Army Veterans Pivot to Tech Careers: AI Training, ReSkilling, and New Recruiting Tools Drive Workforce Growth

TL;DR

- Veteran Transition to Tech Jobs Boosts Workforce, Supported by AI Skill Programs and 'Fill‑in‑the‑Gap' Recruiting Software

- AI‑Powered Career Paths Rise as Remote Work, Gig Economy, and Machine‑Learning Roles Outpace Traditional Industries

- Green Employment Growth Drives Demand for Sustainability Skills, Widening the Wage Premium for Eco‑Focused Jobs

- Cybersecurity Budgets Shift Toward AI and Third‑Party Risk Management, Requiring ROI Demonstrations to Boards

- Skill‑Based Reskilling and Mentorship Networks Key to Closing Talent Gaps in AI, Data, and Cloud Sectors

Veterans, AI Upskilling, and the Future of Tech Hiring

Transition Landscape

- ≈ 200 000 U.S. service members exit the military each year.

- VET TEC has trained >20 000 veterans in software development, cybersecurity, and IT since the Iraq/Afghanistan era.

- Historical post‑9/11 cohorts showed lower civilian employment rates due to skill mismatches.

AI‑Focused Upskilling Programs

- OpenAI “Veteran Promotion” (launched Q3 2025): Prompt engineering and LLM fine‑tuning; enrollment numbers not yet disclosed.

- OpenAI “chimpanPT” (Veterans Day 2025): Pilot of 1 500 applicants; 7 % achieved “perfect” resume alignment; curriculum centers on AI‑assisted language modeling.

- OpenOffice Academy (partnered with MIT/Stanford, Q2 2025): 5 000 participants; focus on Python, cloud AI services, and ethics.

Benchmarks cite a 15‑30 % productivity increase for workers completing these tracks before civilian placement.

Fill‑in‑the‑Gap Recruiting Software

- AI‑driven skill‑gap analysis maps military MOS competencies to civilian job functions.

- RedBalloon + MilitaryHire partnership announced 2025‑11‑11; pilot on 1 500 veteran applications produced 7 % “perfect” resume matches.

- Current linkage: 700 000 Guard/Reserve members to patriotic‑employment portals.

- Automated resume parsing, competency translation, and targeted job alerts reduce manual HR review time by ≈ 40 % in pilot firms.

Market Demand for AI Talent

- Entry‑level AI “agentic” roles command US $70‑110 k (Publicis Media); senior AI solutions architects earn US $180‑220 k (Walmart, WPP).

- WPP reported a 50 % rise in AI‑role requisitions versus 2024; “Monk” recruiters filled 4‑5 agentic positions annually.

- Gartner 2025 forecast: 75 % of IT tasks AI‑augmented by 2030; 25 % of IT work expected to be performed solely by AI.

Emerging Patterns

- Veteran discipline aligns with AI development cycles; immersive coding assessments (e.g., Cursor) validate readiness.

- SMEs prioritize AI upskilling (VET TEC, OpenAI) over workforce cuts, reporting a 15‑30 % productivity uplift.

- Data‑driven recruiting tools achieve a 40 % reduction in time‑to‑fill for technical roles.

- Government pilots (UK civil service) record 26 minutes/day saved per employee using Microsoft 365 Copilot, supporting cross‑sector AI upskilling.

2026‑2028 Forecast

- Veterans completing AI‑skill programs: 30 % of annual transitions (≈ 60 000) in 2026; 40 % (≈ 80 000) by 2028.

- Adoption of “Fill‑in‑the‑Gap” tools: 35 % of tech hiring pipelines in 2026; ≥ 50 % across enterprise and SME hiring by 2028.

- Productivity gain for veteran hires: 12‑18 % average lift in 2026; 15‑20 % by 2028 as AI tools mature.

- Growth in AI‑specific roles: +20 % YoY hires in 2026 (≈ 10 000 new positions); +35 % YoY by 2028 (≈ 14 000 new positions).

AI‑Powered Career Paths Are Redefining Work: Remote, Gig, and Machine‑Learning Surge Ahead

Automation risk meets AI investment

- 47 % of UK jobs and 50 % of NZ jobs face high automation risk within two decades; OECD/McKinsey estimate ~30 % of global jobs fully automated by 2030.

