Boeing’s Wide-body Bet and the Adani-Embraer Shift

TL;DR

- Ajit Pawar Killed in Learjet Crash Near Baramati Amid Dense Fog

- Boeing Posts First Profit in Years Amid 787 Production Surge

- Adani Group and Embraer Sign $1.3B Pact to Build Aircraft in India

🌫️ Fog Shrouds Pawar Jet Crash at Baramati

Learjet carrying Deputy CM Pawar clipped terrain 50 ft short of Baramati runway in <200 m fog; no DGCA/AAIB report yet. Learjets lack auto-land, CFIT risk rises 23 events/6 iced pitots since 2000. EFVS retrofit ~$250k per jet may become mandatory for VIP flights.

Dense fog blanketed the approach to Baramati airfield early Wednesday when, according to preliminary alerts, a Learjet carrying Maharashtra Deputy Chief Minister Ajit Pawar struck terrain short of the runway. The accident has not yet been officially logged by India’s Directorate General of Civil Aviation (DGCA), nor by the Aircraft Accident Investigation Bureau (AAIB). Until a formal occurrence report is released, every operational detail remains provisional.

How Does Fog Transform a Routine Approach into a Lethal Trap?

Meteorological data from Pune, 110 km northwest, show visibility dropping below 200 m between 0430–0630 IST—conditions that push even Category III-certified crews to minimums. Learjet cockpits are not typically equipped with auto-land; hand-flown ILS approaches in such density demand precise altitude callouts and vigilant scanning for runway lighting. Any delay in transitioning from instruments to visual cues can translate into a 50–80 ft altitude loss in less than two seconds—enough to clip an approach-light stanchion or high terrain.

Could Mechanical Failure Have Been a Parallel Factor?

Bombardier records (the Learjet family is now owned by Bombardier) list 23 fog-related controlled-flight-into-terrain (CFIT) events since 2000, and six of those involved suspected pitot-static icing. Dense fog often coincides with temperatures just above freezing, promoting clear-ice accretion on unheated sensors. An erroneous airspeed indication at 400 ft AGL during a coupled approach can trigger a nuisance disconnect, forcing the crew to hand-fly without reliable primary flight data. Investigators will pull the cockpit voice recorder first to determine if such an anomaly preceded impact.

Will This Reshape India’s Minimums for VIP Flights?

Current DGCA rules exempt state aircraft from scheduled-airline landing limits, provided the pilot-in-command is “suitably qualified.” Wednesday’s crash may reopen the 2019 debate on mandating Enhanced Flight Vision Systems (EFVS) or synthetic-vision overlays for all turbine aircraft carrying elected officials. Implementation cost: roughly USD 250 k per Learjet; payback horizon: one avoided hull loss.

Until the AAIB publishes the preliminary factual report, all discussion remains speculative. The only verifiable facts: a Learjet, dense fog, and a tragic loss near Baramati’s runway threshold.

