Morgan Stanley Bets Big on Rivian (82% Below IPO) as Tesla Stake Drops: EV Growth vs Dominance?

Morgan Stanley just made Rivian its LARGEST holding by boosting stakes 3% (≈3.9M shares)—a shocking bet even as Rivian’s stock is still 82% below its IPO price. 🚗 The move comes after Rivian’s Q4 earnings blew up: $120M gross profit, software revenue SURGED 109% to $447M, and per-vehicle costs dropped $7,200 YoY—yet delivery volume still fell 31% in 2025. But why dump Tesla (third quarter in a row, down 1% stake, cumulative 9.6M shares lost) when it’s still worth $800B? For EV investors: Are you betting on Rivian’s cost-cutting growth or Tesla’s proven dominance?

Morgan Stanley made a bold portfolio call in Q4 2025: it hiked its Rivian Automotive stake by 3.0%—enough to make the EV startup its largest single holding—while cutting its Tesla position for the third straight quarter. The move, detailed in recent filings, isn’t just a stock pick; it’s a strategic pivot toward EV startups with clearer paths to profitability, away from high-valuation incumbents with slower growth.

What’s Driving the Shift? Performance and Profitability

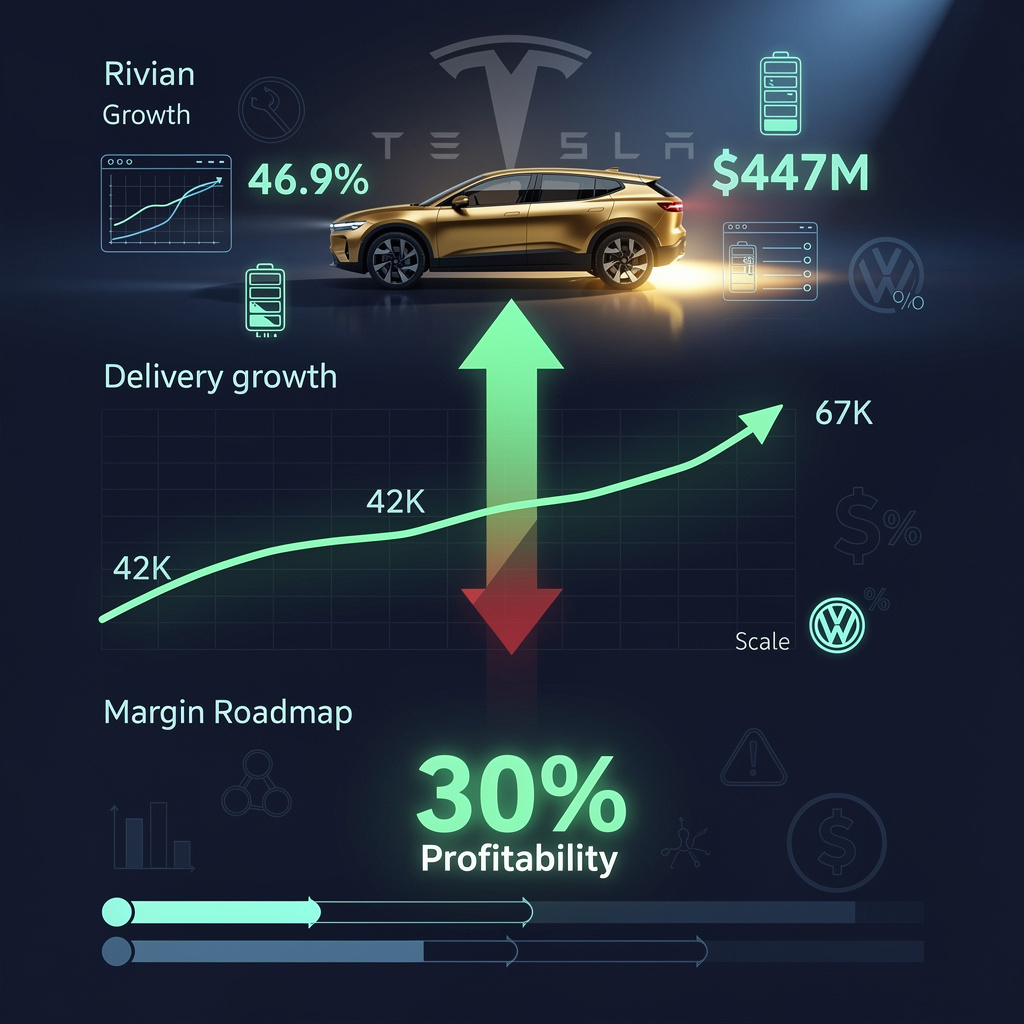

The reallocation is rooted in Rivian’s operational momentum. In Q4 2025, the startup reported $120 million in gross profit, a $7,200 year-over-year reduction in per-vehicle costs, and a 109% surge in software revenue (to $447 million)—diversifying beyond hardware sales. Its stock rallied 46.9% that quarter, rewarding investors for progress. For Tesla, Morgan Stanley is de-risking: its stake fell 1% in Q4 (a cumulative 9.6 million shares shed over three quarters) as the automaker’s $800 billion market cap outpaces near-term earnings growth.

The trend isn’t isolated. Peers like JPMorgan (up to 22 million shares) and Capital International have expanded Rivian holdings, while UBS and Bank of America have trimmed Tesla exposure—hinting at a broader institutional shift toward mid-cap EV innovators with margin potential.

The Risks (and Rewards) of Betting on Rivian

Morgan Stanley’s bet hinges on Rivian’s ability to translate operational wins into sustained growth—but execution risks loom large:

- Strengths: Software revenue growth (a recurring revenue stream) and a Volkswagen joint venture (which provides capital and supply-chain access) position Rivian to compete. Its Gen 2 platform targets a 45% material cost reduction by 2026, directly boosting margins.

