90% of Trump Tariffs Hit U.S. Consumers—Chevrolet Doubles EV Discounts to $10k: Market Trade-Offs

TL;DR

- U.S. Companies Raise Prices Amid Trump Tariff Pressures, Inflation Hits 2.4%

- Chevrolet Doubles Cash Allowances on 2026 Equinox EV, Prices Drop Up to $10,000

💸 90% of Trump-Era Tariff Costs Hit U.S. Households: $1,300 Annual Hit Projected for 2026

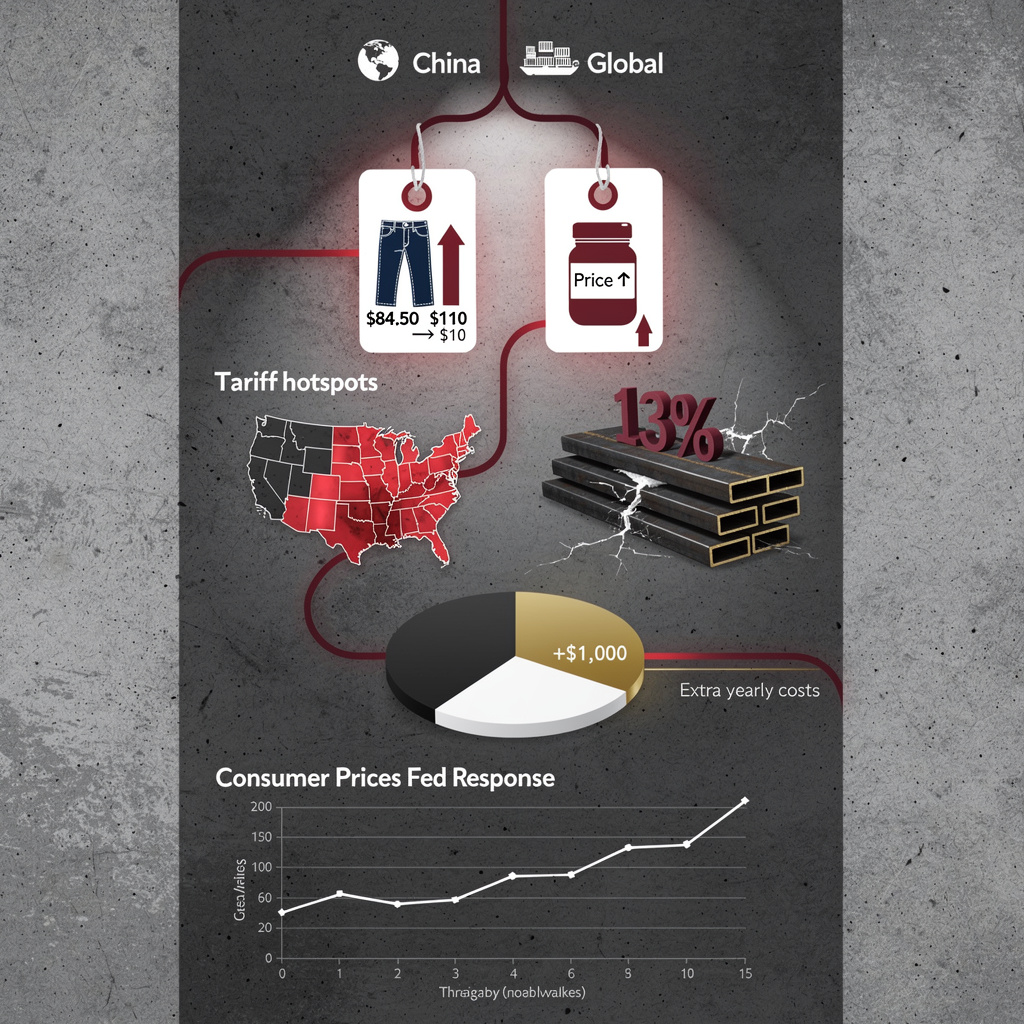

≈90% of Trump-era tariff costs are quietly absorbed by U.S. firms and consumers—NOT foreign exporters 💸. That’s 9 out of 10 dollars hitting American wallets, not the companies we’re ‘penalizing.’ Levi Strauss paid $70M in tariff expenses in 2025 and hiked jeans by $10-$108 (a popular style from $84.50 to $110). The promise was ‘protecting jobs’—but households now face $1,300 more annually. Is this the tariff trade-off we wanted? U.S. families, small businesses, and your favorite brands are feeling it—how much have YOU noticed price hikes from tariffs lately?

Levi Strauss & Co. and McCormick & Co. aren’t just raising prices—they’re signaling a broader shift: America’s companies are directly absorbing and passing on the costs of President Donald Trump’s import tariffs, driving inflation to 2.4% in January and squeezing household budgets. The Adobe Digital Price Index recorded its largest monthly online price jump in over a decade that same month, while Federal Reserve data confirms U.S. consumers and firms are shouldering 90% of the tariff burden, not foreign exporters.

