Trump Faces 2026 Midterms; Supreme Court Revises Finance Rules; US Takes Strike on Drug Boats

TL;DR

- Trump faces headwinds in 2026 midterms; Democrats likely gain control of Congress, raising concerns over affordability and policy resets.

- Supreme Court loosens campaign finance rules, challenging 50‑year limits on coordinated spending.

- US military strikes eliminate drug boats off Venezuelan coast, intensifying anti‑narcotic enforcement.

- ICE Operation Metro Surge in Minnesota yields 19 arrests, spotlighting immigration enforcement focus.

- US welcomes revised security strategy aligning with Russia, signaling shift in diplomatic posture.

- US withdraws from Afghanistan, leaving $7.1 bn in weaponry, raising concerns over defense budget allocation.

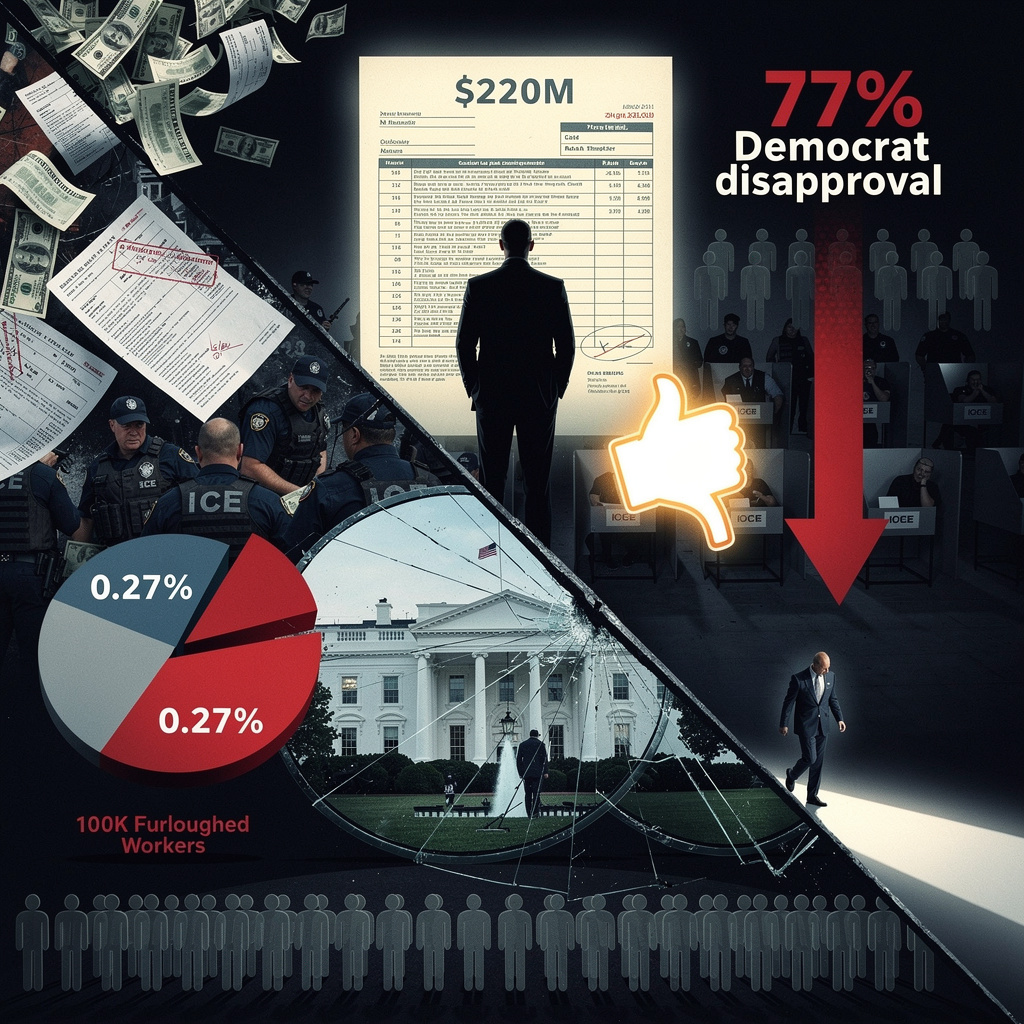

Affordability Gap Threatens GOP in 2026 Midterms

Affordability Dominates Voter Concerns

- Seven in ten voters cite rising food, housing, and health‑care costs as their top personal worry.

- 78 % of the nation backs extending ACA tax‑credit subsidies; even 57 % of self‑identified MAGA Republicans support the extension.

