China’s $729M Rocket Surge: State-Backed Space Boom vs. Private Innovation — A New Orbital Divide

TL;DR

- Ispace Raises $729 Million in Largest Chinese Launch Startup Funding

- Anthropic’s Super Bowl Ads Spark 32% Surge in Claude App Downloads, Triggering OpenAI Backlash

🚀 $729M Funding for Ispace: China’s Largest Space Startup Round — Reusable Rocket Race Intensifies in Beijing

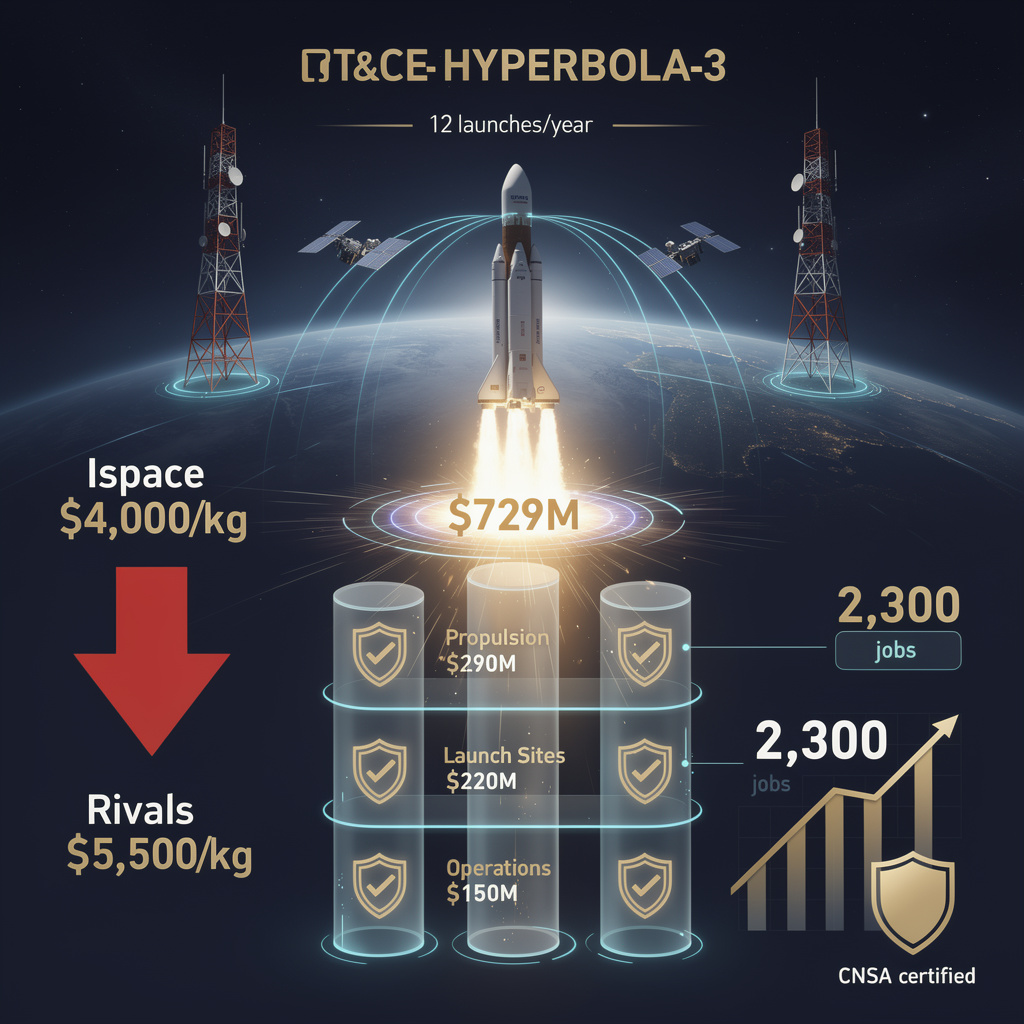

$729M poured into one Chinese rocket startup — that’s enough to buy 14 Boeing 737s. 🚀 This isn’t just more fuel — it’s a full-scale rebuild of China’s orbital supply chain. Delay on rocket recovery? $120M was set aside to build backups. Beijing’s aerospace cluster will add 2,300 jobs by 2027 — but who gets left behind when state-backed giants dominate the sky?

Chinese launch startup Ispace closed a $729 million D++ round on 13 Feb 2026, the largest single financing ever disclosed by a domestic space-transport company. The industrial-municipal syndicate backing the deal positions the firm to finish its Hyperbola-3 reusable booster and double annual launch output within 18 months.

