US Navy Seizes Venezuelan Drug Ship, 83 Killed

TL;DR

- US Navy Eliminates All Aboard Suspected Venezuelan Drug Vessel, Killing 83 People

- Trump Claims Presidential Powers Unconstrained by Congress, Intensifying Constitutional Debate

- Canada Joins EU's SAFE Defense Fund, Reducing 70% of Military Spending Away from US

- DHS's SAVE Program Expansion Sparks Constitutional Concerns Over Voter Data Surveillance

- ICE Agents Fire at Fence, Injuring Women and Children During Midway Blitz Protest

Operation Southern Spear: A Shift in U.S. Counter‑Narcotics Tactics

From Kinetic Strike to “Double‑Tap”

- Sept 2 2025 – First missile strike on a vessel identified as a Venezuelan drug boat; 9‑11 crew members killed, two survivors left adrift.

- Hours later – A second strike, ordered by SecDef Pete Hegseth and executed by Adm. Frank M. “Mitch” Bradley, eliminated the survivors, raising the death toll to roughly 11 on a single target.

- Sept 7 – Oct 31 2025 – Additional engagements against more than twenty vessels in the Caribbean and Eastern Pacific, bringing total fatalities to approximately 83.

Legal and Policy Concerns

- LOAC compliance – Targeting individuals who were no longer combatants may breach the principle of distinction and the prohibition on attacking persons hors de combat.

- Congressional oversight – The Senate and House Armed Services Committees have launched formal inquiries into the authorization chain, citing 10 U.S.C. §§ 1622 and 18 U.S.C. §§ 2385‑2387.

- Executive authority – The White House cites Title 10 and the 2023 International Terrorism Authorization Act as the legal basis, a claim that remains untested in the courts.

- International ramifications – Venezuela and several EU members have labeled the strikes extrajudicial; the ICC could consider a pre‑investigation under the Rome Statute.

Emerging Patterns

- Preference for pre‑emptive lethal force over traditional board‑and‑search methods.

- Operational tempo accelerated: intervals between strikes fell from ten days (pre‑2025) to three days during the September‑December window.

- Increasing legislative scrutiny suggests a new norm of real‑time congressional review for high‑risk kinetic actions.

- Policy tension between counter‑narco‑terrorism objectives and adherence to LOAC standards.

Forecast for the Next Year

- Revised rules of engagement will likely require positive confirmation of combatant status before secondary strikes.

- After‑action reports to congressional committees are expected within 30 days of each engagement.

- Potential ICC pre‑investigation triggered by accumulated civilian casualty data.

- Gradual reintegration of non‑lethal interdiction to mitigate diplomatic fallout.

- Continuation and possible expansion of the State Department’s $50 M and $25 M bounty programs targeting Venezuelan leadership and cartel figures.

Trump’s Claim of Unchecked Presidential Power: A Data‑Driven Reality Check

Legal Battleground

- Supreme Court has scheduled oral arguments (Dec 8 – Jan 21) on the congressional role in removing members of independent commissions, directly revisiting FTC‑Humphrey (1933) and the executive‑primacy precedent set by *Curtiss‑Wright* (1936).

- Recent rulings show a judicial preference for expanding executive removal authority, suggesting a forthcoming decision that may further limit congressional oversight.

- A dissent by Justice McReynolds emphasizes the need for legislative safeguards, highlighting the split within the Court on this issue.

Historical Analogies

- Trump invoked Jefferson’s Louisiana Purchase, Obama’s 540 drone strikes, and Clinton’s NATO interventions as examples of unilateral executive action.

- Each historical case received judicial endorsement based on implied executive powers, especially in foreign‑affairs contexts, as articulated in *Curtiss‑Wright*.

- The frequency of these references—six distinct citations across two days—creates a coordinated narrative framing current claims as continuations of established precedent.

