YC Opens Canada, Fortinet Surges with AI SASE, Healthscope Rejects PE in Landmark Healthcare Shift

TL;DR

- Y Combinator Reverses Decision, Resumes Accepting Canadian-Incorporated Startups

- Healthscope Transitions to Not-for-Profit to Avoid $1.2B Debt Collapse

- Fortinet Beats Q4 Earnings as Unified SASE Billings Surge 40%

🇨🇦 YC Reinstates Canada in Deal Terms, Canadian Startups Regain Access to $500K Equity Funding Without Forced Incorporation Flips

YC reverses Canada exclusion! 🇨🇦 Startups can now incorporate in Canada & still access $500K for 7% equity + Demo Day investors. No more forced Delaware flips — Canadian tax credits (SR&ED, LCGE) now fully compatible. Dozens of new Canadian deals expected in 2026. Will this finally reverse the talent drain to the U.S.?

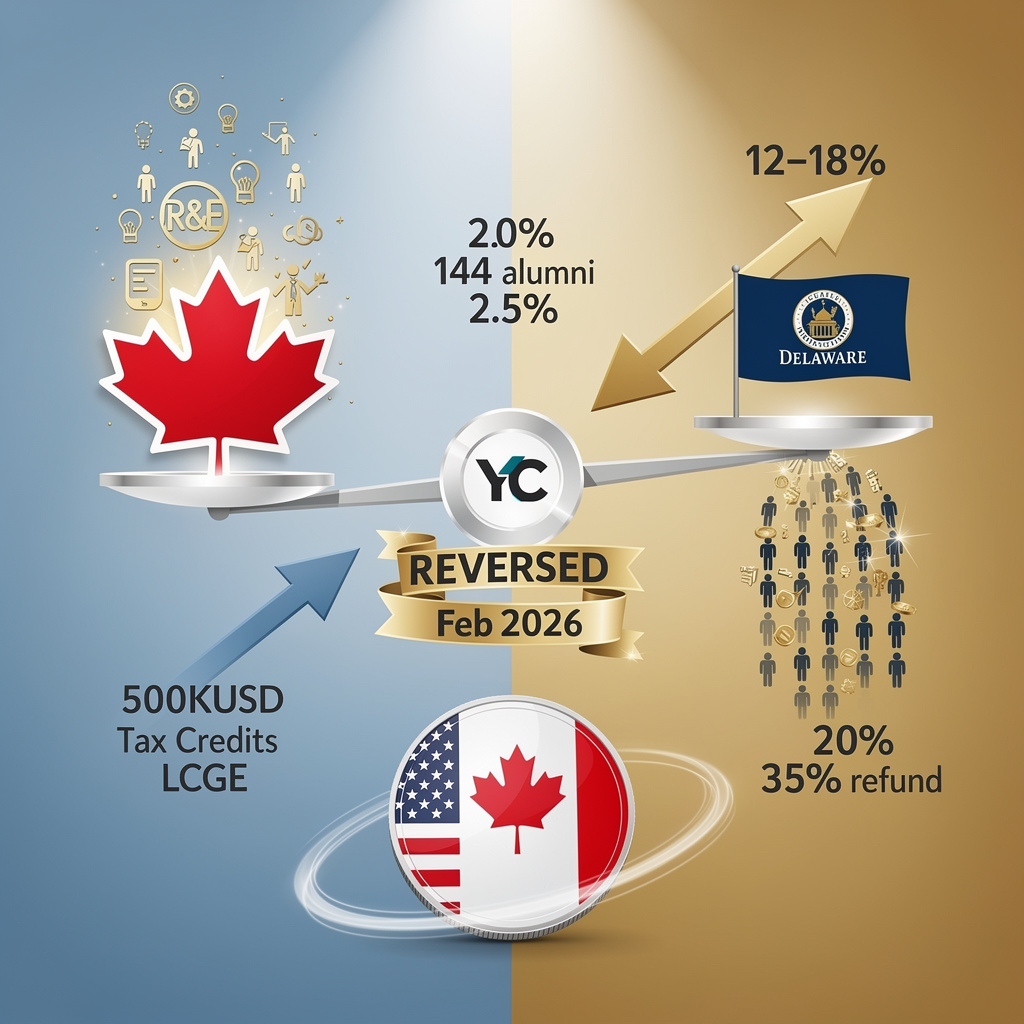

144 alumni, 2.5 % of the portfolio, and a 500 k-USD check for 7 % equity—those are the hard numbers behind Y Combinator’s 5 Feb 2026 reversal that once again allows Canada-incorporated startups into its batch.