How will the money lift Ispace off the pad?

Roughly 40 % of the round—about $290 million—is locked to propulsive-landing hardware, heat-shield refurbishment kits and a redundant expendable variant. Another $220 million hardens launch sites, while $150 million scales satellite-integration halls and $70 million covers operating burn. Two new Beijing TT&C stations come online in Q4 2026, giving the company in-house telemetry coverage for up to 12 flights a year.

Who feels the shockwave?

- Domestic rivals: Combined 2025 fund-raising of Space Pioneer ($350 M) and Galactic Energy ($336 M) is now eclipsed by one Ispace check, widening the cash gap to $43 million.

- Beijing aerospace cluster: Municipal models project 2,300 full-time jobs by 2027 as factories and test cells expand.

- LEO satellite operators: A reusable first stage could drop Ispace’s posted price below $4,000 kg⁻¹, undercutting today’s $5,500 kg⁻¹ expendable tariff and freeing ¥1.2 billion in customer capital annually by 2028.

- Policy gatekeepers: With $30 million earmarked for CNSA licensing, Ispace becomes a test case for China’s 2026 safety rules.

What still keeps the flight director sweating?

| Observed hurdle | Recommended buffer |

|---|---|

| Hyperbola-3 recovery slipped from 2024 to 2025 | Allocate $120 M to parallel hardware streams and accept dual expendable/reusable fleet |

| Syndicate of industrial, municipal and PE voices | Install weighted steering committee to prevent capital-gridlock |

| Upcoming “Space Launch Safety” certification | Embed compliance officers inside engineering teams, not just legal units |

Timeline: three horizons to watch

- Late-2026: 8 launches planned; first booster-recovery demo sets 70 % reliability bar.

- 2027-2028: 10-12 launches per year, ¥1.2 billion satellite-service revenue, 15 % share of Chinese LEO market.

- 2029-2030: If recovery hits target, state “Space + AI” fund could inject another ¥2 billion, cementing Ispace as preferred dual-use launch provider.

Bottom line

The $729 million round does more than refinance a startup; it bankrolls a national bid for reusable-rocket sovereignty. Delivering Hyperbola-3 on the new timetable would give China an internally controlled, cost-competitive ride to orbit—and leave global competitors watching the countdown from the back seat.

🚀 Claude Downloads Surge 32% After Super Bowl Ad — U.S. Users Reject ChatGPT’s Ad Rollout