Public and Market Backlash

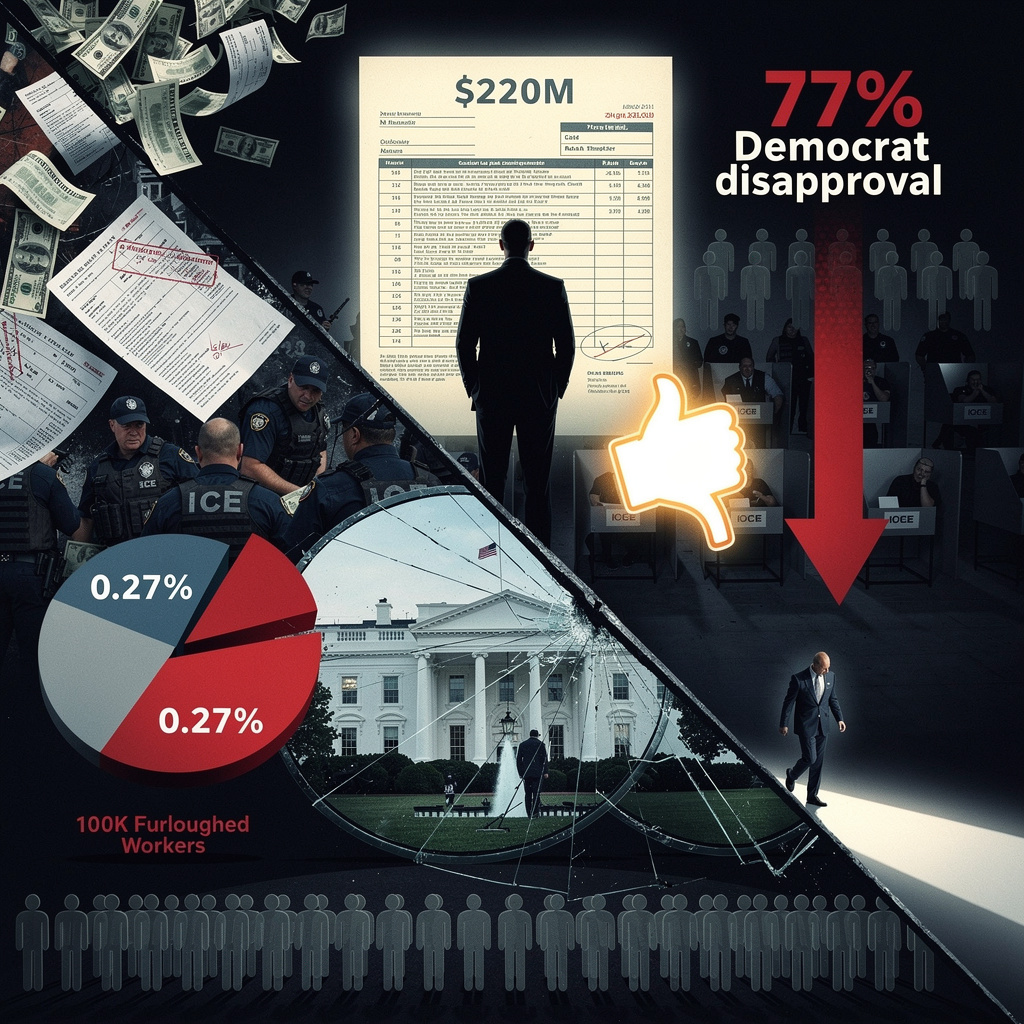

- Approval rating dropped to 36 % on Dec 1, with disapproval climbing to 60 % across party lines.

- Wall‑Street‑Journal reported a 86‑99 % decline in equities linked to the Trump family, erasing more than $1 trillion in market value.

- Rally attendance remains high (> 900 events since 2015), illustrating a mobilized base that operates independently of poll fluctuations.

Future Trajectory

- Legislative proposals are anticipated to amend FTC removal statutes and introduce appropriations riders that restrict unilateral foreign actions.

- Trump’s announced intent to act against Venezuelan leader Nicolás Maduro without congressional authorization introduces immediate diplomatic risk and may prompt swift congressional rebuttal.

- The 2026 midterm outlook could reflect a fracturing Republican coalition as voters weigh executive dominance against congressional authority.

Canada’s EU SAFE Move Rewrites the Trans‑Atlantic Defence Ledger

What the Numbers Reveal

- SAFE fund: €150 bn (≈ $170 bn) in loans for procurement that meets a 65 % EU‑origin component rule.

