1B-User Tap-to-Pay Feed Launch: Musk’s X Money Beta Challenges Cash Apps

TL;DR

- xAI Launches X Money in Closed Beta, Building Full Financial Layer on X Platform

- Apple Acquires Severance IP for $70M, Takes Full Control of Series Production

- Waymo Valuation Hits $126 Billion as Ride Volume Surges to 15 Million in 2025

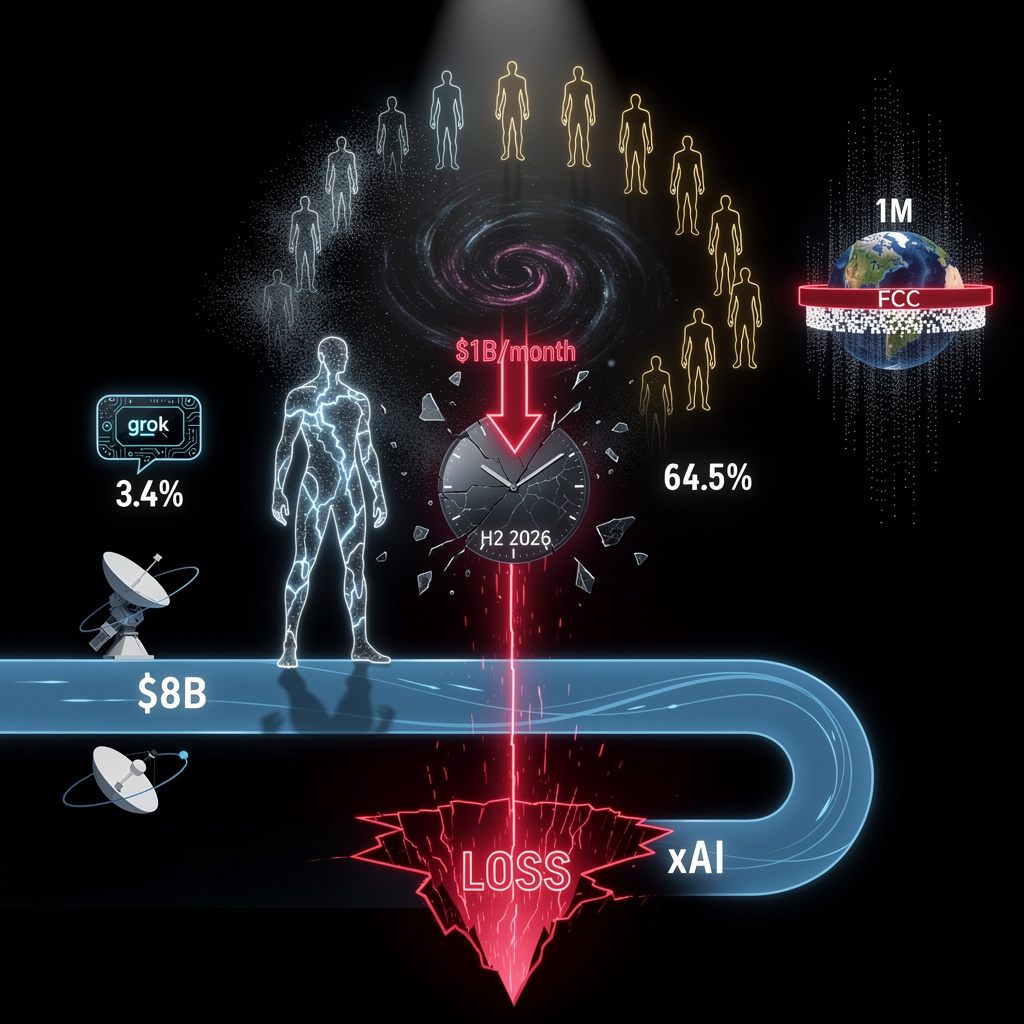

💸 X Money to Onboard 1B-User Base in U.S. Beta, Outpacing PayPal Volume by 2027

1B+ users can now tap-to-pay INSIDE their feed—X Money beta opens next month 💸 That’s PayPal’s ENTIRE user base baked into one app, with Bitcoin-grade encryption & 0-fee onboarding for 30 days. Creators keep 98% of subs, but will regulators let Musk own the wallet AND the town square? Would you ditch Cash App for a tweet-to-pay life?

xAI quietly flipped the switch on X Money this week, giving its own staff instant access to a Visa-backed wallet baked inside the X app. The closed beta, disclosed 12 Feb 2026, is the first step toward a full financial layer that could let any of X’s 1-billion-plus daily users send cash, pay creators, or swap dollars for crypto without leaving their timeline.