How Tariffs Are Fueling the Price Chain

The mechanics are clear: Trump’s 2025 tariff hike—from an average 2.6% to 13% on imports—has sent input costs soaring. Steel prices alone rose 10% year-over-year, forcing Structural Systems Repair Group to lift prices 10–15%. For Levi Strauss, tariffs added $70 million in gross expenses in 2025; the company projects another $70 million hit in 2026, directly tied to its decision to raise denim prices by high single-digits (a women’s “ribcage straight-ankle” style jumped from $84.50 to $110). McCormick followed with similar hikes across its spice portfolio, aligning with the Fed’s warning that tariffs are “seeping” into general price levels.

What Impacts Are Already Landing

The ripple effects are tangible:

- Household Costs: The Tax Foundation estimates U.S. households spent $1,000 more on tariffed goods in 2025—up from pre-tariff levels—and that could climb to $1,300 in 2026.

- Commodity Spikes: Beyond apparel and spices, 2026 has seen coffee prices jump 33.6%, beef 19.3%, lettuce 16.8%, and orange juice 12.4%, per the Tax Foundation.

- Corporate Margins: Apparel firms like Levi Strauss face 0.5–1.0 percentage-point margin compression unless price hikes fully offset tariff costs, according to preliminary earnings guidance.

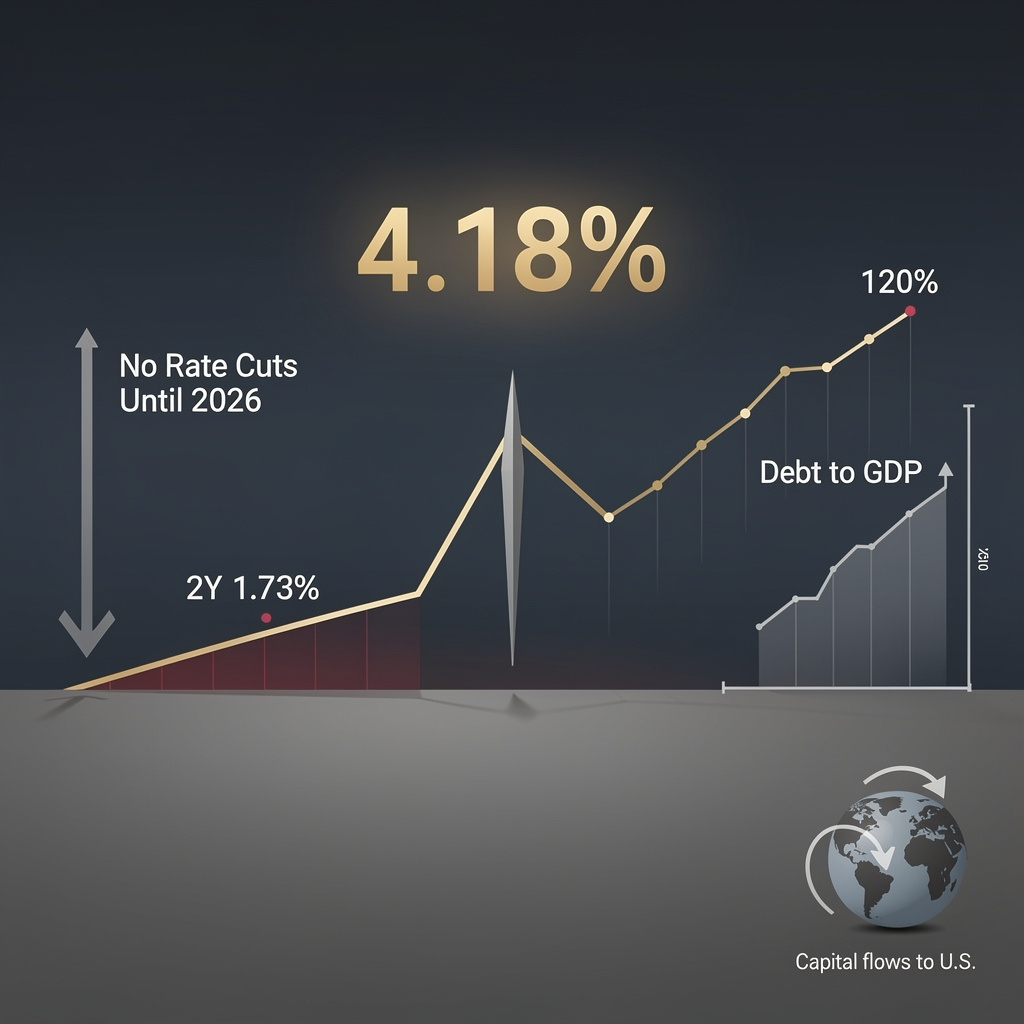

- Inflation Pressure: January’s 2.4% CPI marks a modest rise from December’s 2.7% core CPI, but Fed models project Q2–Q3 2026 inflation could hit 2.6–3.0%—keeping it above the Fed’s 2% target.

