Boeing, GSK & EU Inc Ignite Funding Surge: Defense Wins, $2.2B Acquisitions & 48-Hour Company Registration Redefine Funding & Growth

TL;DR

- Boeing Secures F-47 Contract Win and Boosts Backlog, Bernstein SocGen Raises Price Target to $277 Amid Defense Division Recovery

- GlaxoSmithKline acquires Rapt Therapeutics for $2.2B to advance ozureprabart IgE antibody pipeline for severe food allergies

- EU Inc Launches 48-Hour Online Company Registration to Boost Startup Ecosystem Across 450 Million Europeans

- Another Launches $2.5M Seed Round Led by Anthemis FIL to Solve Retail Off-Channel Inventory Challenges

🚀 Boeing’s F-47 Win Lifts Backlog to $23.5B; Price Target Raised to $277

Boeing’s F-47 contract adds $5.8B to backlog, pushing total defense backlog to $23.5B. EPS forecast ↑ to $13.20, EBIT margin ↑ 1.5ppt. Bernstein/SocGen raise PT to $277 (30% upside). Firm-fixed-price structure ensures cash flow certainty. #Boeing #Defense #Investing

Boeing’s Defense, Space & Security division secured a firm-fixed-price contract from the U.S. Department of Defense to produce 120 F-47 advanced fighter airframes, with deliveries spanning 2026–2032. The award adds $5.8 billion to backlog, pushing total defense backlog to $23.5 billion—a 21.8% year-over-year increase.

Defense division revenue is projected to rise 12.5% YoY to $5.4 billion in FY 2026, with EBIT margin expanding 1.5 percentage points to 13.2%. Adjusted EPS forecast is lifted to $13.20, up 11.9% from $11.80 in FY 2025. Free cash flow is expected to reach $7.4 billion, up 9%.

Bernstein and SocGen raised Boeing’s price target to $277 (from $245), citing three drivers: (1) contract certainty under firm-fixed-price terms; (2) margin accretion from high-margin defense work; and (3) sustained U.S. defense spending. The $16 billion enterprise value uplift aligns with this target, implying a 30% upside from current market cap.

Supply-chain risks for advanced composites are mitigated by dual-sourcing and 12-month inventory buffers. U.S. defense budget reallocation risk is low, as the F-47 program is fully funded and sustainment contracts are non-contingent line items. Avionics integration risks are reduced through joint testing with Raytheon and Lockheed, under cost-plus-incentive fee structures.

With FY 2026 EPS and cash flow largely backlog-locked, Boeing’s stock is positioned in a $260–$285 corridor. Failure modes—supply delays or DoD budget shifts—could trim EPS by 0.5–0.8 points, but probability remains low due to contract structure and inventory safeguards.

Is Boeing’s $277 Price Target Justified?

Yes. The F-47 contract delivers predictable cash flows, margin expansion, and long-term sustainment revenue. Valuation multiples are rising from 1.8x to 2.1x FY 2026 sales, reflecting improved earnings quality. No material contradictions exist in public data. The target is achievable if delivery timelines hold and fiscal policy remains stable.

💉 GSK’s $2.2B Bet on IgE Antibody for Severe Food Allergies

GSK acquires Rapt Therapeutics for $2.2B to secure ozureprabart, a once-every-12-weeks IgE antibody for severe food allergies. Phase 2b in 2027. Peak sales potential: $1B+ by 2035. Fast-Track FDA filing due Q3 2026. #Biotech #Pharma #M&A

GlaxoSmithKline (GSK) completed an all-cash acquisition of Rapt Therapeutics at $58/share—65% premium—totaling $2.2B. The target asset: ozureprabart, a first-in-class IgE antibody for severe food allergy desensitization, with Phase 2b trials scheduled for 2027. GSK’s FY-2025 cash reserves of $12B funded the deal without debt, limiting dilution to just $0.02 EPS.

The global severe food allergy market reached $5.5B in 2024 (CAGR 10%). Ozureprabart’s 12-week dosing regimen differentiates it from Novartis’ Xolair (2–4-week dosing), potentially capturing 5–10% market share—projected to generate $1B in peak annual sales by 2035 if pricing aligns with Xolair’s $1.5B/year trajectory.

GSK’s AS01 adjuvant platform and global commercial infrastructure can accelerate Phase 3 enrollment and post-launch adoption. Manufacturing transfer of Rapt’s cell-culture process to GSK’s UK and Belgian sites is targeted for Q4 2026.

