AI‑Driven GPUs Poised to 100× Data Center Compute Power by 2025

Industry‑wide GPU spending is projected at $500 B for 2025‑26, feeding a $3‑4 T AI‑infrastructure budget through 2030. Major hyperscalers have lengthened depreciation from three to five years, with some vendors extending to six years. Extending asset life by 2‑3× translates into an estimated $7 B annual operating‑income lift, roughly 10 % for the largest cloud operators. Cash‑flow metrics now dominate performance reporting as CAPEX climbs into the trillion‑dollar range.

Compute Growth Benchmark

- Aggregate GPU compute: ~2 EFLOPs (2020) → ~200 EFLOPs (2025) → ≈100× increase

- Annual AI‑chip sales: $200 B (2020) → $500 B projected (2025‑26) → 2.5× growth

- Data‑center power demand: 1 GW (2020) → 7 GW (OpenAI) → 7× rise

- Weekly active ChatGPT users: 300 M → 800 M → 2.7× expansion

These metrics align with Nvidia’s Q4 revenue outlook of $65 B and a 60 % year‑over‑year sales increase, confirming the compute surge.

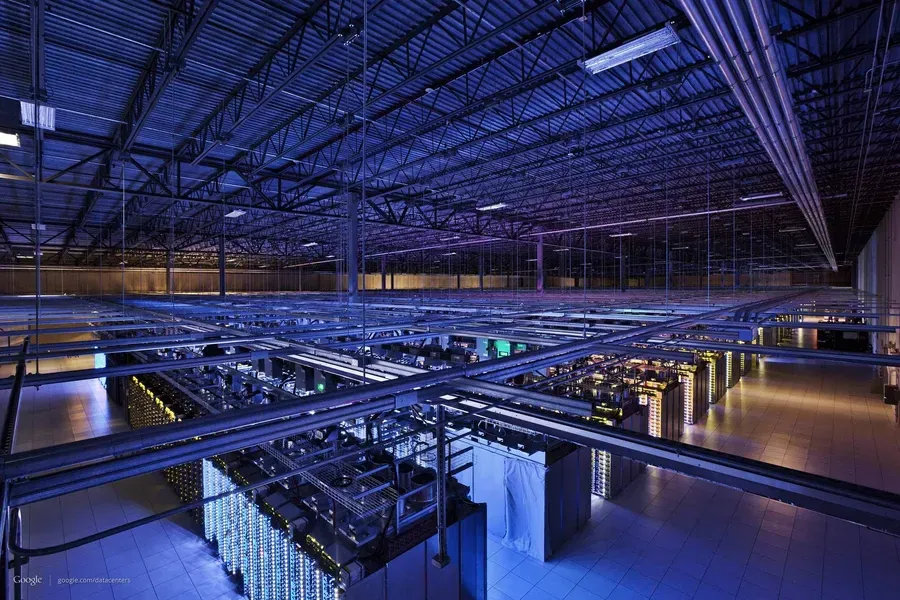

Cooling Innovations and Energy Efficiency

Adoption of liquid and evaporative cooling leverages water’s latent heat capacity (≈4 400 kJ / kg), exceeding air cooling by more than 4 000×. Resulting rack densities now support ten times more GPUs per unit, cutting floor‑space needs and lowering per‑GPU infrastructure cost by roughly 30 %. Closed‑loop evaporative systems achieve >95 % water recirculation, addressing resource constraints while extending GPU lifespan by 15‑20 %.

Market Structure and Competitive Dynamics

Nvidia commands 80‑95 % of the AI‑GPU market; its H200 chip delivers twice the performance of the H100 despite ongoing export controls. Emerging players—CoreWeave, Nebius, Lambda Labs, and the Saudi‑backed Stargate consortium (Microsoft, Nvidia, Arm)—scale dedicated AI clusters through joint‑venture equity. Google targets a six‑month capacity doubling cadence, implying a 1 000× scale‑up over 4‑5 years, while OpenAI’s 7 GW investment and Microsoft’s Cobalt 200 CPU rollout add further pressure.

Future Outlook (2026‑2030)

A convergent five‑year GPU asset life is expected to become industry norm, balancing rapid innovation against CAPEX amortization. By 2028, average rack power density should exceed 30 kW, driven by liquid cooling as the default architecture. Annual GPU spend is projected to rise ≈15 % YoY, fueled by model scaling (parameters >1 T) and EU AI‑Act‑induced private‑cloud migration. TSMC’s 60 % share of advanced AI‑chip fab capacity remains a strategic bottleneck; diversification via 3 nm and emerging‑node fabs is likely to accelerate after 2027.

Comments ()