How does it work?

- Wallet: Bitcoin-grade encryption, Visa card rails, ≤ $10k peer-to-peer transfers.

- Fees: 0.5% on fiat-crypto swaps, 2% on recurring creator subscriptions.

- Scale target: 100 million daily transactions once 5% of X’s user base activates.

Immediate ripple effects

Revenue

$5B in projected creator earnings × 2% cut = $100M new annual revenue for xAI by Q4 2026.

Competition

PayPal’s 400M actives and Stripe’s 200M look small beside X’s built-in billion-user funnel.

Engagement

Internal data show session time rises 12% as soon as wallet features appear.

Risk

1B user records linked to financial KYC raise breach stakes; a third-party audit is scheduled before the public launch.

What’s missing?

- Licenses: Only pre-approved U.S. states covered; nationwide “money transmitter” stack still pending.

- Latency: Target <200ms per tx; early beta averages 180ms but spikes under load.

- Adoption friction: Zero-fee first month offered to offset wallet-switching inertia.

Timeline to scale

Mar–Apr 2026: 10k–20k external testers, <$50M cumulative volume.

Q3 2026: U.S. public beta opens to ~60M users (10% of DAU).

2027: Global rollout after regulatory nod; 5% adoption yields >$1B annual throughput.

Bottom line

X Money converts X’s social graph into a payments graph. If the licensing and security gates hold, the same feed that delivers memes could clear more transactions than PayPal by 2027—turning audience attention into tangible financial flow.

📺 Apple Drops $70M to Own ‘Severance’ IP—Locking $200M Future Cost at 6% Interest

Apple just paid $70M to OWN Severance—equal to 3.5 entire seasons at $20M/episode 😱📺. That’s more than most startups raise in a C-round. With NY & Canada tax credits shaving 30% off, Cupertino is betting a 4-season arc will lock subscribers in at 6% interest. Viewers binge, Apple’s balance sheet absorbs the hit—will this cash-heavy IP play become the new Hollywood norm, or burn a $200M hole by 2027? — Streamers & founders, would you stake your runway on one prestige show?

Apple closed December 2025 by writing a single $70 million check that moves the hit drama Severance from licensee to wholly-owned property. The transaction hands Apple Studios every script, every Emmy statuette (eight wins, 27 nominations in 2025), and every future ad dollar, while Fifth Season steps back to an executive-producer role. The deal is already shaping what Apple TV+ costs to run—and what it must earn back.

How Does Apple Erase a $20M-Per-Episode Price Tag?

Season 2 burned through roughly $20 million each installment. By internalizing the intellectual property, Apple stops paying repeat licensing fees that industry insiders peg at $10-15 million a season. Filming in New York this summer secures a 30 % tax credit, slicing the net episode cost to about $14 million; a fallback shoot in Alberta could push the rebate to 35 %, although relocation adds ~$2 million in overhead. Six Season 3 scripts are finished; if the four-season arc stays on track, total production exposure reaches $200 million for 40 more episodes.

What Does the Balance Sheet Feel?

- Cash: Apple holds >$200 billion, so the $70 million outlay equals 0.04 % of liquid reserves and avoids 5.5-6 % market debt.

- Annual carry: Financing the full amount externally would cost ~$3.9 million a year; Apple can simply self-fund.

- Subscriber lift: Season 2’s premiere month correlated with a 12 % jump in Apple TV+ sign-ups, the platform’s largest to date.

- Ad inventory: Three to four sponsors (State Farm among them) already bought Season 2 packages; expanding in-episode placements could add $10 million a season.

