Dell/HP Adopt Chinese DRAM, Envision Powers HPC with 12.8GWh Battery, Starlink Enables Satellite HPC

TL;DR

- Dell and HP Shift DRAM Sourcing to Chinese Supplier CXMT Amid Global Memory Crunch

- Envision Completes 12.8 GWh Energy Storage Cluster in Inner Mongolia, Grid-Connected in December 2025

- SpaceX's Starlink Dominates Satellite Internet with 97% Speedtest Share and 9M+ Users

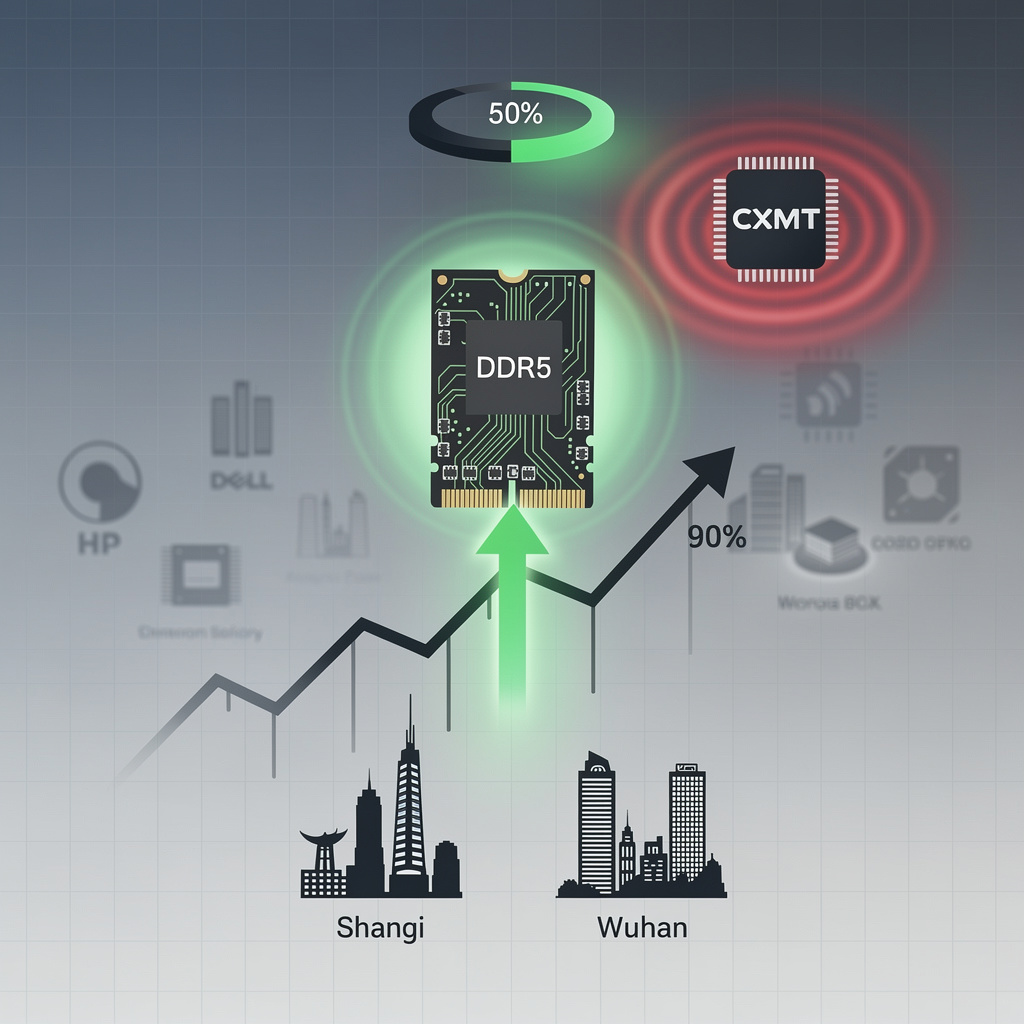

📊 Dell & HP Qualify CXMT DRAM, Acer & Asus Test; Global DRAM Prices Spike 90% as Chinese Fabs Expand

Dell & HP just qualified CXMT’s DDR5/HBM2 DRAM—10-15% cheaper, 2-3x Chinese fab expansion underway. Global DRAM prices spiked 90% QoQ; now OEMs diversify from Micron/Samsung. Can China’s memory surge stabilize AI server costs without risking supply chain resilience?

