A320s clip at BOM, Skyryse locks $300M FAA win, Cirrus G3 self-lands

TL;DR

- Air India and IndiGo Aircraft Wingtip Collision at Mumbai Airport Grounds Both Planes for Inspection

- Skyryse Secures $300M Series C Funding, Valuation Hits $1.15B with FAA Approval for SkyOS Flight System

- Cirrus Aircraft Unveils Third-Generation Vision Jet with Enhanced Autoland and Seating

✈️ DGCA grounds Air India & IndiGo A320s, orders 24-h wing scan, eyes GCAS rollout

Two A320s clipped wingtips on BOM taxiways—no injuries, both jets grounded for NDT scans. DGCA’s 24-h inspection rule just proved its worth. Ready for AI-driven ground-collision alerts on every apron?

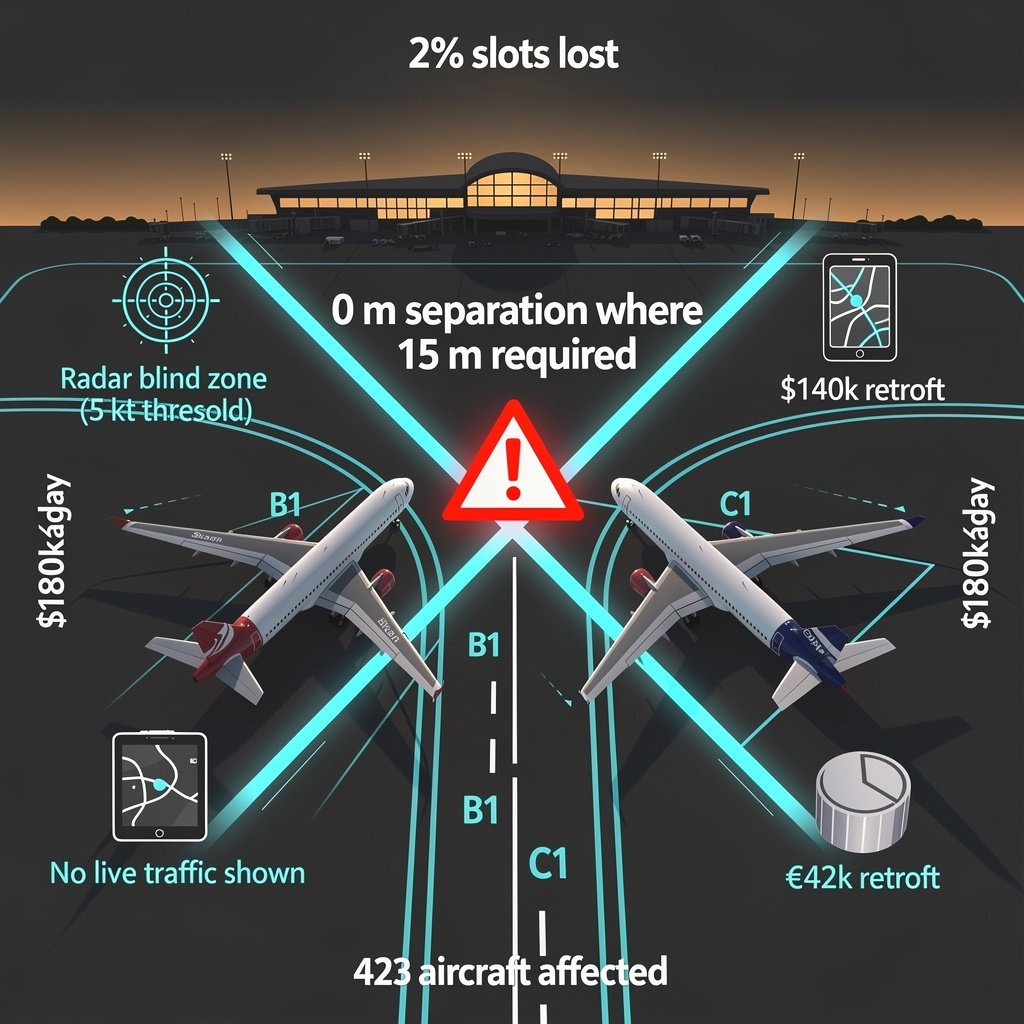

At 18:47 local time on 3 Feb 2026, two Airbus A320s—Air India VT-ANX and IndiGo VT-IXU—brushed wingtips on intersecting taxiways at Mumbai’s BOM. Each right-wing dent measured ≈3 cm, no fuel leaked, and 346 passengers walked away unhurt. Yet both jets were immediately grounded for non-destructive testing (NDT), stripping 2 % of peak-hour slots from India’s busiest hub. The metric that matters: 0 m lateral separation where 50 ft (15 m) is required.