Trump’s Economic Credibility Erodes

- Yahoo News poll: Trump approval 43 % vs. 55 % disapproval of the economy.

- NBC/YouGov: 66 % rate the administration “fell short” on the economy.

- While 51 % still approve of Trump’s overall economic approach, only 32 % approve of his handling of inflation, a gap that widens among 18‑29‑year‑olds (from +10 pts to –46 pts).

Democrats Making Inroads

- Marist poll: Democrats lead the generic ballot by 14 pts nationwide.

- Special House election in Tennessee: Democrat Matt Van Epps wins by 9 pts, signaling a swing in a traditionally GOP district.

- County‑level flips in New Jersey and Virginia show Democratic gains of 10 pts or more.

Republican Disarray

- Speaker Mike Johnson faces criticism from rank‑and‑file and high‑profile members such as Elise Stefanik and Anna Paulina Luna.

- Departure of Marjorie Taylor Greene and announced retirements of more than 20 House members weaken GOP cohesion.

- Health‑care proposals like “MAHA accounts” lack bipartisan traction, leaving the party without a credible alternative to ACA subsidies.

What the 2026 Midterms Likely Look Like

- Democratic control of the House appears likely, given the 14‑point generic lead and recent special‑election gains.

- Senate control remains possible for Democrats, though margins are narrower.

- Projected Republican net seat loss in the House: 5–12 seats.

- Trump’s personal vote share projected around 42 % overall, dropping below 30 % among younger voters.

- Public support for ACA subsidy extensions expected to stay above 70 % across party lines.

The GOP must craft a tangible affordability platform—ideally a bipartisan health‑care compromise—to stop the drift toward Democratic dominance.

Supreme Court poised to reshape coordinated campaign‑finance limits

Legislative and judicial backdrop

- 1971 – Federal Election Campaign Act creates coordinated‑expenditure caps (e.g., $63,600‑$3.9 M for House races).

- 2001 – FEC v. Colorado Republican Federal Campaign Committee upholds those caps.

- 2010 – Citizens United v. FEC eliminates restrictions on independent corporate and union spending.

- 2014 – McCutcheon v. FEC removes aggregate contribution limits for individuals.

- 2024 – Arguments heard in NRSC v. FEC challenge the 50‑year‑old caps.

- 2025 – Oral arguments scheduled on the constitutionality of 52 U.S.C. § 30116(d) limits.

- 2026‑2028 – Anticipated impact on two federal election cycles.

Case at issue

- Petitioner: National Republican Senatorial Committee (NRSC).

- Defendant: Federal Election Commission (FEC).

- Claim: Coordinated‑expenditure caps infringe the First Amendment by restricting party assistance to nominees.

- Amicus: 14 states and several Republican entities support NRSC; Democratic groups and the Brennan Center oppose.

Key financial metrics

- House race caps: $63,600 – $3.9 M.

- Senate race caps: $63 k – $1 M.

- Presidential candidate cap: $3.5 M.

- 2024 joint fundraiser for Vice‑President Harris – maximum individual contribution $929,600.

- Aggregate donor contributions to party‑candidate coordination (2024 cycle) estimated at $1.2 B.

Observed patterns

- Judicial trajectory favors deregulation, extending Citizens United and McCutcheon precedents.

- Post‑McCutcheon donations have risen sharply; coordination caps now represent a modest portion of total party fundraising.

- State coalitions backing NRSC signal a coordinated effort to shape federal campaign‑finance jurisprudence.

- Eliminating caps would merge “independent” and “coordinated” spending streams, allowing unlimited donor funds to flow directly to candidate campaigns.

Projected financing outcomes

- Caps upheld: Coordination limits remain; parties continue to rely on independent‑expenditure structures; total party‑candidate spending sees limited growth.

- Caps struck down: Unlimited donor funds can be pooled for direct candidate support; modeling predicts a ≈30 % rise in party‑direct spending, based on 2024 donor flow; heightened risk of quid‑pro‑quo dynamics and reduced donor‑intent transparency.

Systemic implications

- A ruling against coordination caps extends First‑Amendment protection to party structures, consolidating the view that contributions are core political speech.

- The FEC would need to overhaul reporting to capture previously exempt coordinated expenditures.

- Parties could allocate high‑net‑worth contributions with greater precision, amplifying donor influence on candidate messaging and ballot access.

- Monitoring post‑decision rulemaking and state‑level legislative responses will be essential to assess long‑term effects on electoral integrity.