Dell and HP quietly added CXMT DDR5 modules to their approved-vendor lists on 5 Feb 2026, a move that instantly gives the Chinese supplier a double-digit share of two of the world’s largest PC memory budgets. The trigger is arithmetic: DDR5 contract prices jumped 90 % quarter-over-quarter in Q4 2025, and every 8 GB module now erases roughly 5 % of the OEM’s margin on an entry-level laptop. CXMT’s parts are quoted 10–15 % below Micron, Samsung and SK hynix, so the switch recovers half of that lost margin without raising sticker prices.

How Tight Is the DRAM Supply?

All three incumbent vendors are running fabs at 100 % utilization and still can’t meet demand. AI accelerators are soaking up every extra wafer of HBM2/3, forcing PC-grade DRAM lots onto the spot market where prices tripled in six months. CXMT, meanwhile, brought a new Shanghai fab on-line in late 2025 and doubled clean-room floor space in Wuhan; the company is on track to ship >50 % of its output as DDR5 by 2027. That capacity delta is the only visible buffer between OEM production schedules and a prolonged shortage.

What Technical Hurdles Remain?

CXMT modules have passed Jedec-spec electrical tests, but field-failure databases are thin. Dell and HP are mitigating risk with 12-month burn-in clauses and dual-source contracts that keep Korean DRAM on critical SKUs. Acer and Asus, still in qualification, are sampling 4 Gb and 8 Gb DDR4/5 devices across 25 notebook boards; if error rates stay below 100 FIT at 85 °C, mass qualification will close before Q3.

Could Sanctions Upend the Deal?

U.S. export rules already block Chinese fabs from 18 nm-class DRAM tools, yet CXMT obtained older DUV lines through domestic equipment vendors. A future sanctions package could freeze CXMT out of U.S.-designed controllers or EDA software, but not out of memory module sales already inside U.S. PCs. OEM lawyers have inserted force-majeure clauses that let them pivot back to Korean supply within one quarter if policy shifts.

Will Consumers Notice?

Not on the spec sheet. Jedec timings, voltage and pin-out match legacy parts, and firmware already trains to CXMT SPD tables. The first Dell Inspiron and HP Pavilion units with Chinese DRAM ship in Q4 2026; if reliability mirrors early lab data, CXMT could command 30 % of global PC DRAM demand by 2027 and shave 15 % off AI-server memory costs once HBM2 ramps. For buyers, the only visible change is a price tag that stops climbing.

⚡ Envision Energy Deploys 12.8GWh LFP Storage, Enables Exascale HPC Power Stability

Envision Energy just launched the world’s largest single-phase LFP battery storage station — 12.8 GWh in Inner Mongolia, fully grid-connected and proven with 72h continuous discharge. This isn’t just energy storage — it’s the backbone for exascale HPC, AI clusters, and renewable stability. Can HPC data centers be the next major off-takers of grid-forming storage?

Inner Mongolia’s new Jingyi Chagan Hada battery park is not a pilot—it is a production-scale grid node.

12.8 GWh of LiFePO₄ (LFP) containers, tied to the 800 kV trunk line in December 2025, passed three 100 % depth cycles plus a 72-hour continuous discharge at name-plate power. That 72-hour window is the new long-duration benchmark Chinese grid codes will require for every storage asset >100 MWh from 2026 onward.

Why LFP, and why now?

LFP already dominates 98 % of 2025 Chinese storage additions because cycle life >10 000 and volumetric density 434 Wh L⁻¹ erase the nickel-cobalt price delta. Envision’s 530 Ah prismatic cells—stacked two thousand 10 MWh containers—deliver the same energy as 1.2 million urban households, but release it in sub-second response. The chemistry’s flat voltage curve keeps inverter efficiency >94 % round-trip, a figure previously reserved for pumped hydro.

What does “grid-forming” storage mean for compute?