Where Are the Remaining Gaps?

- Talent risk: Performance-based payouts tie creator compensation to user growth; if sign-ups flatten, costs still escalate.

- Rate exposure: Without hedging, any swing back to 6 % borrowing would raise project IRR hurdles.

- Tax-credit timing: New York caps annual allocations; missing the 2026 certification window would erase ~$6 million per-episode savings.

- Franchise fatigue: Benchmark spin-off valuations (Silo model) assume viewer appetite holds through 2029—an eight-year storyline bet.

What Happens Next?

- Summer 2026: Cameras roll in New York; Apple targets 30 % cost rebate locked before Q4.

- 2027: Season 3 drops; internal forecast projects +8 % cumulative subscriber growth across Seasons 3-4.

- 2028: Season 4 finale; ad packages aim for $10 million incremental revenue through branded integrations.

- 2029: Decision gate on Season 5; franchise extensions (foreign adaptations, consumer products) could add ~$150 million in IP value if ROI exceeds 1.5× production cost.

Apple’s $70 million gambit is therefore less a splurge than a calculated down-payment on exclusive content that already delivers the service’s biggest audience spike. Control the IP, control the cost, control the upside—Apple is betting the severance pay-off will keep compounding long after the final episode cuts to black.

🚗 Waymo Lands $16B at Record 360× Revenue Valuation, Scales to 15M Rides

$126B for 15M rides: Waymo just raised at 360× revenue—like valuing a lemonade stand at the price of a skyscraper 🤯. 90 % fewer injuries vs humans, yet 2 probes still loom. Phoenix riders love it; regulators eye it. Would you hop in before your city goes live?

Alphabet’s robotaxi unit closed a $16 billion equity round this month, lifting its post-money valuation to $126 billion—about 360 times its current $350 million annual revenue run-rate. The leap follows a 233 percent year-over-year jump to 15 million paid rides in 2025, cementing Waymo’s lead in the still-nascent autonomous-mobility market.

What powers the 57,000 daily trips?

A 2,500-unit Jaguar I-PACE fleet now covers six U.S. metros, logging 57,100 rides per day at an $18 average fare. Phoenix alone supplies 68 percent of volume, while algorithmic dispatch squeezes 400,000 rides a week from the fleet—enough to hit management’s 1 million weekly rides target by late 2026.

Where is the money going?

- Fleet growth: 800–1,000 additional vehicles planned this year

- Geographic push: commercial launches slated for Tokyo (Q3 2026) and London (Q4 2026) plus ≥10 new U.S. cities

- Safety upgrades: software fixes for school-bus interactions after two NHTSA investigations; zero fatalities to date

What do the numbers reveal about risk and reward?

Strengths

- Safety record: 90 percent fewer serious-injury crashes over 127 million autonomous miles

- Investor depth: $29 billion raised since 2020, including Sequoia, Kleiner Perkins, DST Global

Pressure points

- Valuation multiple: 360× ARR dwarfs Tesla’s 3–4× revenue, leaving little room for slip-ups

- Market concentration: 68 percent of rides still originate in Phoenix

- Regulatory glare: child-strike incident in Santa Monica triggered federal review

How might the story unfold?

2026–2027

- ~5 percent U.S. robotaxi share; $500 million ARR trims valuation multiple toward 250×

2028–2029

- $1 billion ARR and 30 percent domestic market share set up IPO or Alphabet spinoff

2030+

- International scale—Japan and U.K. dominance—could push valuation toward $200 billion if 30 percent annual ride growth persists

Bottom line

Waymo’s $126 billion price tag is no fantasy; it rests on 15 million real trips, a defensible safety record, and $29 billion in cumulative capital. Sustaining the premium means replicating Phoenix’s density in Tokyo, London, and ten more U.S. metros while keeping regulators—and rival robotaxis—at bay.

In Other News

- Chase to Replace Goldman Sachs as Apple Card Issuer Amid $1B Losses

- Stoke Space Raises $350M in Series D Extension, Total Funding Reaches $1.34B

- Zulip Maintains 100% Open Source Model, Builds Sustainable Business Without Venture Capital

Comments ()