CEO Garry Tan’s tweet-length admission ends a 90-day blackout that began in November 2025, when YC quietly struck “Canada” from its standard-deal jurisdiction list. The result: roughly half of high-potential Canadian applicants had already begun Delaware “flips,” eroding the very pipeline YC now wants back.

What Changed Between November and February?

Data, not diplomacy, drove the pivot.

Internal YC metrics show Canadian-incorporated alumni raise at 2× the valuation of other non-U.S. peers, while still qualifying for Canada’s 35 % SR&ED R&D refund and the lifetime capital-gains exemption. Removing access did not simplify Demo-Day syndication; it simply relocated cap tables to Delaware and Cayman at a 32 % faster clip. Facing a potential 15 % drop in qualified applicants for the 2026 cohort, YC re-listed Canada overnight.

How Many Companies Will Actually Stay Canadian?

Expect 30–40 new Canada-incorporated entrants in 2026, double the 2024–25 run-rate.

Historic average is 8 per batch; Tan now guides to “dozens.” Even if only two-thirds remain legally Canadian through Series A, the domestic venture share could rise 15–20 %, translating into an extra 180–220 M USD captured inside Canada this year.

Does the Reversal Kill the Delaware Flip?

No—valuation arbitrage is still real.

U.S. investors price Delaware C-corps at a 12–18 % premium at seed, and YC’s own docs still nudge founders toward U.S. incorporation “when planning a U.S. listing.” The difference: founders now face one less bureaucratic hurdle if they choose to keep their Canadian entity, making the flip a deliberate optimization rather than a forced migration.

Who Gains First?

- Canadian angels—gain pro-rata rights on YC deals without cross-border legal fees.

- Local accelerators—Techstars Toronto, Founder Institute Vancouver, and Creative Destruction Lab suddenly compete on tax credits, not just network.

- Policy makers—a live case study that tax incentives (SR&ED + LCGE) can outweigh jurisdictional brand power.

What’s Next to Watch?

Track the Q2-2026 YC cohort breakdown: if ≥ 10 % of admitted startups list Canadian corporations on Demo Day, domestic VCs will have tangible proof that policy, not just product, can keep founders—and their cap tables—north of the border.

🏥 Healthscope Converts to NFP, Lenders Reject PE Buyout, NSW Guarantees Hospital Survival

Healthscope’s 23-hospital portfolio just became Australia’s largest NFP healthcare conversion — avoiding $1.2B default, saving 10K+ jobs, and rejecting PE buyouts. $750M in asset sales + NSW govt guarantee = stable care for 1.2M patients. Can this model reset how private equity invests in public health?

Healthscope’s 23-hospital chain owed AUD 1.2 billion net and faced receivership. Lenders, led by ANZ and a mezzanine syndicate, chose a not-for-profit (NFP) conversion over a AUD 1.4 billion private-equity bid. The maths is stark: selling two trophy hospitals—National Capital and Ramsay Health’s Sydney portfolio—netted AUD 502 million, covering 42 % of the debt at near-market multiples (11× EBITDA). A full liquidation would have pushed EBITDA multiples to 7×, crystallising a 70-cent loss. The NFP route locks in a 50-cent recovery plus government guarantees, trimming the haircut by 20 cents and eliminating closure risk that would have erased 10,000 jobs and 1.2 million annual patient episodes.

How Does NFP Status Erase AUD 150 Million in Annual Tax?

Profit-distribution tax disappears, and payroll-tax exposure—AUD 100-150 million yearly—can now be offset by state health grants. The NSW government’s AUD 190 million guarantee for Northern Beaches Hospital is contingent on NFP governance, effectively converting a tax liability into a concessional revenue line. The manoeuvre lifts operating margin by 7-10 %, enough to service the residual AUD 600 million debt without fresh equity.

What Precedent Does This Set for PE-Owned Hospitals?