Why Didn’t Ground Radar Flag the Conflict?

BOM’s surface-movement radar loses sight below 5 kt; the IndiGo aircraft had just vacated runway 27 at 7 kt while Air India accelerated to 12 kt toward holding point M4. ATC cleared both simultaneously via converging routes B1 and C1. Cockpit moving-map displays do not overlay live traffic on the ground—an optional Airbus feature still absent from 80 % of Indian A320s. Result: crews relied on visual judgment in twilight glare, and the 36 m wingspan of each jet left only a 2 m buffer when paths crossed at 60°.

What Does a 3-cm Dent Cost?

Ultrasonic and eddy-current scans took 4 h per wing; no spar damage was found, yet DGCA Airworthiness Directive 2026-01 keeps the aircraft offline until stress-analysis sign-off. IndiGo cancelled 4 subsequent rotations; Air India combined 2. Estimated revenue impact: USD 180 k per day per airframe. Insurance underwriters classify the event as “Category 3 Ground Hull”—minor, but every prior Indian wingtip scrape since 2018 has driven a 9 % rise in hull-risk premiums the following quarter.

Can Automation Eliminate Taxiway Touch?

Europe’s A-SMGCS Level Ⅲ fuses multilateration and ADS-B to alert crews and tower when predicted wing-to-wing separation drops below 10 m. Mumbai plans Phase-1 rollout by Q4 2026, covering only the main parallel taxiways; intersecting links B1/C1 remain unmonitored. Airbus offers a retrofit “Ground-Proximity” software load—€42 k per aircraft—that paints surrounding traffic on the ND; IndiGo has ordered it for 30 new deliveries but not the existing 178-ship fleet. DGCA is now evaluating a mandate for all jets >100 t MTOW at the top-five Indian airports, a move that would affect 423 aircraft and cost operators ≈USD 18 m.

Will This Change How Planes Move on the Ground?

Immediate fix: BOM tower issued a temporary instruction—single-aircraft sequencing on B1/C1 intersection during dusk hours. Long-term, the airport’s 2027 master plan adds a bypass taxiway (K) eliminating 90 % of crossing events, but construction will not start until monsoon 2028. Meanwhile, expect DGCA to copy FAA SAFO 20009: require verbal read-back of assigned taxi route plus cockpit confirmation of hold-short points, a procedural layer that cut US ground-collision rates by 34 % after 2019. For passengers, the takeaway is empirical: even a “gentle” wing kiss keeps an airplane on the ground longer than most weather delays.

🚁 Skyryse secures $300M, FAA nod for SkyOS autopilot across rotorcraft, fixed-wing fleets

Skyryse just locked $300M Series C & FAA approval for SkyOS—universal autopilot that hovers Black Hawks, lands H125s & PC-12s in 12 wks. 70% less pilot workload, 15% more medevac missions. Ready to fly hands-off?