U.S. Kinetic Campaign Against Venezuelan Drug Boats: Data, Law and Policy

Operational Scale

- Strikes on vessels (Sep 2025 – Dec 2025): 22‑23 go‑fast boats

- Confirmed deaths: 87‑90 individuals

- Follow‑up “double‑tap” killings of survivors: 2

- Largest single seizure: >20 000 lb of cocaine

- Total cocaine interdicted to date: ≈100 000 lb (≈45 % of estimated cargoes)

Chronology of Key Actions

- 2 Sep 2025 – First kinetic strike destroys a 40‑ft boat, 11 persons killed (including 2 children).

- Oct 2025 – Operations expand into the Eastern Pacific; first Pacific‑area vessel eliminated.

- 22 Oct 2025 – “Double‑tap” strike on the same vessel after survivors surfaced; order confirmed in congressional briefing.

- 4 Dec 2025 – Cumulative metrics above reported.

- 7 Dec 2025 – Senate Intelligence and House Armed Services committees hold hearings on the legality of follow‑up strikes.

Legal Contours

- Double‑tap legitimacy: Defense officials argue residual threat justification; critics cite proportionality and duty to render aid, labeling the practice a potential war crime.

- War‑powers authority: Administration cites inherent power to protect U.S. borders from narcotics‑linked threats; congressional resolutions contend that sustained kinetic actions exceed presidential authority without a formal war declaration.

- Cartel terrorist designations: November 2025 listings of “Cartel de los Soles” and “Tren de Aragua” provide a legal veneer for lethal action; opponents claim evidentiary standards are insufficient.

Regional Dynamics

- Infrastructure upgrades on Tobago (radar, runway, roads) enhance surveillance for future interdictions.

- Limited U.S. access granted by the Dominican Republic and Trinidad & Tobago for counter‑drug missions, despite public opposition exceeding 70 %.

- Drone sortie frequency rose from 3 per week (Sept 2025) to 7 per week (Nov 2025), indicating operational scaling.

Forecast and Policy Implications

- Projected strikes in the next six months: >30 vessels, fatalities >120, cocaine interdicted ≈150 000 lb.

- Anticipated congressional action: renewed War Powers Resolution within 3‑6 months may curb “double‑tap” use but is unlikely to halt the core interdiction effort.

- Strategic shift toward multilateral surveillance—evidenced by radar agreements and infrastructure support—suggests a move away from unilateral kinetic reliance.

Takeaway

The campaign delivers measurable disruption of narcotics flows while generating persistent legal and diplomatic challenges. Sustained effectiveness will depend on clear rules of engagement, congressional oversight, and deeper regional partnership.

ICE’s “Operation Metro Surge” in Minnesota: Policy Clash and Detention Realities

The Numbers

- 19 undocumented individuals were detained during the December 7, 2025 operation.

- Demographics: seven Somali nationals, three Mexican nationals, two El Salvadoran nationals; remaining detainees are of unspecified origin.

- Criminal histories: no violent convictions documented for any of the 19 detainees; national ICE data show over 70 % of detainees lack prior criminal records.

- ICE operational goal: 3,000 arrests per day nationwide; average actual arrests stand at approximately 824 per day.

Policy Narrative vs. Detention Profile

- ICE statements cite “public safety threats, national security threats, and illegal presence” as justification for the sweep.

- Data from Minnesota, New Orleans, and other recent sweeps reveal a consistent mismatch between cited threat levels and the criminal profiles of those detained.

- Federal funding continues to prioritize large‑scale removal actions despite limited correlation with violent or organized‑crime offenses.

Local Resistance and Institutional Impact

- State officials deny any racial targeting in the operation.

- Municipal leaders, including the mayor of Minneapolis, have previously limited cooperation with ICE, invoking sanctuary policies.

- Augsburg University issued an advisory after a student was approached on campus, demonstrating the extension of enforcement activity into academic settings.

Emerging Patterns

- Increased reliance on “reasonable suspicion” thresholds in neighborhoods with high immigrant density, independent of documented criminal activity.

- Enhanced monitoring of social‑media discourse related to enforcement actions, indicating a broader surveillance component.

- Legal challenges are rising as local jurisdictions contest the scope of ICE authority under constitutional and anti‑discrimination statutes.

Looking Ahead

- Continued implementation of targeted sweeps in Minnesota and comparable jurisdictions is anticipated, driven by federal deportation benchmarks.

- Litigation from civil‑rights groups and municipal governments is expected to intensify, focusing on alleged violations of due process and equal‑protection rights.

- Operational adjustments may shift ICE focus toward financial‑crime investigations, such as illicit money‑transfer networks, to align arrest metrics with prosecutable offenses.