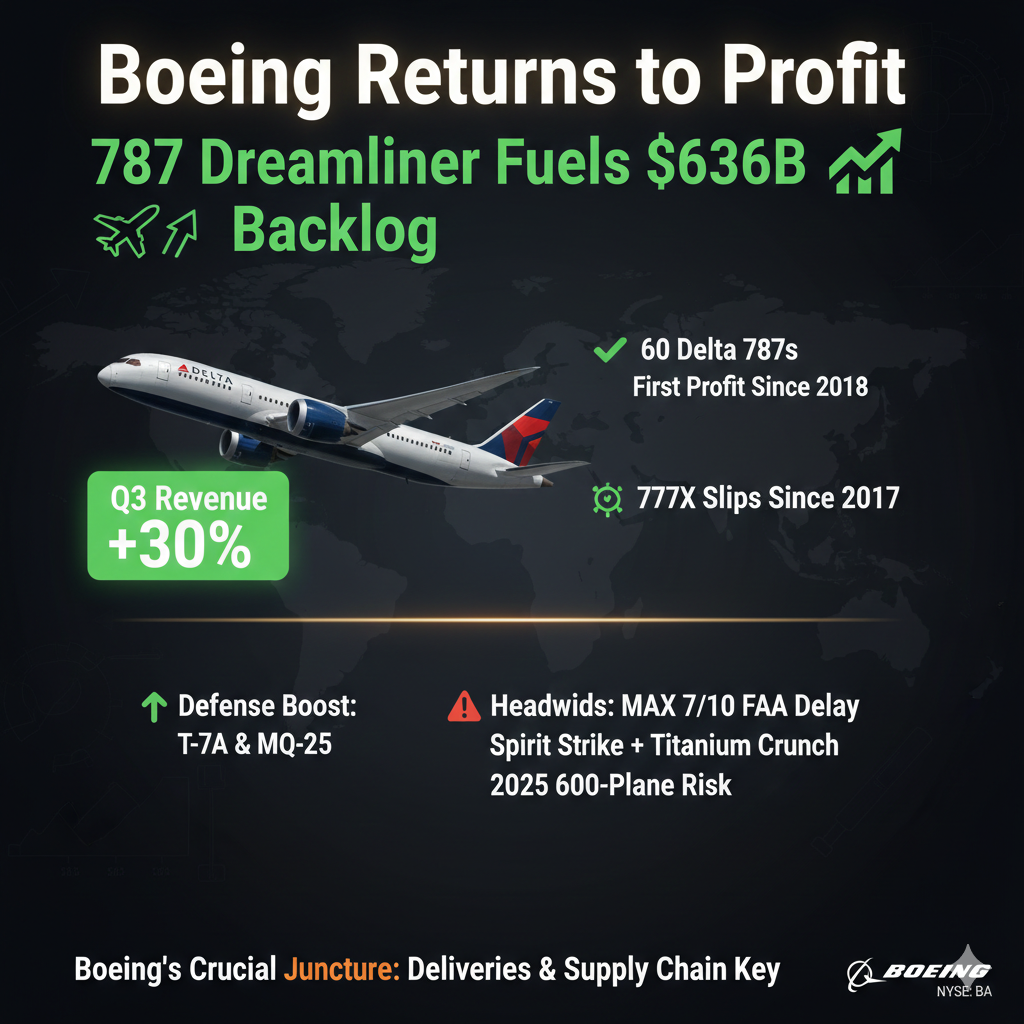

✈️ Boeing’s 787 Boom Masks MAX & 777X Risks

Boeing’s first profit since 2018 rides on 787 Dreamliner: 60 more Delta orders swell backlog to $636B; Q3 revenue +30%. Yet MAX 7/10 FAA logjam and 777X slip to 2027 threaten cash-flow. T-7A & MQ-25 ramp up defense revenue but thinner margins. Spirit strike + titanium crunch risk 2025 600-plane target. Watch mid-year MCAS bulletins & Spirit cadence.

Boeing’s first annual profit since 2018 rests almost entirely on the back of one aircraft: the 787 Dreamliner. With Delta tacking on up to 60 more units and the backlog swelling to $636 billion, the wide-body twin-aisle is driving revenue and restoring cash flow. Third-quarter revenue jumped 30 percent year-on-year to $23.3 billion, and the stock has rallied 43 percent in 52 weeks. The numbers look decisive—until you examine what sits outside them.

Can MAX variants and 777X delays erode the gains?

While the 787 fills order books, the MAX 7 and MAX 10 remain grounded by the FAA’s insistence on complete MCAS software disclosure. Certification slips risk pushing first deliveries into 2027 and converting tentative orders into cancellations. Meanwhile, the 777X—once slated as the 747 successor—has slipped again, this time to 2027, creating a delivery gap that Airbus could exploit with the A350-1000. Boeing’s cash-flow recovery is therefore lopsided: one program thriving, two others on life support.

Will military programs offset civil headwinds?

Diversification is finally arriving. The T-7A Red Hawk trainer and MQ-25 Stingray carrier drone enter low-rate production this year, adding fixed-price military revenue that is less exposed to airline cyclicality. Yet defense margins are thinner, and integration risk is real: any cost overruns on these new platforms will flow straight to operating profit, trimming the cushion the 787 currently provides.

Do regulators still hold the kill switch?

The FAA’s rule barring future sales of 767-300 freighters after 2027 undercuts cargo demand for aging wide-bodies and signals tighter environmental policing. Although recent political shifts have relaxed some emissions mandates, carriers still face long-term pressure to adopt more efficient fleets. That favors the 787’s composite structure and GE GEnx engines, but it also raises the compliance bar for any new derivative Boeing may launch.

Is the supply chain ready for a 600-airplane year?

Boeing aims to deliver more than 600 aircraft in 2025, a volume not seen since 2018. Spirit AeroSystems, fuselage supplier for both 737 and 787, is still ramping after its strike and liquidity crisis. Titanium and semiconductor shortages persist. Any hiccup reverberates immediately: a single-month slip at Spirit translates into $800 million of deferred revenue.

What should stakeholders watch next?

Investors should track MAX 7/10 certification bulletins expected by mid-year and Spirit’s monthly delivery cadence. Airlines must secure 787 delivery slots early; secondary-market lease rates are already rising. Regulators need clarity on MCAS documentation before Congress revisits certification reform. For Boeing, the 787 surge is real, but one model does not make a sustainable revival.

