Dollar Drops 10% in 12 Months: $1.5T Trust Erosion — Gold Soars as Central Banks Flee U.S. Treasuries

📉 Dollar Hegemony Cracks: 10% Drop, $5,500 Gold, and $15T Treasury Risk — Fed Independence Under Siege

The U.S. dollar lost 10% in just 12 months — equivalent to losing nearly $1.5 trillion in global trust. Gold hit $5,500/oz as central banks quietly abandon Treasuries. With $15 trillion in foreign-held debt and a Fed under political siege, who’s left holding the bag? — Foreign pension funds and taxpayers — What does this mean for your retirement savings if U.S. bonds keep losing value?

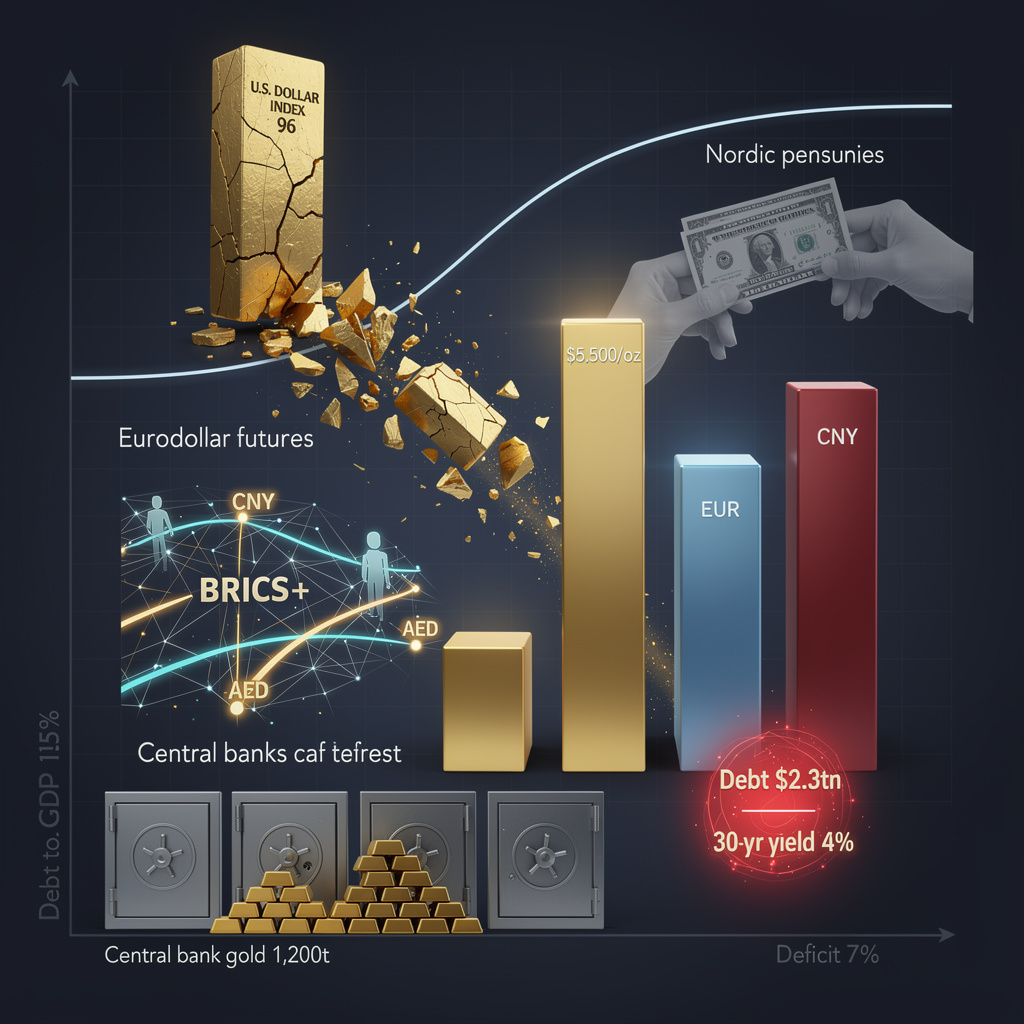

The U.S. Dollar Index has fallen to 96, a 10% year-to-date slide that matches the steepest four-month drop since 2020. Behind the move: real-money sellers, not speculators. Nordic pension funds have dumped a combined $80bn in Treasuries, China’s regulators have quietly advised banks to cap “concentration risk” in U.S. sovereign paper, and global reserve managers have cut the dollar share of official holdings to 50%—down from 60% in 2015. The selling is orderly, but it is persistent, and it is happening while the U.S. still needs to place >$2.3tn in new debt this fiscal year.

Why Are Foreign Creditors Walking Away?

The math is simple: debt-to-GDP >115%, a fiscal deficit >7% of output, and a political premium attached to trade threats. Denmark’s Alecta sold every long-dated Treasury it held after Washington floated 100% tariffs on Canadian metals; the fund’s CIO cited “unacceptable policy volatility.” China’s $53bn reduction in custody holdings at Belgium’s Euroclear follows internal PBOC stress tests that model a 200bp spike in 10-yr yields if reserve diversification accelerates. Gold’s 85% surge to $5,500/oz is the mirror image: central banks bought 1,200t in 2025, the fastest pace since 1968.

Does Kevin Warsh Nomination Signal a Hawkish Pivot—or Political Capture?

Markets now price a 64% chance the White House names Kevin Warsh, a 2008-crisis veteran who opposed QE3, to replace Chair Powell in 2026. Overnight index swaps imply 75bp of additional tightening by Q4, even as headline CPI has fallen to 2.1%. The contradiction is not lost on foreign investors: if the Fed is forced to choke growth to defend the dollar, recession odds spike and tax receipts evaporate—widening the very deficit that undermines confidence. Eurodollar futures show the first inverted 1-yr/5-yr spread since 2006, a vote of no-confidence in long-run U.S. solvency.

Can Anything Stall the Multi-Currency Shift?

Short of a systemic crisis, no. The BRICS+ clearing pool now settles 18% of member trade in yuan or dirham, up from 3% in 2022. IMF data show the euro, yuan and gold together capturing 60% of the reserve share lost by the dollar since 2020. Even U.S. multinationals are adapting: Boeing’s 2026 bond prospectus includes euro-denominated covenants to hedge revenue booked in Paris and Lagos. The Treasury’s own borrowing advisory warned last month that a 40bp concession may be needed to place 30-yr paper if foreign participation falls below 30%—a threshold breached at the February 7 refunding auction.

Bottom Line: Higher Yields, Weaker Dollar, New Rules

Expect 30-yr Treasury yields to grind toward 4% by summer as reserve managers shave another $5–7bn per month. The Fed can slow, not stop, the rotation: every 1ppt drop in dollar reserve share adds roughly 8bp to term premiums, according to NY Fed models. For investors, the takeaway is mechanical: own shorter-duration TIPS to catch inflation drift, overweight exporters with non-USD revenue, and treat gold as the de-facto second reserve currency. The exorbitant privilege is shrinking; the bill is coming due in higher discount rates for everything priced in dollars.

Comments ()