U.S. Security Strategy Shifts Toward Moscow: What It Means for Europe and Ukraine

From Direct Threat to Flexible Realism

The December 7 National Security Strategy replaces the “direct threat” label for Russia with a “flexible realism” framework. The Kremlin’s press secretary, Dmitry Peskov, welcomed the language as “largely consistent with our expectations,” signaling Moscow’s readiness to engage on a revised set of premises. By reframing the bilateral dynamic, Washington signals a willingness to explore limited cooperation while retaining core U.S. interests in strategic stability.

European Burden‑Sharing on the Table

The strategy reiterates NATO’s “Hague Commitment” of 5 % of gross domestic product for defense, contrasting with the current European average of roughly 3 %. The document ties U.S. assistance to measurable European contributions, effectively making fiscal support contingent on a tangible increase in defense spending. Data‑driven forecasts anticipate a gradual climb toward 4 % of GDP by 2027, driven by diplomatic pressure and upcoming NATO budget reviews.

Strategic Leverage in Peace Negotiations

Zaporizhzhia nuclear plant negotiations feature prominently. Six reactors remain under partial Russian control, making the facility a focal point for any cease‑fire framework. The softer U.S. stance provides Moscow a diplomatic foothold to demand “radical changes” in the U.S.–UK peace plan, potentially accelerating talks if Kyiv’s security guarantees can be reconciled with Russian preconditions.

Risks to NATO Cohesion

U.S. emphasis on burden‑sharing may provoke internal debate within the alliance. Historical patterns show that “America First” policies can strain collective resolve, especially if member states perceive a reduction in guaranteed U.S. commitment to forward‑deployed operations. Maintaining alliance unity will depend on transparent articulation of shared security objectives and a balanced approach to fiscal expectations.

Short‑Term Outlook (2025‑2026)

- U.S.–Russia strategic dialogue: Incremental increase in formal contacts, likely limited to confidence‑building measures such as arms control and cyber norms.

- European defense spending: Gradual rise toward 4 % of GDP by 2027, contingent on U.S. pressure and NATO budgetary reviews.

- Ukraine peace talks: Conditional progress; core issues—Zaporizhzhia control and territorial concessions—remain bottlenecks.

- NATO cohesion: Potential strain as U.S. burden‑sharing emphasis sparks debate over alliance commitments.

The revised strategy marks a measurable pivot from confrontation to calibrated engagement with Moscow. While the approach may lower immediate escalation risks, it also places new demands on European allies and introduces uncertainty into Ukraine’s path to peace. Continuous monitoring of defense spending trends, NATO discourse, and the status of key negotiation points will be essential to gauge the durability of this strategic realignment.

U.S. Weapon Residue in Afghanistan Threatens Future Defense Spending

Financial Legacy of the Afghan Mission

- U.S. invested $144.7 bn in the Afghan National Defense and Security Forces from 2002‑2021.

- Audit of the 2021 withdrawal identified $7.1 bn in abandoned weapons, vehicles and facilities.

- Forensic review revealed $26‑29.2 bn classified as waste, fraud or abuse, including unauthorized base construction.

Escalating Regional Risks

- At least 63 seized weapons in Pakistan match U.S. serial numbers; these rifles and carbines surpass pre‑2021 Afghan stock.

- Approximately 6,000 TTP fighters now field a mix of U.S.-origin gear, contributing to a recent cross‑border assault in South Waziristan that killed 16 Pakistani security personnel.

- The diffusion of U.S. equipment expands the threat envelope beyond Afghanistan to neighboring Pakistan.

Congressional Defense Budget Surge

- The 2025 reconciliation proposal adds $150 bn of mandatory defense spending.

- Projected FY‑2027 defense request exceeds 3 % of GDP, with some legislators pushing toward 4 %.

- Funding growth is not currently tied to performance metrics or asset‑recovery safeguards.

Systemic Oversight Failures

- Absence of a mandatory asset‑disposition plan allowed $7.1 bn of materiel to vanish after the Afghan government collapse.

- Real‑time tracking mechanisms were missing, preventing verification of equipment status during the withdrawal.

- Historical waste patterns suggest that unchecked budget expansions risk repeating inefficiencies.

Policy Path Forward

- Embed asset‑recovery clauses in all future overseas appropriations; fund release contingent on verified disposition.

- Allocate a dedicated recovery fund equal to 1 % of the $150 bn reconciliation allocation for inventory, secure storage or destruction of abandoned materiel.

- Mandate annual independent audits during the wind‑down of any foreign operation, with findings reported to OMB and defense committees.

- Establish cross‑border intelligence‑sharing protocols with Pakistan to monitor and interdict the flow of U.S.-origin weapons into extremist networks.

Comments ()