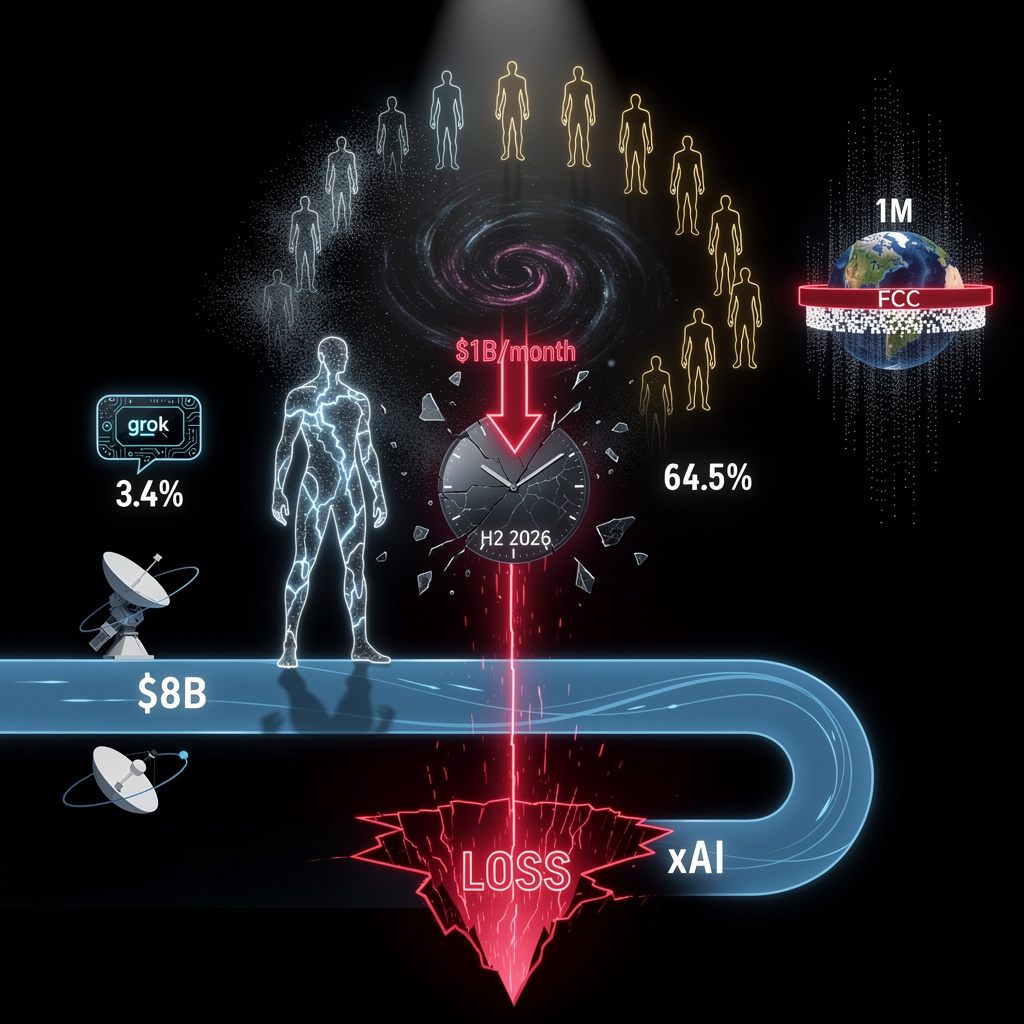

Claude app downloads surged 32% in just 3 days — that’s 260K new users after a single Super Bowl ad. 🚀 While OpenAI rolled out ads in ChatGPT, Anthropic bet big on being ad-free — and users voted with their downloads. Enterprise contracts quadrupled. DAU rose 11%. Meanwhile, OpenAI’s DAU grew just 2.7%. Who wins when users choose privacy over free? — U.S. consumers or Big Tech’s ad engine?

On 9 Feb, Anthropic ran its first Super-Bowl spot—one 30-second satire that mocked OpenAI’s coming ad-supported ChatGPT tier. By 12 Feb, Claude’s U.S. downloads had jumped 32 %, adding roughly 260 000 new installs and pushing the app to #7 in Apple’s free-app chart. Daily active users rose 11 %, while Anthropic’s website traffic lifted 6.5 % and enterprise subscriptions—already doubling since January—quadrupled. The campaign cost an estimated $8–10 million per slot, but at ~$0.08 per viewer it bought measurable market share in a category where OpenAI still holds a 10-to-1 user lead.

How the ad flipped the funnel

- Creative hook: a tongue-in-cheek promise of “an AI assistant that won’t serve you ads.”

- Media plan: 30 s in-game plus a 60 s pre-game teaser, both geo-targeted to high ChatGPT-free usage states such as Texas.

- Conversion path: QR code → app store → freemium tier → gated enterprise trial.

Impacts in one week

- Consumer adoption: 260 k incremental downloads → Claude’s U.S. consumer base grew ~7 %.

- Engagement: 11 % DAU lift signals trial is converting to habit, not hype.

- Enterprise pipeline: 4× contract growth since 1 Jan; average deal size undisclosed but SaaS ARR implied to rise.

- Competitor bleed: OpenAI DAU up only 2.7 %, Gemini 1.4 %—both within normal weekly variance.

- Earned media: Altman’s “dishonest” retort generated 3.4 million additional Twitter impressions, amplifying Anthropic’s message at zero cost.

Response & gaps

Observed

- OpenAI accelerates ad-tier rollout to 20 % of free users by March.

- Google keeps Gemini ad-free for now, but internal memo flags “brand-ambush” risk.

Recommended

- Anthropic should lock new users into annual plans before recall decay sets in.

- Regulators may probe comparative claims; prepare disclosure docs.

Outlook

- Q2 2026: Claude expected to hold +15 % download lead over pre-Super-Bowl baseline; enterprise ARR could hit $200 m if 30 % of new trials convert.

- 2027: Ad-supported vs ad-free positioning stabilizes; dual-track market share (OpenAI 55 %, Anthropic 18 %) projected.

- 2028–29: EU and U.S. AI-advertising rules likely mandate transparency, raising compliance costs for both camps.

Bottom line

A single, well-aimed commercial shifted measurable market momentum. Whether the surge endures depends less on ad spend than on Anthropic’s ability to keep its newfound users—and regulators—convinced that “ad-free” also means “advantage.”

In Other News

- Zulip Maintains 100% Open Source Model Amid VC Funding Pressure

Comments ()