California’s $950M Billionaire Tax Sparks Tech Exodus: $200B Capital Flight Risk as Page, Ellison Sell Assets and 45 LLCs Flee

California’s 5% billionaire wealth tax could raise $950M—but risks $200B tech capital flight. $73M in real estate sold by Page. 45 LLCs relocated. 5K–10K jobs at risk. Ballot deadline: Jun 24, 2026. #WealthTax #TechExodus #California #BillionaireTax #EconomicPolicy

California’s proposed 5% wealth tax on residents with net worth ≥$1B—retroactive to Jan 1, 2026—targets 250–255 individuals and projects $950M in revenue, with 40% allocated to Medicaid, 35% to K–12 nutrition, and 25% to public health. But fiscal gains may be offset by capital flight.

SEC filings confirm $73M in Bay Area real estate sold by Larry Page and $45M by Larry Ellison. Forty-five LLCs have re-registered in Delaware, Nevada, or Texas. Early asset transfers total $150M–$250M; analysts project up to $200B in tech-sector capital relocation if enacted—a 10% shift of California’s billionaire wealth pool.

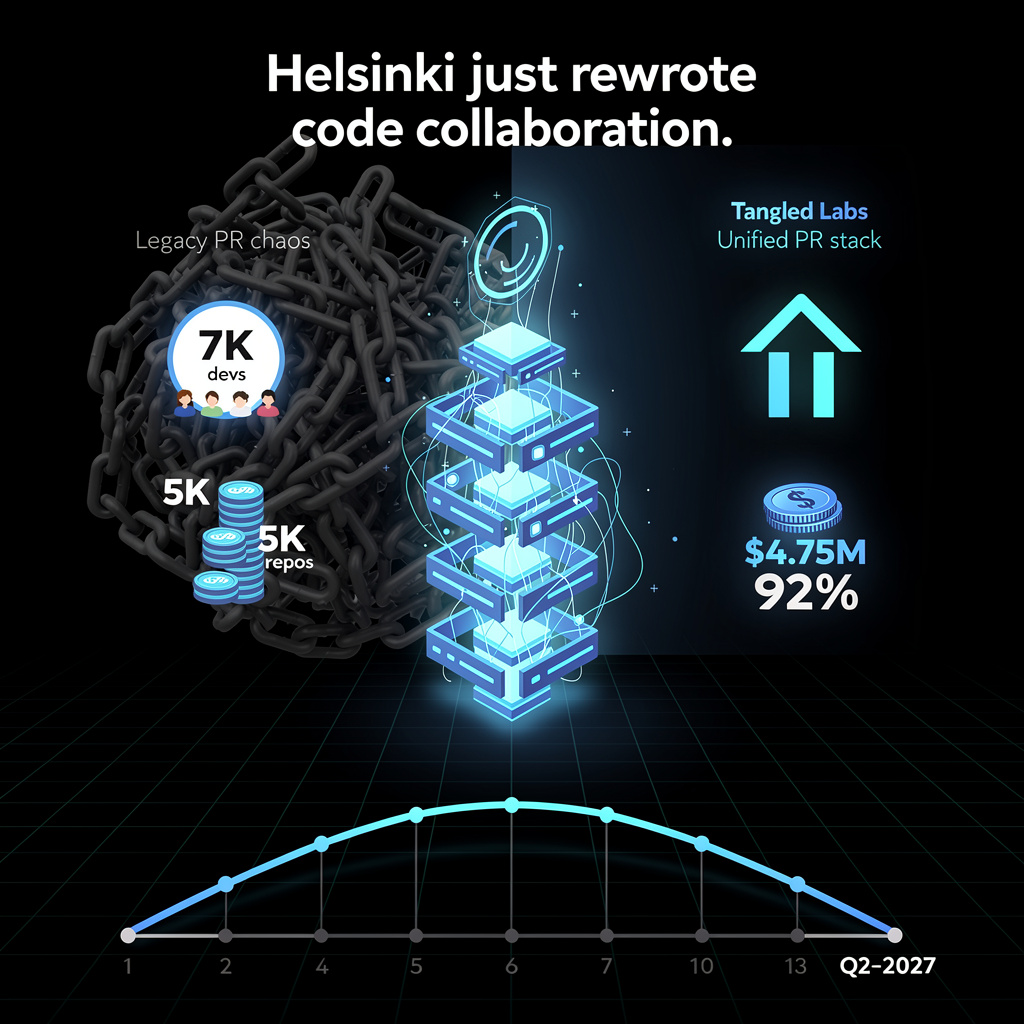

UC Berkeley’s econometric model estimates 5,000–10,000 tech jobs at risk if capital outflows exceed 8% of sector value. The tax must gather 870,000–900,000 valid signatures by June 24, 2026, to reach the November 2026 ballot. Current petition trends show 92% of the threshold met.

Polling (Jan 2026): 48% support, 44% oppose. Legal challenges are anticipated on retroactivity, dual-class share valuation, and constitutional uniformity. Opposition is funded by Peter Thiel ($3M to PAC) and the California Business Roundtable; support comes from Rep. Ro Khanna and economist Gabriel Zucman.

Federal Medicaid cuts and OECD’s 15% global minimum corporate tax have widened California’s $45B FY2027 deficit, making this tax a fiscal stopgap. Yet OECD data show most wealth taxes raise <0.3% of GDP; France’s 2022–23 experience warns of limited yield and high evasion.

Policy Recommendations:

- Implement a graduated rate: 3% on $1B–$5B, 5% above $5B.

- Define valuation rules for illiquid assets and dual-class shares.

- Bond $950M revenue to earmarked programs to insulate funding.

- Offer R&D matching grants to incentivize retention.

Revenue efficiency: ≥85% collection expected if passed → $800M–$950M realized by FY2027. But capital flight risk remains systemic.

In Other News

- Sequoia Capital, GIC, and Coatue Lead $25B Funding Round for Anthropic at $350B Valuation, Backing Claude AI

- AtaiBeckley Group Raises $300M in Capital and Redomiciles to U.S. to Advance Mental Health Therapeutics Pipeline

Comments ()