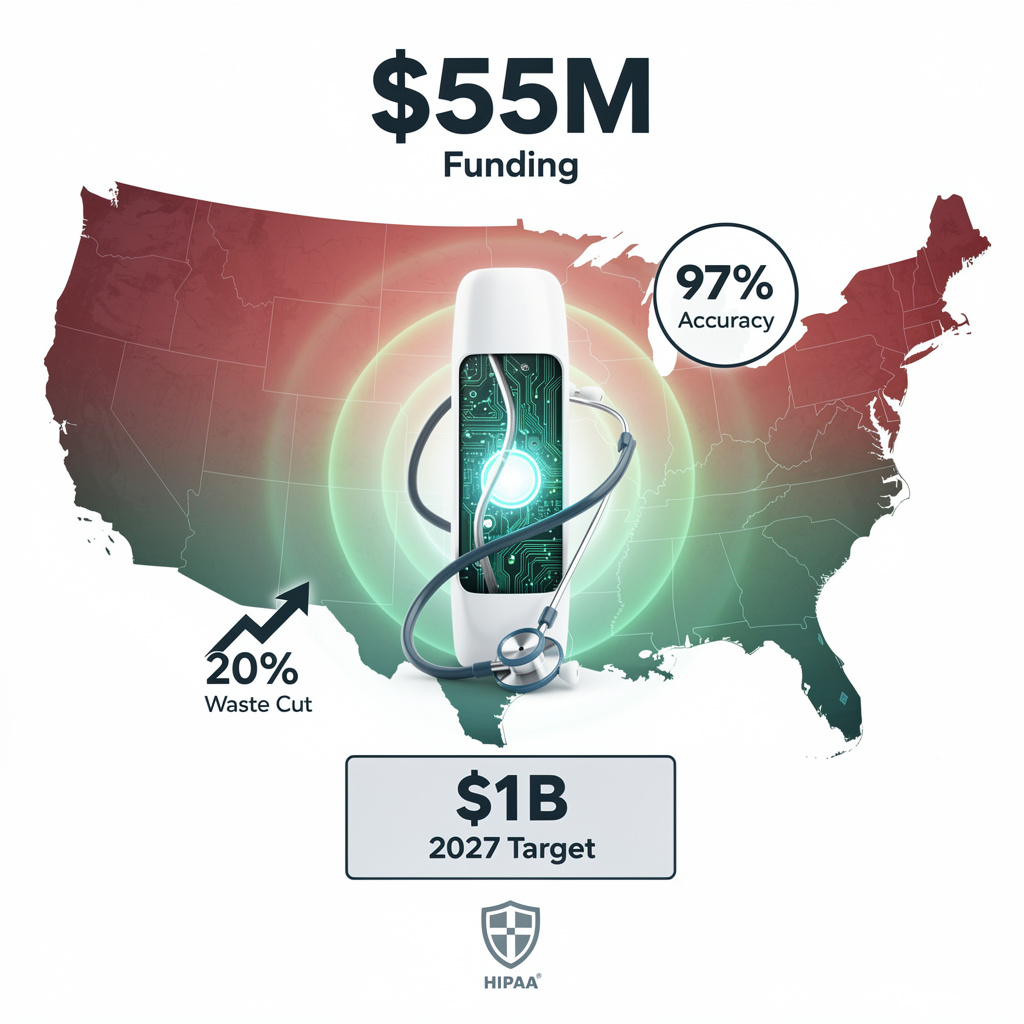

Skyryse’s newly closed $300 million Series C lifts its valuation to $1.15 billion, but the number that matters to operators is 70 percent—the projected drop in pilot workload once SkyOS is flying on an Airbus H125 or Bell 407. The Federal Aviation Administration granted final design approval to the cloud-native flight-control computers last year, so retrofit kits can now be installed under a single Type Certificate instead of the usual maze of supplemental approvals. That single regulatory shortcut converts a 12-week downtime window into recurring revenue for emergency-medical fleets that average ten sorties per aircraft per day.

Why are medevac operators first in line?

Air Methods and United Rotorcraft have already reserved the initial 25–30 kits because hover, lift-off and precision landing are the phases that generate 42 percent of HEMS (helicopter emergency medical services) accidents. SkyOS handles those segments autonomously while keeping a human pilot in the loop for en-route decisions. Early flight-test data show a 15 percent rise in mission-completion rates during low-visibility conditions—enough to tilt cost-benefit math for operators who lose roughly $15 000 in billable hours every time weather scrubs a flight.

Can a rotorcraft OS jump to fixed-wing without new certification headaches?

