Wyoming Data Centers Drive 92% U.S. Q1 GDP Growth; HPC Tool Cuts Annotation by 40%—IP Theft Risk Looms

Data center investments in Wyoming accounted for 92% of U.S. GDP growth in Q1 2025, driven by AI demand and partnerships with hyperscalers. The state is leveraging its low-cost energy and land to host large-scale facilities, including the NCAR-Wyoming Supercomputing Center, positioning itself as a critical hub for next-generation HPC and cloud-native computing infrastructure.

Wyoming’s unexpected transformation into a data-center colossus isn’t just a local success—it’s rewritten the nation’s economic ledger. According to the U.S. Bureau of Economic Analysis, data-center investments in the state accounted for 92% of U.S. real-GDP growth in Q1 2025, a milestone driven by AI demand, hyperscaler partnerships, and a strategic edge: low-cost energy, vast land, and hyper-targeted policy. The result? Wyoming is fast becoming the U.S. preeminent hub for high-performance computing (HPC), where cutting-edge infrastructure meets climate and economic ambition.

How Wyoming Became HPC’s New Engine

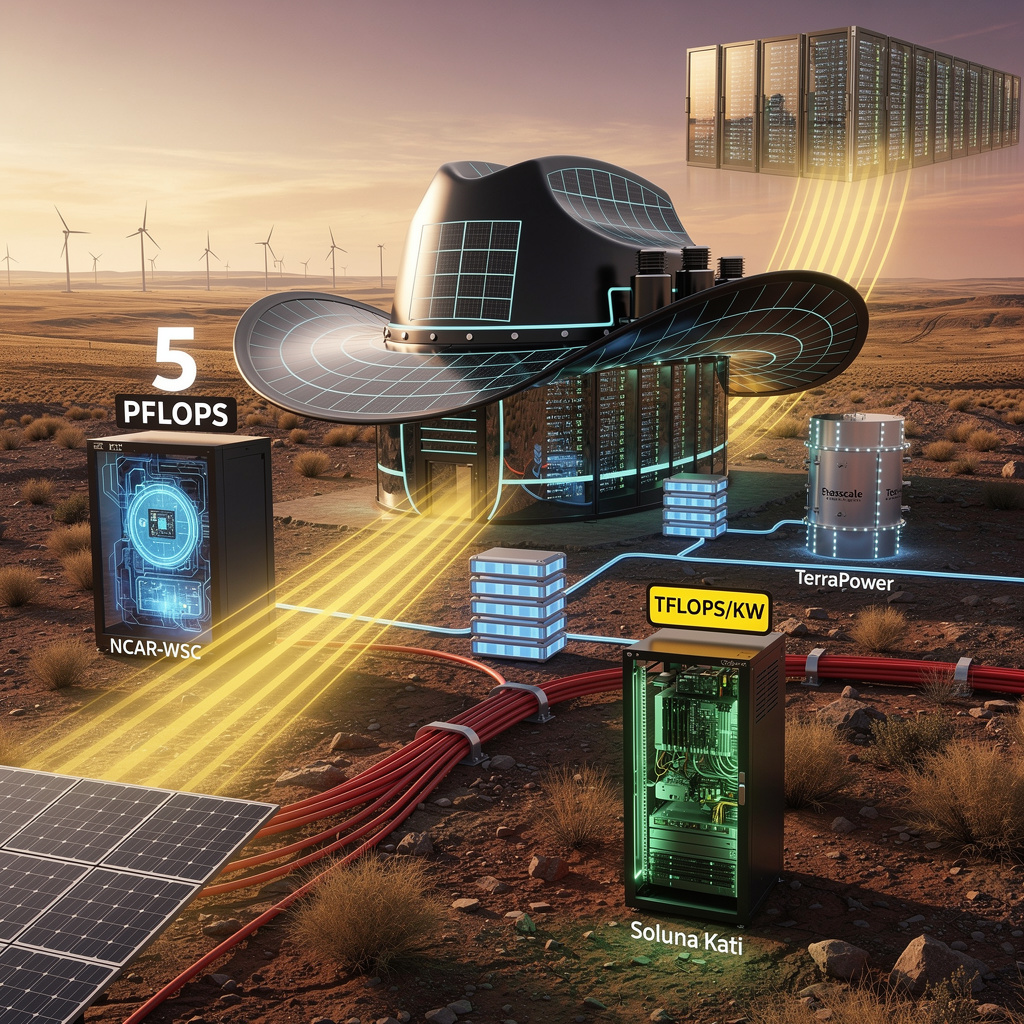

The boom is no accident. Wyoming leverages three non-negotiable assets: abundant, carbon-light electricity (via 1 GW+ of solar power purchase agreements, or PPAs), unlimited land for 1 MW+ data-center footprints, and state tax incentives that slash operational costs for hyperscalers like Google, Microsoft, and Amazon. Anchoring this growth is the NCAR-Wyoming Supercomputing Center (NCAR-WSC), a 1.2 PFLOPS hybrid CPU-GPU facility that combines with private projects—such as Soluna’s AI-ready “Kati” rack (targeting ≥2 TFLOPS/kW compute density)—to set new industry benchmarks. Technical specs aren’t just impressive: InfiniBand EDR/HDR fabrics at NCAR-WSC will enable low-latency MPI workloads critical to DOE climate simulations, while liquid-to-die cooling reduces power usage effectiveness (PUE) from 1.5 to 1.2, aligning with state sustainability goals.

The Ripple Effects: Economic, Technical, and Environmental

Wyoming’s data-center surge isn’t confined to spreadsheets—it’s reshaping three key areas:

- Economic Catalyst: Individual projects generate $10M–$120M in annual property-tax revenue, with Q1 2025’s contribution directly fueling 92% of national GDP growth. Hyperscalers are doubling down: Google’s $200M joint venture with NCAR-WSC, announced post-Q4 2025 operational debut, taps Wyoming’s low-latency fiber backbones for edge-AI services.

- Technical Benchmarking: Parallel file systems (Lustre, GPFS) with ≥150 PB capacity per site support massive training datasets and scientific archives, while Tier-4 power quality (≥99.99% availability, 10ms ride-through) meets mission-critical HPC standards.