What Firms and the Fed Are Doing (And What’s Missing)

Companies are reacting fast: 50% of 600 small-business leaders surveyed by Vistage Worldwide plan price hikes this year, while larger firms like Stanley Black & Decker are exploring steel substitutions to cut costs. The Fed, meanwhile, is monitoring “tariff seep” through regional manufacturing surveys (Philadelphia and Richmond districts show rising price-setting activity) but has few tools to counteract it—tariff policy, not monetary policy, is the root cause. The gap? Only 86% of tariffs are shouldered by foreign exporters (per NY Fed data), yet the political will to roll back duties remains limited.

What’s Next for Prices and Inflation

The path forward is tied to tariff policy:

- Short-Term (Q2–Q3 2026): Mid-tier consumer goods (apparel, packaged foods) will see continued high-single-digit price hikes as firms finalize 2026 calendars. CPI is projected to settle near 2.8% annualized, driven by persistent commodity shocks.

- Mid-Term (2026–2027): If tariffs stay at 13%, inflation will hover above 2% through 2027, with a median forecast of 2.5–2.7%, per Fed analyses.

- Long-Term (12–18 Months): Firms may institutionalize “cost-plus pricing” to protect margins, while supply-chain diversification (to avoid steel/logistics bottlenecks) could accelerate—though tariff rollbacks are the only sure way to ease pressure.

For investors and consumers, the message is simple: Trump’s trade policies aren’t just about global competition—they’re about pocketbooks. As long as tariffs remain elevated, inflation won’t just be a Fed statistic; it will be the line item on every grocery receipt and clothing tag.