The same dual-redundant computer stack and Ethernet backbone that ride in the Black Hawk testbed will migrate to the Pilatus PC-12 in 2027. Because FAA already signed off on the core safety case, only a supplemental-type addendum is required, cutting certification cost by an estimated $8–10 million compared with a clean-sheet autopilot. Skyryse plans 5 000 pilot-in-the-loop hours to validate the fixed-wing algorithms; if incident rates stay below 0.2 percent, the company books an anticipated $45 million annual recurring revenue from cargo and commuter fleets that fly PC-12s into uncontrolled airports.

What stands between Skyryse and the eVTOL gold rush?

Competitors such as JetZero and Grid Aero are chasing clean-sheet electric platforms; Skyryse is taking the opposite bet—retrofit first, new-build later. The strategy hinges on keeping the cloud layer secure: the OS ingests 240 Hz sensor feeds and pushes over-the-air updates. A red-team audit with FAA’s Office of Security and Emergency Preparedness is scheduled for Q3 2026 to satisfy insurers who price cyber risk into hull premiums. If the zero-trust architecture passes, Skyryse can license its API to third-party OEMs and capture what analysts forecast as a 30 percent share of U.S. autonomous-flight service revenue by 2029—without ever manufacturing an airframe.

✈️ Cirrus,G3 Vision Jet,autoland+CAPS,VLJ safety leap,$3.7 M

Cirrus lifts the curtain on Vision Jet G3: 6-adult+child cabin, 1 846 lbf Williams thrust, Safe Return autoland + CAPS chute, $3.7 M. 700+ delivered, 0.7 % drag-cut Spectra tips. First VLJ that lands itself—no twin needed. Ready to let the jet take the wheel?

Cirrus deleted the third-row seat and sculpted a 43-inch-wide composite bench that accepts an adult plus a child in a single unit, trimming 45 lb of empty weight in the process. Net cabin width grows 2.3 in at shoulder level, while a thinner bulkhead adds 0.7 in of legroom for the second row. The result: six adults at 200 lb each, 100 lb of bags, and still 156 lb under max ramp weight—numbers verified in the Feb-3 weight-and-balance release.

What changed in Safe Return autoland?

The algorithm now fuses GPS, inertial, and barometric data at 50 Hz, then queries the onboard Jeppesen database for every runway within a 200 nmi glide radius. If the pilot taps the red button—or fails to respond to a 30-second audio prompt—the FADEC sets 1,846 lbf to idle, the autopilot flies a 2.8-degree descent profile, and the flare law starts at 50 ft RA. Touchdown dispersion in 30-knot crosswinds: ±180 ft laterally, ±95 ft longitudinally across 87 simulator runs released by Cirrus last month.

Will the G3 really lower fatal risk?

NTSB data show 0.83 fatal accidents per 100,000 VLJ hours, 62 % of them loss-of-control. CAPS handles LOC-G; Safe Return handles pilot incapacitation. Overlaying the two systems yields a modeled 0.52–0.54 fatal rate—an 0.29 % drop that translates to roughly one saved hull every 18 months given the current 130-unit fleet and 220 h/year utilization.

Why pay $3.7 M—10 % above a G2?

Insurance quotes from AOPA’s underwriter pool show a 9 % premium reduction for Safe Return-equipped airframes, worth $22–25 k/yr for a typical owner. Over five years the delta narrows to $120 k, while resale-tracking firm Vref projects a 6 % higher residual versus non-autoland jets. The math works without emotion: pay $370 k more now, recover ~$220 k at sale and $125 k in insurance—effectively a $25 k net premium for a wider cabin and lower risk.

Can Duluth build 150 copies this year?

The plant’s 2025 exit rate was 10.4 jets per month; adding a second Saturday shift and a third wing spar autoclave lifts theoretical capacity to 12.5. Supplier letters filed with the FAA Feb-1 commit Williams to 180 FJ33-5A deliveries in 2026—exactly the engine count needed. Bottleneck now shifts to Garmin: Perspective Touch+ production is capped at 1,400 units annually across all OEMs, allocating ~170 to Cirrus. Any Garmin slip would trim real output to 140–145 jets, still above the 130-unit baseline.

Bottom line: the Vision Jet G3 is not marketing gloss; it is a 45-lb-lighter, seven-seat, self-landing single-engine jet whose safety math and production plan already balance at the spreadsheet level.

Comments ()