- Canada’s redirection: 70 % of its defence‑capital spending will now flow to EU‑based production lines.

- NATO budget pledge: 5 % of GDP by 2035, raising overall spend without prescribing supplier geography.

- Projected impact: Canadian contracts to EU firms could reach ~55 % of total value by 2028.

- U.S. export outlook: Anticipated 10‑15 % decline in defence sales to Canada over the next three years.

Why It Matters

- Supply‑chain diversification. The 65 % EU‑origin clause forces Canadian buyers to partner with firms such as Saab, Airbus, and Rheinmetall, reshaping their procurement ecosystem.

- Industrial leverage. The SAFE loan pool creates a financing conduit that can tilt future NATO contracts toward EU manufacturers, especially where joint projects require component‑origin compliance.

- Geopolitical friction. President Trump’s public suggestion that Canada become the 51st U.S. state signals heightened U.S. sensitivity; an export‑control review targeting SAFE‑eligible items is a plausible response.

- Budgetary symmetry. NATO’s 5 % GDP target inflates defence spend across the alliance, yet the EU‑SAFE mechanism uniquely channels a sizable share to European firms, counterbalancing historic U.S. dominance (> 50 % of NATO procurement).

Looking Ahead

- By 2028, EU‑origin components are likely to represent ~30 % of total NATO‑approved equipment spend, driven by SAFE financing and Canadian procurement shifts.

- SAFE loan utilization is projected to exceed 80 % of the €150 bn allocation, with a significant portion earmarked for Canadian‑EU joint projects.

- U.S. policymakers may enact targeted export‑control revisions, affecting the licensing of weapons and technology destined for SAFE‑compliant contracts.

- Canadian defence firms will need EU partnerships to maintain relevance; failure to adapt could marginalize them within the alliance’s evolving supply chain.

Bottom Line

Canada’s entry into the EU SAFE fund is more than a budgeting tweak—it is a strategic re‑orientation that redistributes the flow of defence capital across the Atlantic. The data point to a measurable erosion of U.S. market share, an accelerated rise of European defence producers, and a probable policy pushback from Washington. Stakeholders on both sides of the ocean should monitor procurement data, loan disbursements, and NATO contract allocations to gauge the long‑term balance of power in the alliance’s industrial base.

DHS SAVE Program Expansion Raises Privacy and Constitutional Concerns

Scope of the Expansion

- SAVE database now includes a ten‑fold increase in records, adding hundreds of millions of native‑born and tens of millions of naturalized citizens.

- Driver’s‑license numbers, Social Security numbers and passport data are stored alongside immigration status.

- Bulk verification queries return results within 48 hours; ICE performed roughly 900,000 NLETS searches in the past year.

State Reactions and Legal Action

- American Oversight filed a public comment and a coalition lawsuit alleging violations of the Privacy Act, which requires Federal Register notice.

- Republican‑led states Ohio, Florida, Indiana and Iowa settled with DHS, agreeing to a 90‑day memorandum of understanding that limits future data sharing.

- Oregon, Colorado and three other states blocked NLETS from supplying driver‑license data to ICE.

- Federal courts may review injunctions that could restrict voter‑purge use of SAVE data.

Constitutional Implications

- The aggregation of citizenship‑verification data without explicit legislative authority raises Fourth Amendment concerns over unreasonable searches.

- Use of the database to disqualify voters implicates the Fourteenth Amendment’s due‑process guarantees, especially where individuals receive no notice of a purge.

- Privacy‑Act non‑compliance creates a procedural vulnerability that courts could deem sufficient for injunctive relief.

Emerging Trends and Forecast

- DHS may issue a regulatory amendment to address Privacy‑Act deficiencies, potentially adding opt‑out options for U.S. citizens within the next 12 months.

- At least three additional states are expected to pass legislation prohibiting NLETS data sharing with federal immigration agencies by mid‑2026.

- Congressional hearings on a de‑facto national ID registry are scheduled for the upcoming session, which could lead to stricter oversight.

- Judicial rulings may limit bulk voter‑list checks, preserving individual due‑process rights.

Comments ()