Chevrolet Doubles Cash Allowances on 2026 Equinox EV, Prices Drop Up to $10,000

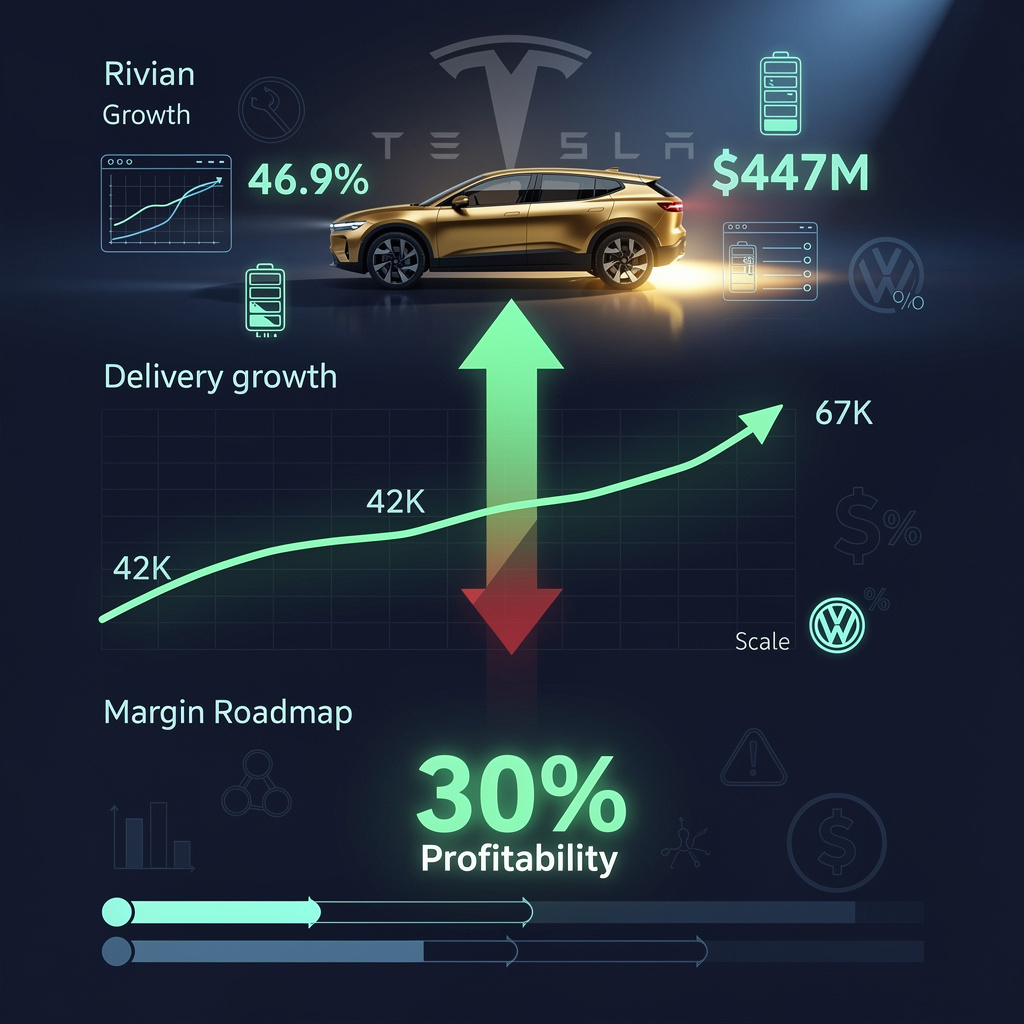

Chevrolet has doubled its cash allowances for the 2026 Equinox EV, offering up to $10,000 in discounts—up from $6,500 on the LT 1 model. The LT FWD trim now starts at $30,295, with extended range (319 miles) and a 17.7-inch touchscreen. The move follows broader industry price pressures amid rising EV supply and weakening demand.

Chevrolet has doubled cash allowances for its 2026 Equinox EV, slashing effective prices by up to $10,000—from $6,500 previously—to push the entry-level LT FWD trim to a starting $30,295 (after incentives). Publicized in February 2026, the move comes as General Motors (GM) grapples with EV inventory overhang, a $6 billion asset write-off, and weakening demand in a crowded electric vehicle market.

How Did Chevrolet Cut Equinox EV Prices—and What Does It Mean?

The allowance expansion applies to both customer-cash and conquest-cash incentives, with the LT FWD trim starting at $30,295 (down from a $36,495 pre-incentive MSRP). The RS AWD model lists at $48,895 (including destination). Key specs include a 319-mile EPA range (14% higher than the Nissan Leaf), 117 MPGe city/100 MPGe highway, and an estimated 65–70 kWh battery—outperforming the Hyundai Kona Electric’s 48.6 kWh while matching its range efficiency.

What Are the Key Impacts: Affordability, Competition, and Margins?

- Consumer Affordability: The $10,000 discount drops the LT FWD’s effective price to ~$26,300, below the $30,000 psychological barrier many buyers cite—directly targeting price-sensitive EV shoppers.

- Competitive Edge: At $30,295, the Equinox EV undercuts GM’s own Bolt EV ($28,595–$35,695 after incentives) by $6–7k and rivals sub-$30k competitors like the Nissan Leaf and Hyundai Kona Electric.

- GM Margin Strain: The incentive follows a $6 billion EV asset write-off and 1,200 layoffs at Factory Zero, signaling inventory overhang and pressure to clear 2026 models ahead of new releases.

- Range Anxiety Relief: The 319-mile range addresses a top consumer concern, differentiating the Equinox EV from lower-range competitors.

What’s GM’s Response—and Where Are the Gaps?

GM’s strategy relies on coordinated dealer action: by Feb 6, 2026, dealers in 16 states offered ≥$10,000 off base prices, aligning with the brand’s push to clear stock. Yet gaps persist: the move depends on short-term discounts, not structural cost cuts, as federal EV tax credits (a 2025 boon) have since expired. Dealers face margin pressure from absorbing larger cash-back costs, even as GM boosts profit guidance by $13–15 billion via ICE truck sales.

What’s Next: Short- to Long-Term Forecasts for the Equinox EV?

- Q2–Q4 2026 (Short-Term): Equinox EV deliveries could rise 5–7% vs. Q1 2026, driven by the sub-$30k price point. But gross profit per unit may fall 10–12% from 2025 averages, as the $10k allowance erodes margins.

- 2027 (Mid-Term): Incentives are projected to normalize to $5–6k as inventory stabilizes, aligning with industry averages once price elasticity flattens.

- 2027–2029 (Long-Term): GM may shift resources to higher-margin ICE/SUV platforms, maintaining a leaner EV portfolio focused on cost-effective, high-volume models like the Equinox EV—acknowledging EV profitability still requires scale.

Chevrolet’s Equinox EV incentive blitz is a tactical fix for an industry grappling with EV oversupply. While the $10k discount could lift U.S. EV market share by 0.5% in 2026, it also underscores a reality: for automakers like GM, sustainable EV growth demands balancing affordability with profitability—something the current strategy only temporarily masks.

In Other News

- Fed Minutes Reveal Concerns Over Persistent Inflation and Rate Trajectory

- U.S. Same-Store Sales Rise 6.8% as McDonald’s Reports $7 Billion Revenue, $2.16 Billion Net Income

- US Federal Deficit Projected to Reach $2.4 Trillion Annually Through 2036

Comments ()