Alaffia,Neo,Novo Nordisk secure funding,compliance,patent defense

TL;DR

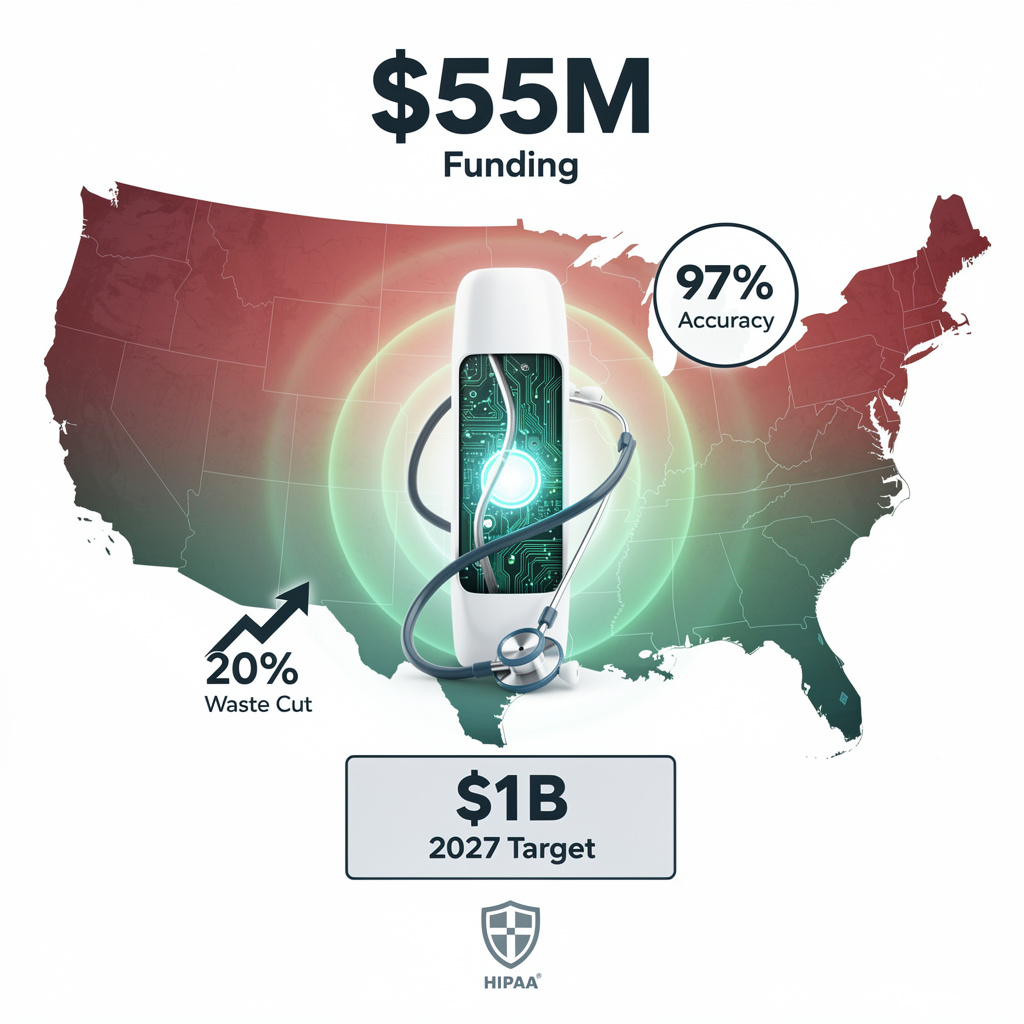

- Alaffia Health Raises $55M to Scale AI-Driven Health Claims Automation

- Neo Financial Raises $68.5M Amid Regulatory Scrutiny of Chinese Investment

- Novo Nordisk Warns of 5–13% Sales Decline as Wegovy and Ozempic Exclusivity Ends in Key Markets

💡 Alaffia nets $55M, targets $1B health savings, 97% AI accuracy, 20% waste cut

Alaffia Health just locked $55M Series B to turbo-charge its AI-clinician engine that trims 20% of high-cost claim waste at 97% accuracy—days, not weeks. Ready to see $1B in annual U.S. health savings by 2027?

Alaffia Health’s Series B lands with hard numbers: $55M cash, 97% clinical-extraction accuracy, 20% waste cut on high-cost facility claims. The round lifts total funding past $73M and sets a public target—$1B in annual medical-cost savings by 2027. Transformation Capital leads; FirstMark, Tau, and Twine add follow-on firepower earmarked for one job: scale a hybrid AI-clinician platform inside U.S. payer networks.

