenous AI foundation models at the India AI Impact Summit marks a strategic pivot. This initiative, backed by BharatGen and Digital Public Infrastructure, directly targets a critical exclusion gap: an estimated 90% of India’s population has been sidelined by English-centric AI systems. By optimizing these models for 22 Indian languages and pricing compute access at a democratizing Rs 65/hour, the government is laying a public infrastructure foundation for sovereign AI.

The Technical Core

The twelve transformer-based large language models (LLMs) are engineered with sparsity and quantization techniques for efficiency, though specific parameter counts remain undisclosed. Their intended domains—education, healthcare, agriculture, public service delivery, and defense analytics—signal a focus on high-impact societal applications. Critically, they are integrated with India’s Digital Personal Data Protection Act and the IndiaAI Safety Institute’s guidelines, incorporating watermarking and harmful-content filters from the outset.

Infrastructure and Investment Scale

The hardware backbone is substantial: 38,000 high-end GPUs are already onboarded, with an additional 20,000 announced at the summit, bringing total planned capacity to ~58,000 units. This compute power is paired with a Rs 10,372 crore (≈$125 M) government budget for the broader AI ecosystem, including semiconductor fabs and data labs. Industry projections cited at the summit suggest a staggering >$200 B in AI-related capital inflows over the next two years, with $70–90 B already pledged.

Immediate Impacts and Institutional Response

The rollout strategy is aggressive. APIs for the models are slated for release within four weeks, with a free tier for startups and academia. An early adopter cohort of roughly 200 startups is projected to consume 15% of the newly priced GPU capacity, primarily for vernacular applications like agricultural advisories and local-language chatbots. The government’ response framework is defined by a “Sovereign AI Stack,” mandating domestic data residency for sensitive sectors and enforcing compliance for public-sector AI services starting in Q3 2026.

Strengths & Gaps

- Inclusion & Market Creation: Targets a vast, underserved multilingual user base, creating a new domestic services market with export potential to similar nations.

- Strategic Autonomy: Aims to reduce foreign-model dependency in critical government workloads from 80% today to 10% by 2029, enhancing security.

- Infrastructure Risk: Concentration of GPU resources in government data centers could limit private-sector scaling flexibility.

- Data Challenge: Ensuring model robustness across 22 languages, especially low-resource dialects, requires extensive benchmark datasets that are currently limited.

The Roadmap: A Phased Outlook

- 2026: APIs launch, early startup adoption drives initial use-cases in education and agriculture. Data-sovereignty clauses for public-sector AI take effect.

- 2027–2028: Target of 10,000–15,000 world-class AI researchers by 2030 begins scaling from ~200 today. Five national AI research labs established, focusing on multilingual training.

- 2029–2031: Goal of 90% of critical government AI workloads on domestic models. If the $200 B investment trajectory holds, AI-driven productivity gains could add up to $1 trillion to India’s GDP by 2031.

The summit’s announcements move India’s sovereign AI vision from rhetoric to operational reality. The fusion of language-optimized models, publicly accessible compute, and massive planned investment directly confronts the dual challenges of digital exclusion and strategic dependency. The true test will be in execution—bridging the data gaps for low-resource languages, ensuring the compute pool scales efficiently, and nurturing the talent pipeline of 12 million annual new workforce entrants into high-skill AI roles. If these align, India is positioned not just to consume AI, but to shape its next, more inclusive chapter.

📜 U.S. Treasury Mandates Six AI‑Governance Resources for Financial Sector by May 15

58% of financial institutions now use AI, but only 25% had formal governance in 2025. The U.S. Treasury just mandated 6 new AI-governance resources for the entire sector by May 15. 🚨 This framework includes zero-trust data rules, fraud-detection blueprints, and EU-aligned audit logs. Could standardized AI rules save the industry $1.2B in fraud losses annually?

The U.S. Treasury Department has launched a decisive, six-part governance framework mandating how financial institutions must build, audit, and secure their artificial intelligence systems. Released this week, the resources target the sector’s most acute vulnerabilities—fraud, opaque data pipelines, and unauditable models—with enforceable technical specifications and a staged 90-day adoption deadline. This initiative operationalizes the White House’s broader AI Action Plan, converting policy ambition into a concrete compliance calendar for banks and fintech firms.

The Mechanics of Mandated Governance

The framework, developed by the Treasury’s Artificial Intelligence Executive Oversight Group (AIEOG), prescribes exact technical controls. It mandates cryptographic provenance tags on training data, JSON-based audit logs stored for seven years in federally validated systems, and model compression that limits parameter pruning to 30% to preserve baseline accuracy above 95%. For digital identity, it requires multi-modal biometric systems calibrated to a false-accept rate below 0.2%, with a human reviewer for any transaction exceeding $100,000.

Impacts: Closing the Gaps

The resources directly address gaps highlighted in recent industry surveys, where 72% of firms cited poor data quality as a top barrier and only 25% had formal AI-governance programs in place.

Auditability & Compliance: Mandated traceability records and model documentation align U.S. requirements with the EU AI Act, enabling cross-border model reuse and satisfying SEC guidance on AI-reliance disclosure.

Fraud & Risk Reduction: Standardized anomaly-detection pipelines and a dedicated fraud-detection blueprint are projected to cut fraud-related losses by 18–20% against the 2025 baseline, translating to an estimated $1.2 billion in annual savings.

Cybersecurity Resilience: The playbook includes adversarial-threat templates for prompt-injection and model-extraction attacks, requiring sandbox isolation and differential-privacy noise injection on query logs to mitigate data-leakage risks.

Institutional Response and Remaining Challenges

The rollout is coordinated with the FBIIC, FSSCC, and CISA, ensuring federal alignment. However, the Treasury acknowledges hurdles, including fragmented legacy data systems and potential conflicts with emerging state-level AI statutes. In response, it recommends a 90-day “baseline audit” for data domains and will issue a compliance FAQ by July 2026, including a preemption matrix to clarify federal versus state obligations.

The Regulatory Horizon

The adoption timeline is aggressive, with final compliance required by May 15, 2026. The forecasted rollout shows measurable industry shifts within two years.

- Q2–Q4 2026: Over 60% of top-50 U.S. banks integrate the transparency standard into internal model-risk management, leveraging existing AI labs at the Fed and CFPB.

- 2027–2028: Fraud-detection loss rates drop by the projected 18–20%, and investigation times shorten by approximately 30%, mirroring efficiency gains already observed in Department of Justice AI pilots.

- 2029–2030: Full regulatory convergence with the EU AI Act is achieved, allowing seamless cross-border AI deployment and eliminating duplicate audit burdens for multinational institutions.

This framework moves the financial sector from experimental AI adoption to governed integration. By embedding technical guardrails—from zero-trust data architecture to quantified performance thresholds—the Treasury provides a scalable foundation. It balances innovation with accountability, aiming to secure the system while preserving the competitive advantages AI enables. The success of this sprint will be measured not just in compliance checkmarks, but in the subsequent downturn of fraud losses and the increased resilience of the financial network itself.

In Other News

- CSDA Program Releases 99cm-Resolution Multispectral Earth Data via SDX Platform

- Legora Raises $400M at $5B Valuation Amid Legal AI Competition

- Qwen 3.5 Released by Alibaba with 256K Context, 60% Cost Reduction

- Heidelberg University Develops Orbital-Free ML Method for Accurate Quantum Chemistry Simulations

Comments ()