Regulatory risk remains: FTC scrutiny under Lina Khan requires immediate Hart-Scott-Rodino filing with detailed market-share analysis. Fast-Track FDA designation is being pursued, with IND submission planned for Q3 2026.

Pro-forma analysis shows a $1.1B NPV for ozureprabart (10% discount rate). Payback is expected by FY-2028, assuming Phase 2b success (≥70% desensitization). Competitor IgE programs from Sanofi and Amgen are in earlier stages; GSK’s dosing advantage and safety profile are key differentiators.

Action items: (1) File HSR notice immediately; (2) Secure Fast-Track IND; (3) Reserve 200L bioreactor capacity; (4) Revise FY-2027–2029 revenue guidance; (5) Launch quarterly competitive intelligence briefs tracking IgE pipelines.

This acquisition transforms GSK’s immunology portfolio beyond vaccines and oncology. Execution on integration, regulatory, and manufacturing timelines will determine whether this $2.2B bet becomes a $1B+ revenue engine by 2035.

🚀 EU’s 48-Hour Startup Registration Sparks 22% Surge in New Tech Firms

EU launched a 48-hour online company registration portal — slashing incorporation from weeks to days. 22% more startups expected in 2026. €1B saved. €800M in AI funding unlocked. Sovereign cloud. eIDAS-verified. 0.05% shell company rate. #StartupEurope #AI

The EU’s new 48-hour online company registration portal, EU Inc, launched Jan 21, 2026, slashes incorporation latency from 2–4 weeks to under two days across all 27 member states. Built on eIDAS digital identity and sovereign cloud infrastructure, the system enables single-sign-on AI-assisted incorporation for startups, SMEs, and university spin-outs.

Baseline data shows 1.10 million annual filings in 2025. Projections indicate a 22% increase to 1.34 million by 2027—adding roughly 240,000 new entities. AI-intensive startups (biotech, clean-tech, SaaS) now represent 22% of filings, up from 18%, unlocking an estimated €800M in additional Horizon-Europe AI funding access.

Costs plummet: average incorporation expense drops from €1,200 to €300, generating €1 billion in EU-wide savings. Latency reduction accelerates time-to-revenue, enabling faster grant applications and VC fundraising cycles.

Technical safeguards ensure integrity: eIDAS-verified identities + EU-wide sanctions API reduce AML/KYC false negatives to ≤0.1%. AI risk-scoring (confidence >0.95) and mandatory fiscal declarations limit illicit shell companies to ≤0.05% of filings. Sovereign cloud infrastructure, ISO-27001 certified and 2x over-provisioned, maintains 99.9% SLA even during 200k+ daily registration surges.

Cross-border cluster formation is accelerating: Vienna-Berlin-Paris startup corridors are emerging, cutting due diligence costs by 30%. Standardized governance templates reduce duplicate compliance filings by 30%, freeing administrative capacity for R&D.

Near-term impact: €180M in additional AI budget spend within six months. By 2027, a €12B pan-EU VC pool is projected to form, anchored by unified registration and transparent data flows.

Recommendations: enforce real-time eIDAS verification, publish OpenAPI specs for national registries, deploy live KPI dashboards linked to the AI Act Service Desk, and mandate 48-hour post-registration audit windows. Failure to act risks exploitation by non-EU actors seeking to undermine digital sovereignty.

This is not just bureaucracy reform—it’s infrastructure for Europe’s AI-driven entrepreneurial future.