Grid-forming inverters source reactive power and hold frequency without external reference. For HPC campuses that means a 50 MW AI cluster can ride through a 500 ms transmission fault without spinning diesels. Inner Mongolia hosts 24 GW of wind; curtailment fell 12 % in 2025 simulations once the 12.8 GWh buffer was added. Expect colocation contracts offering <5 ms deviation and 99.999 % power quality—specs that match the U.S. exascale sites now under construction.

Where is the next 30 GWh?

Pipeline data show 20 GWh already permitted across Xilingol, Ulanqab and Alxa leagues. Envision’s domestic cell line runs at 60 GWh yr⁻1; containerized replication cuts CAPEX to $280 kWh⁻1, 30 % below European tenders. Policy tailwinds: NDRC mandates 180 GW nationwide by 2027 and spot-market participation for storage >50 MWh, turning arbitrage into a regulated revenue stream.

Bottom line

A single province now operates more dispatchable electron capacity than the entire German battery fleet. For operators planning 2027-era exascale pods, the takeaway is concrete: firm, long-duration power is no longer a constraint—it is a commodity, traded by the millisecond, 12.8 GWh at a time.

🚀 Starlink Dominates Satellite Internet, Enables Edge HPC; 97.1% Market Share, 117 Mbps Speeds, 45ms Latency Enable Remote Supercomputing

Starlink now dominates global satellite internet with 97.1% market share, delivering 117 Mbps downlink & 45ms latency—enabling remote HPC job submission from rural labs. With 9,600+ satellites and BEAD funding, it’s becoming the backbone for edge-HPC clusters. Can satellite backhaul replace fiber for exascale data ingest?

Ookla’s Q3-2025 data set shows 97.1 % of all satellite-based Speedtest samples worldwide ran over Starlink; Viasat and HughesNet split the scraps at 1.7 % and 1.0 %. The constellation’s 8 300 operational LEO satellites deliver a median 117 Mbps down / 15 Mbps up at 45 ms latency in the U.S.—figures that beat geostationary rivals by > 50 Mbps and 600 ms respectively. With > 9 million active terminals, the network has become the de-facto reference for “satellite internet” in consumer-grade measurement tools.

Why does the HPC community care about a consumer ISP?

Remote instruments, edge clusters and disaster-response labs often sit beyond fiber. A 117 Mbps LEO pipe with 45 ms RTT lets scientists ssh into supercomputers, push 50 GB checkpoint files or stream visualization frames without the 700 ms geostationary penalty. Starlink’s $50–120 retail tiers and $1 terminal-rental program drop the CapEx for a 10-node ARM cluster below the cost of a single month of leased fiber in many rural counties.

Where are the remaining bottlenecks?

Urban canyons still see only 17–36 visible satellites, triggering 2–4 % packet loss during rush hour. The 60–140 W power draw of Gen-3 user terminals forces off-grid sites to budget 3.5 kWh/day—non-trivial for solar-battery rigs. Most importantly, only 44.7 % of U.S. tests hit the FCC’s 100/20 Mbps BEAD threshold; the rest fall short on upload, a problem for instrument data ingress.

What happens when the constellation doubles?

SpaceX added ~7 500 birds in 2025-26 and targets > 10 000 operational by late 2026. Simulations show that 30+ passes per hour over CONUS will cut median latency to ≤ 40 ms and raise the BEAD-compliance share above 55 %. If the trend holds, a 200-node micro-datacenter on a mountaintop observatory could see sustained 1 Gb/s aggregated downlink—enough to feed a 10 PB/year sky survey directly into a national supercomputing facility.

Could regulators still clip Starlink’s wings?

Light-pollution petitions and spectrum-sharing disputes loom, but the immediate risk is competitive: Amazon’s Project Kuiper and OneWeb’s Gen-2 plans promise sub-40 ms latency at comparable price points within 24 months. For HPC planners, the safest hedge is multi-orbit redundancy—pair Starlink terminals with terrestrial 5G or future Kuiper links and automate failover at the job-scheduler level.

In Other News

- China implements national fixed-cost pricing for grid-side energy storage

- Raspberry Pi 4 Model B Rev 1.5 adopts dual DRAM modules to mitigate supply chain constraints

- Anker Solix Launches $3,799 Whole-Home Backup System for Residential Energy

Comments ()