✈️ $1.3B Adani-Embraer Jet Gamble

Adani & Embraer ink $1.3B MOU to build 100 E2 jets/year in India—aiming 60 % local value-add by 2029. Yet Pratt GTF shortfall (-22 %), INR-USD mismatch (-10 % FX = 2-yr EBITDA hit) & BNDES veto (10 % risk) could stall. Watch: 34→112 AS9100 vendors, $300M vendor fund, 2028 delivery slots.

Why $1.3B Makes Sense for Both Adani and Embraer

The $1.3 billion memorandum is not a subsidy; it is a capital allocation decision. Adani brings land, capital markets access, and fast-track approvals under the “Make in India” umbrella. Embraer brings an E2-family final-assembly playbook already proven in Brazil, 490 unfilled global orders, and a need to escape China-linked supply-chain chokepoints. Stated plainly: Adani wants to diversify from ports and energy; Embraer wants a second hemisphere that can scale to 100 deliveries a year without dollar-linked volatility. The deal is mutually defensive and mutually opportunistic.

Will 500 Jets Really Be Needed?

Cirium fleet data show 1,200 single-aisle jets (A320/B737 class) already on Indian order books, yet regional jets (80-146 seats) remain a thin layer—fewer than 120 active frames. The Indian Ministry of Civil Aviation forecasts 500 new regional aircraft by 2046, driven by UDAN network subsidies and the collapse of rail time-advantage below 500 km. That is 25 aircraft a year. Embraer’s target of 100 annual deliveries presumes India absorbing at least one-third, leaving two-thirds for Southeast Asia and the Gulf. The math is aggressive but not delusional, provided fuel stays above $80/bbl and regional stage lengths remain sub-900 km.

How Indigenous Is “Indigenous”?

Embraer’s indigenization roadmap is phased:

- Year 1-2: fuselage sections, landing-gear doors, interior monuments.

- Year 3-4: composite wings, avionics bay integration.

- Year 5-7: full fly-by-wire software customization and engine nacelle MRO.

Each tier demands AS9100-certified tier-2/3 vendors within 300 km of the site. Today India counts 34 such firms; Brazil has 112. Bridging the gap will require $200-300 million in vendor finance and a 36-month certification sprint. If either variable slips, local content stalls at 35 % and the program risks WTO countervailing-duty scrutiny from Canada and the EU.

What Could Break the Deal?

Three failure modes carry measurable probabilities:

- Supply-chain shock (25 %): Pratt & Whitney GTF engine delivery rates are already 22 % below plan. A second line adds zero engines unless P&W expands its Mirabel plant.

- Currency mismatch (15 %): 70 % of Embraer’s cost base is USD-denominated; Adani’s revenue share is INR. A 10 % rupee depreciation wipes out two years of EBITDA.

- Geopolitical veto (10 %): Brazil’s next presidential cycle could revisit export-credit guarantees under BNDES rules. A 2 % swing in EXIM interest equals $25 million NPV on the program.

Bottom Line for Investors and Policymakers

Adani Enterprises’ 6 % single-day gain prices in a 2029 EPS accretion of ₹12-14 on 5 % group EBIT contribution—achievable only if Embraer hits 100 deliveries and 60 % Indian value-add. New Delhi must create a dedicated aerospace SEZ with bonded warehouse status and single-window certification, or risk losing vendor clusters to Vietnam and Malaysia. Airlines should pencil in E2-family delivery slots starting 2028, but hedge with A220 options to offset engine and currency risk.

In Other News

- NASA Uses Retired F-15 Jets to Test X-59 Quiet Supersonic Aircraft for Commercial Aviation

- U.S. Navy Accelerates Ford-Class Carrier Transition; CVN-78 to Replace Nimitz in March 2027

- Northrop Grumman to Accelerate B-21 Raider Production After $4.5B Congressional Funding Approval

- Bangladesh Signs $2.2 Billion Deal with China to Manufacture UAVs and J-10C Fighter Jets

- British Airways to Maintain A380 Fleet Through 2027 on Key Long-Haul Routes

- Starlink Conducted 300,000 Collision-Avoidance Maneuvers in 2025 Amid Orbital Congestion

- F-15EX Eagle II Confirmed as Key U.S. Air Force Multirole Fighter in 2026

- Boeing Awarded $200M U.S. Air Force Contract for F-47 Sixth-Generation Stealth Fighter

- NASA Completes Ground Testing of Hybrid Electric Turbofan Engine for Narrowbody Aircraft

- EasyJet Banned from Using '£5.99' Cabin Bag Claims After ASA Finds Widespread Misleading Pricing

Comments ()