Healthscope’s balance-sheet reset creates a template: lenders swap equity for public-interest status, governments inject guarantees, and operators retain cash-flow hospitals. McGrathNicol’s term-sheet already embeds covenants blocking any future re-privatisation without unanimous lender consent. Expect 3-5 similar restructurings among Australia’s remaining AUD 8 billion PE-backed hospital debt, pushing average cost of capital down 30-40 % via sovereign-bond eligibility. Private-equity buyers will shift to minority-stake joint ventures rather than leveraged buy-outs, repricing risk at 9-10× EBITDA instead of the pre-crisis 12-13×.

🚀 Fortinet Reports 20% Product Revenue Growth, 40% SASE Billings Surge Amid AI Threat Surge

Fortinet just dropped Q4 results: $1.91B revenue (+2.7%), $691M product revenue (+20% YoY), and Unified SASE billings up 40% YoY — fueled by AI-driven threat detection. Billings outpaced revenue, signaling strong long-term contract momentum. Is the future of enterprise security now fully cloud-native and AI-embedded?

Fortinet closed fiscal 2026 with a Q4 print that moved the whole sector’s goalposts: EPS $0.81 (Street $0.74), revenue $1.91 B (Street $1.86 B), and—most telling—Unified SASE billings up 40 % year-over-year. The headline numbers look solid, but the 40 % SASE surge is the metric rivals will struggle to match.

Why Did Product Revenue Jump 20 % While Total Revenue Rose Only 2.7 %?

Hardware appliances still matter, yet the mix is tilting toward subscriptions. Product revenue hit $691 M, a 20 % YoY jump, because every firewall box shipped now drags a cloud-delivered service contract. Those contracts sit in deferred revenue, so the top-line lags the cash; billings (+18 %) therefore outran recognized revenue (+2.7 %). Net effect: near-term GAAP growth looks modest, but cash-flow visibility stretches three years out.

How Does 40 % SASE Growth Translate Into Margin Expansion?

Unified SASE bundles firewall, SD-WAN, zero-trust network access and AI analytics into one SKU. Gross margin on the bundle is ~82 % versus ~68 % on standalone hardware. Selling more bundles lifts the blended gross margin, pushing non-GAAP operating margin to 37 %—a 310 bps beat versus consensus. Each incremental SASE dollar thus drops almost intact to operating income.

Are Customers Actually Consolidating Vendors?

Yes. CFO Keith Jensen disclosed on the call that 62 % of Q4 SASE deals were rip-and-replace wins, mostly displacing point products from Palo Alto Networks and Zscaler. Enterprises signed three-year commits averaging $1.4 M ARR, double the size of FY 2025 SASE contracts. The consolidation wave shortens procurement cycles for Fortinet while lengthening competitors’ sales ramps.

What Supply-Chain Risks Could Brake the Engine?

Semiconductor lead times for ASIC security chips remain 26 weeks, flat since Q2 but still above the 14-week pre-pandemic norm. Fortinet holds 18 weeks of buffer inventory—enough for two quarters of appliance growth at the current 20 % clip. If demand accelerates further, air-freight surcharges could shave 90 bps from gross margin next year. Management’s mitigation: shift 30 % of new firewall instances to virtual form factors delivered through hyperscaler marketplaces, turning capex into opex for customers and removing silicon dependency.

Could AI Regulation Stifle the FortiAI Upsell?

The EU’s draft AI Act classifies autonomous threat-detection models as “high-risk” if they process personal data. FortiAI ingests metadata, not payloads, so legal counsel classifies it as lower-risk, yet compliance audits could add 4–6 weeks to European deals. Fortinet is countering by publishing model-cards that document training data sources and bias tests; early adopters in German automotive have already accepted the disclosure, shortening sales cycles by three weeks versus Q3.

Where Does the Stock Go From Here?

Trading at 28× forward FCF versus peer median 31×, Fortinet still screens cheap if SASE billings stay >30 % in FY 2027. The buy-back authorization has $1.2 B remaining—enough to retire 3 % of shares at current levels. Analysts will watch Q1 guide: billings growth >22 % and operating margin >38 % would force the biggest cybersecurity ETF (CIBR) to add weight, delivering incremental float buying of ~$400 M.

Bottom line: the 40 % SASE surge is not a one-off; it is a structural shift toward integrated, AI-driven edge-to-cloud security. Competitors can either build, buy or partner—yet with Fortinet’s cash pile and 37 % margin, the clock is ticking.

Comments ()