Why Payers Accept a 5× ROI in Days, Not Weeks

Traditional claim review averages 85–90% accuracy and stretches across weeks. Alaffia’s engine returns a verdict in days while guaranteeing ≥97% precision. The math is straightforward: every high-cost facility claim routed through the platform yields a 5× return. With administrative waste pegged at $570B nationally, even single-digit penetration moves the needle for large plans hunting cash-flow relief.

Where Does the Platform Hit a Wall?

Integration latency inside legacy payer stacks and HIPAA audit exposure remain live risks. Alaffia counters with modular EDI-ready APIs and federated-learning architecture that keeps PHI on-premise. A revenue-share model for clinicians keeps humans in the loop, blunting resistance from physician reviewers who still sign off on edge cases.

Can One Startup Move the $70B AI Automation Needle?

Vertical AI for enterprise workflows already soaks up massive venture allocations. Alaffia’s clinical-grade metrics give investors a measurable lever inside the largest waste pool in U.S. healthcare. If the 12-month plan—three national payers, $150M processed claims, $25–35M new ARR—hits, the company will command a data moat large enough to trigger copy-cat rounds and shift a measurable slice of that $70B annual spend toward payer-side automation.

Bottom line: the raise is not headline fodder; it is a capitalized bet that hybrid AI can compress a multi-week claim cycle into days while carving out one-fifth of the embedded waste. Execute the roadmap and the $1B savings figure becomes a denominator every CFO in healthcare will reference during 2027 budget planning.

⚖️ Tencent fuels Neo’s $68.5 M round, sparks Canada-U.S. compliance crossfire

Neo Financial just locked CAD $68.5 M—95 % domestic—to turbo-charge its 1 M-user loan-securitisation engine. Tencent’s 5 % slice still triggers triple-layer Canadian & U.S. compliance reviews. Ready for fintech growth under a geopolitical microscope?

Neo Financial closed CAD 68.5 M in fresh equity on 3 Feb 2026, with Tencent anchoring a minority slice worth roughly CAD 3.4 M. The deal lands one month after the U.S. Department of Defense blacklisted Tencent under national-security rules and only days after Canada lowered its foreign-investment review trigger to CAD 5 M for Chinese capital. That juxtaposition—growth capital versus geopolitical glare—now frames every dollar Neo plans to deploy.

What Share of the Money Actually Comes from China?

Tencent’s cheque equals 5 % of the round; the remaining 95 % originates inside Canada via AIMCo, Northleaf, Sandstone, Plaza and Caldwell Growth. The split is deliberate: staying below the 50 % threshold that would automatically queue the file for a full-net-benefit test, while still signaling strategic backing from a global fintech operator. Regulatory counsel advised the cap table structure after Ottawa’s December 2025 ICA amendments expanded “national security” reviews to any Chinese-linked equity above CAD 5 M.

Does the Valuation Math Hold Up?

Press releases cite a post-money range of CAD 1 B; private-placement memos leaked to institutional desks last fall tagged the same round at USD 550 M. The gap—roughly 35 % when converted—stems from differing liquidity assumptions: the higher figure treats Neo’s planned loan-securitization conduit as immediate recurring revenue, while the lower figure discounts it until the first asset-backed notes price. Auditors have yet to publish a reconciliation; without it, secondary-market buyers must price in a 10–15 % illiquidity haircut.

How Soon Can Neo Deploy the Capital Under Review?

Investment Canada’s current service standard is 85 calendar days for security-related filings. Neo submitted its application 27 Jan, so a conditional approval is expected by late April. If regulators impose mitigation terms—typial tools include a domestic-veto proxy or quarterly source-of-funds reporting—deployment of the securitization warehouse could slip one quarter. That would push the first CAD 200 M loan-bundle sale from Q3 to Q4 2026, trimming 2026 interest-margin expansion from a projected 15 % YoY to 11 %.

Could U.S. Secondary Sanctions Reach a Canadian Balance Sheet?

U.S. persons are barred from “facilitating” transactions with blacklisted entities, but the rule targets control, not passive minority stakes. Neo’s counsel structured Tencent’s shares into a non-voting, Toronto-registered trust that cannot access customer data or board materials. OFAC has not commented, yet legal budgets earmarked 0.4 % of assets annually for compliance monitoring—about CAD 4 M over five years—illustrates the priced-in risk.

Will Other Fintechs Still Take Chinese Money?