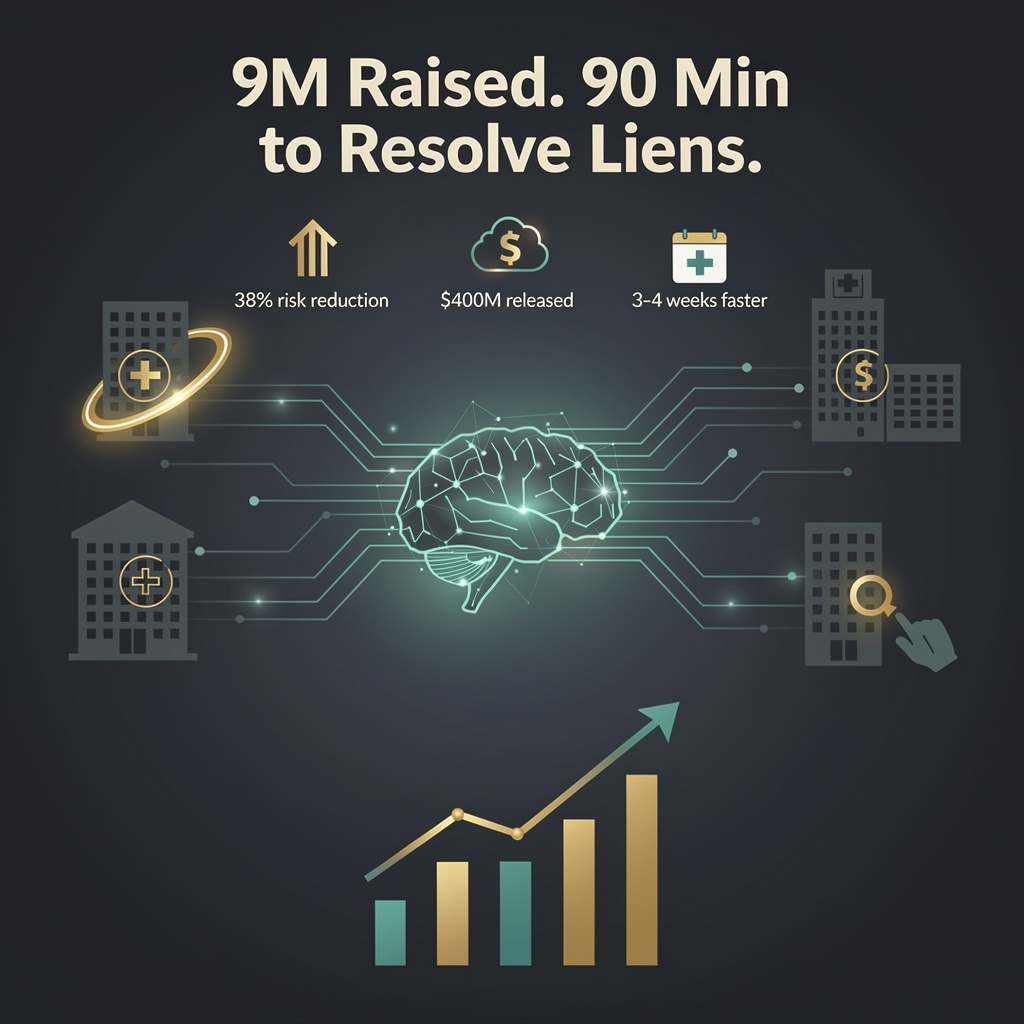

📊 Can Real-Time SKU Reallocation Cut Retail Write-Offs by 10%?

Another raises $2.5M to solve retail off-channel inventory waste. Sub-200ms latency. F1≥0.85 SKU matching. Immutable audit logs. Pilot targets 5-10% write-off reduction. No hype. Just constraint surfaces. #RetailTech #AI #InventoryOptimization

Another’s $2.5M seed round, led by Anthemis FIL, targets a structural inefficiency: off-channel inventory misalignment. The startup’s engine synchronizes unsold stock across Amazon, Walmart, eBay, and retailer ERPs via OpenAPI 3.0 connectors, aiming for sub-200ms latency and F1 ≥0.85 SKU-matching accuracy.

Three technical invariants define success:

- API integrity — Immutable audit logs for every price-floor adjustment, hashed and timestamped. Regulatory exposure is mitigated not by avoidance, but by traceability.

- Master-data convergence — Schema-mapping microservices normalize 12+ divergent product taxonomies. Without this, real-time allocation is noise.

- Latency discipline — Edge nodes process webhook triggers before cloud aggregation. If latency exceeds 200ms, revenue recovery collapses toward <2% savings.

Pilot KPIs are non-negotiable: ≤3% write-off reduction in first 4 weeks; ≥5% sell-through lift by month 6. Failure to meet these triggers model retraining, not scaling.

The market’s demand is not for more AI, but for precision-engineered parasitism — systems that extract value from existing, fragmented infrastructure without disrupting it. Another does not build a new inventory system. It maps the gaps between them.

Anthemis FIL’s conditional $1M convertible note — tied to ≥4% write-off reduction — aligns capital with empirical validation. This is not speculative funding. It is a controlled experiment in distributed retail equilibrium.

If the graph-based similarity algorithm secures its provisional patent by Q2 2026, and three anchor retailers (>$500M revenue) confirm ROI by month 8, the path to a $10–15M Series A becomes a matter of measurement, not vision.

The system’s resilience lies not in its ambition, but in its constraint surfaces: no overreach, no unverified assumptions, no assumption that data is clean until proven otherwise.

What emerges is not a platform. It is a feedback loop with guardrails.

—

The value of real-time inventory is not in speed alone, but in the fidelity of the signal it carries.

Comments ()