- Weaknesses: Rivian’s 2025 deliveries fell 18% year-over-year (to 42,247 units), with a 31% quarterly drop raising questions about scalability. It also posted a $3.6 billion net loss in 2025, though it held $6.7 billion in liquidity.

- Opportunities: The Q2 2026 launch of its R2 compact SUV—targeting the high-volume SUV segment—could drive deliveries to 62,000–67,000 units in 2026 (up from 2025’s 42,247). U.S. EV sales are projected to grow 10% annually through 2030, adding tailwinds.

What’s Next? A Timeline for Morgan Stanley’s Stake

The firm has laid out guardrails to manage risk—capping additional Rivian purchases at 5% of its EV portfolio, keeping $1 billion in EV liquidity, and diversifying into non-automotive clean-tech (e.g., battery materials). But its outlook hinges on Rivian’s execution:

- Short-Term (3 Months): Volatility will persist, but upward momentum could continue if the R2 launch stays on schedule and cost-reduction milestones are met. Delivery guidance still lags analyst consensus, however.

- Mid-Term (12 Months): Morgan Stanley will likely maintain or modestly expand its Rivian stake (1–2% more) while keeping Tesla exposure below 5% of its EV holdings. Margin improvement, not just valuation, will drive decisions.

- Long-Term (2–5 Years): Rivian could become a core part of Morgan Stanley’s “Emerging EV Leaders” portfolio—if it hits 60,000+ annual deliveries and sustains 30%+ material cost reductions. A successful R2 launch would validate its growth thesis.

The Bigger Picture: EV Investing Is Entering a “Profitability Phase”

Morgan Stanley’s shift underscores a broader trend: institutional investors are moving from “hope” to “results” in EVs. They’re abandoning high-valuation incumbents like Tesla for startups that prove they can cut costs, grow software revenue, and scale deliveries—Rivian’s sweet spot.

If Rivian delivers on its promises, Morgan’s stake could evolve from a tactical play to a strategic cornerstone. If not, the message will be clear: in EVs, execution trumps hype. For the sector, that’s a healthy shift—one that could define which startups survive (and thrive) in the years ahead.

In Other News

- BYD Launches Song Ultra EV: 440-Mile Range, $26,000 Price, End of 2026 Release

Comments ()