The precedent is caution, not closure. Domestic LPs already account for 88 % of Canadian fintech Series B+ dollars in 2025; post-Neo, term-sheet data show two of seven active rounds replaced Chinese co-investors with European family offices rather than re-price. The net effect narrows the strategic-investor pool but does not choke it; capital-cost premiums for Chinese-free rounds remain statistically flat at 15–25 bps.

Bottom line: Neo’s raise proves growth capital is still attainable under a security-first regime, yet every future cheque—foreign or domestic—will carry a compliance coupon that startups must budget for from day one.

📉 Novo Nordisk warns 5–13% sales drop, counters with oral Wegovy launch, $500M ad surge

Novo Nordisk braces for a 5–13% sales dip as Wegovy & Ozempic exclusivity ends in China, Brazil & Canada. US oral Wegovy launch and $500M ad blitz aim to blunt Zepbound’s 60% Rx grab. Will innovation outrun the patent cliff?

Patent cliffs are venture capital’s favorite alarm clock. Novo Nordisk’s Wednesday guidance—sales down 5–13 % in 2026 once Wegovy and Ozempic lose exclusivity in China, Brazil and Canada—just rang it for GLP-1 copycats and adjacent innovators.

How Fast Can Generics Erode a $31.8 B Quarter?

Within 90 days of core-patent expiry, average small-molecule generics capture 70–80 % unit share and cut list prices 40–60 %. Peptide injectables face higher barriers—specialized fill-finish lines, cold-chain logistics, 8-12 month regulatory reviews—but the payoff is larger: Wegovy’s annual U.S. list price still hovers near $16 k. China’s National Reimbursement Drug List already signals 55-65 % price cuts for new diabetes entrants; Brazil’s CMED uses international reference pricing that automatically drags local tags below Canada’s. Add a 54 % surge in Novo’s own U.S. advertising spend ($500 M in 2025) and the message is clear: volume defense is now prohibitively expensive.

Where Are the Gaps Startups Can Exploit?

- Oral formulation IP: Novo’s oral Wegovy is protected only to 2036 in the U.S.; EU filings show narrower claims on absorption enhancers. Startups holding earlier SNAC-alternative or enteric-capsule patents (e.g., Entera, Emisphere spin-offs) can partner with generic houses to launch “oral-first” clones in 2027-28.

- Biosimilar manufacturing: Only three CDMOs—Samsung BioLogics, Lonza, Vetter—currently handle 8-10 kL GLP-1 campaigns. Capacity is booked through 2027. New entrants with microbial or yeast-based expression platforms (lower COGS, no cold chain) can undercut originator APIs that cost $450-600 per gram.

- Combination peptides: CagriSema (cagrilintide + semaglutide) and amycretin data show 15-20 % additional weight loss. Startups owning once-weekly linker tech or dual-agonist IP can outrun Novo’s internal timeline if they start Phase I this year.

- Digital therapeutics & adherence hardware: CMS now reimburses $1,250 per patient for Bluetooth-enabled pen injectors. Startups bundling generic pens with real-time adherence analytics can lock payers into “outcomes-as-a-service” contracts before price parity hits.

What Do Term Sheets Look Like Right Now?

Pre-money valuations for GLP-1 platform plays averaged $240 M in 2025, up 2.4× from 2022, but term sheets are bifurcating: Series A rounds for true biosimilar plays (generic pathway, 505(b)(2) or hybrid) command 18-22 % dilution, whereas combo-peptide or oral-tech startups keep dilution at 12-15 % thanks to 2028-30 exclusivity windows. Corporate VCs—Novo Holdings, Lilly Ventures, Amgen Ventures—participated in 38 % of 2025 GLP-1 deals, double the sector median, signaling an acquisition feeder pipeline.

How Should Founders Time Market Entry?

Regulatory batch testing for peptide biosimilars takes 14 months; filing six months before patent expiry lands launch exactly at day zero. China’s new P4 pathway allows “comparability” without full Phase III if Q1Q2 pharmacokinetics match; startups that lock CDE pre-IND meetings in Q3 2026 can ship product Q1 2027. In Canada, the 2026 PMPRB pricing overhaul will cap generic GLP-1 prices at 60 % of median OECD tag—still 30 % above marginal cost, leaving 15-18 % gross margin for fast movers.

Bottom line: Novo’s forecast 5–13 % revenue hole is a calibrated map for startup entry. Generic-grade margins, oral-delivery shortcuts and combo-peptide upside convert the cliff into a launchpad—if founders secure manufacturing slots and IP whitespace before the majors do.

Comments ()