- Energy Transition: Renewable PPAs—805 MW solar in Kansas and 195 MW in Texas—deliver ≈28 TWh over 15 years (enough to power 2.3 million U.S. homes annually), offsetting coal reliance and positioning Wyoming as a model for “green HPC.”

Gaps to Fill: Strengths, Weaknesses, and the Path Forward

Wyoming’s advantages are stark: low energy costs, proximity to existing high-voltage transmission, and fiscal incentives that attract billions in private investment. But challenges persist:

- Weaknesses: Fiber-optic density beyond Cheyenne lags, limiting low-latency access to national markets; seasonal solar generation lacks bulk storage, risking intermittency.

- Threats: NERC projects a 240% increase in U.S. data-center load (6.7–23 GW) by 2030, with Texas flagged as a high-risk blackout zone—compounding competition from edge-HPC hubs in the Southeast.

Opportunities abound, too: 2028 modular nuclear plans (TerraPower) could provide baseload power for exascale clusters, while NCAR partnerships may unlock DOE exascale funding. The key? Mitigation actions: grid-scale batteries (≥500 MWh) to smooth solar intermittency, public-private fiber deals to cut Cheyenne-Denver latency to sub-5ms, and a “HPC-Data-Center Task Force” to align incentives with grid upgrades.

The Road Ahead: 2026–2032

Wyoming’s trajectory is anything but linear—it’s a timeline of exponential growth:

- 2026–2027: ≥1.5 GW of new AI-ready compute (NCAR-WSC expansion, Soluna Kati Phase 2) will boost HPC capacity; solar will cover 45% of demand, with 200 MWh battery storage mitigating intermittency. A state-funded 100 Gbps fiber ring around Cheyenne, completed Q3 2026, will connect the state to east-coast hyperscalers in real time.

- 2028–2032: By 2030, Wyoming could host a ≥5 PFLOPS exascale system—leveraging sub-1.15 PUE and 30 MW of renewables. Modular SMRs (≤300 MW) and 1 GWh+ storage could slash net CO₂ emissions to <0.1 tCO₂/MWh, hitting carbon neutrality. Conservatively, data-center tax revenue growth could keep Wyoming’s GDP contribution above 80% annually through 2032.

Why Wyoming Matters for HPC’s Future

Wyoming’s data-center boom isn’t just a local win—it’s a national blueprint. By merging AI demand with sustainable energy and smart policy, the state has proven that HPC can drive economic growth and decarbonization. The next step? Securing grid resilience and fiber connectivity to maintain its edge. If Wyoming succeeds, it won’t just be the “Cowboy State”—it’ll be the U.S. exascale era’s backbone, showing the world how to build HPC infrastructure that works for people, planet, and progress.

In Other News

- PostgreSQL-Based Workflow Engine Enables Durable Orchestration Without External Brokers

- AWS Launches M8azn Instance Family with 5th Gen AMD EPYC Processors

- Africa’s Solar Capacity Grows 17% in 2025 Amid Surge in Chinese Panel Imports

- Sandia Labs Demonstrates Neuromorphic Computing Breakthrough for Solving PDEs in HPC Simulations

Comments ()