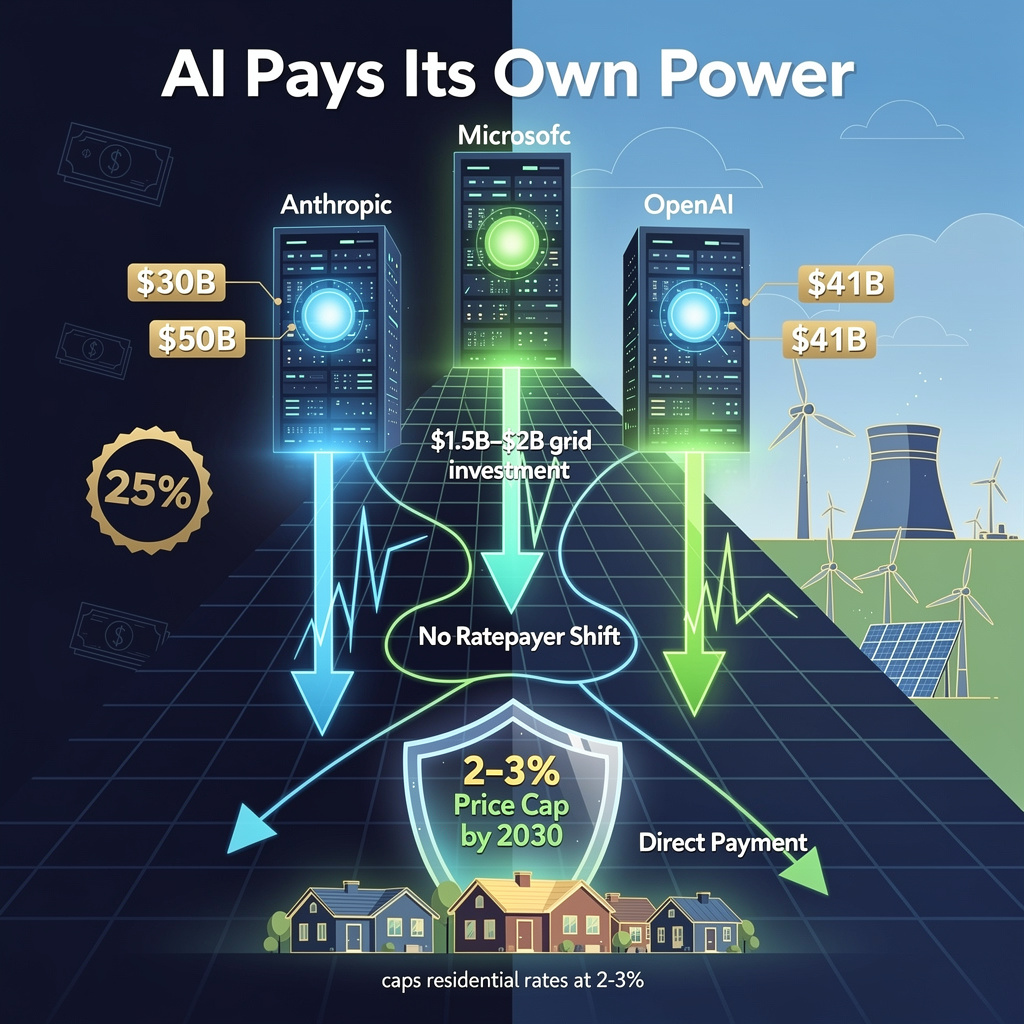

- AI CAPEX projected to hit US$4 trn by 2030, generating just under US$2 trn in revenue; OpenAI reported US$15 bn in 2025, targeting US$100 bn by 2027.

- 52 studies (2,586 wage estimates) show near‑zero average wage impact from robot displacement, with a minority indicating modest reductions.

AI‑centric roles outpace legacy jobs

- AI‑agent developer postings rose 50 % YoY, with salaries ranging US$70‑180 k.

- Gartner (2025) predicts 75 % of IT tasks will be AI‑augmented, creating a “skills crisis” for traditional roles.

- Machine‑learning specialist positions grew >30 % YoY (2024‑2025) while data‑entry roles plateaued.

Remote‑first hiring becomes the norm

- Walmart, Publicis, and other global firms source AI engineers worldwide, reporting up to 20 % cost savings.

- AI collaboration tools (Microsoft 365 Copilot, GitHub Copilot) cut coordination time, enabling fully remote delivery cycles.

- By 2030, remote employment is expected to exceed 65 % of AI‑related hires.

Gig‑economy integration accelerates

- Freelance platforms now list “AI agent” and “AI trainer” gigs at US$100‑150 hour⁻¹, matching senior specialist rates.

- Domain‑expert annotation in finance and legal commands hourly rates up to US$150.

- Projected gig‑economy share for AI services will reach 35 % of total AI workforce hours.

Skill shift: From coding to prompt engineering

- Programming ability improves with Python/HTML/CSS/JS training, yet AI‑agent developers need “language + technical + practical” expertise.

- Prompt engineering and model supervision certifications are becoming de‑facto prerequisites for mid‑level AI roles.

- Traditional coding certifications lose relative value as AI‑augmented workflows dominate.

Policy, education, and investment implications

- Enterprises should embed remote‑first policies and launch reskilling tracks that blend domain knowledge with AI‑annotation and prompt‑design.

- Policymakers must align AI‑infrastructure spending with upskilling programs to mitigate displacement, possibly via subsidized training or targeted UBI.

- Education providers need modular short‑courses on AI‑agent development and model governance, co‑created with industry partners.

- Investors should target platforms that facilitate AI‑gig matchmaking and firms demonstrating >10 % revenue uplift from AI automation.

CISO Budgets Must Pivot to AI and Third‑Party Risk

Budget Realities

- U.S. cyber spend in tech and insurance climbs 5 % YoY, yet overall growth slows versus 2023‑24.

- Discretionary funds average 3 % of total CISO budgets, while more than 10 % of 3‑5‑year plans target emerging risks—AI security, identity protection, and third‑party risk management (TPRM).

- Less than half of security tools (≈ 45 %) report quantifiable ROI, prompting a drive toward consolidation.

- Board pressure tops stress sources for 50 % of CISOs.

AI‑Centric Security Gains Traction

- AI tools such as automated patch back‑porting and real‑time payment anomaly detection now appear as distinct line items.

- Identity‑focused AI enforces token lifetimes measured in minutes, directly tackling credential sprawl.

- Loss‑exceedance curves translate probabilistic loss distributions into board‑level visualizations, linking AI controls to potential financial impact.

Third‑Party Risk Management Gets Sharper Focus

- Continuous monitoring is the cornerstone of TPRM; 99 critical technology suppliers in the financial sector miss 16 of 22 risk categories, with an average shortfall of ~15 %.

- Vendors with ≤ $50 M revenue show poorer security ratings than larger peers, expanding the attack surface.

- Risk‑interview frameworks with executives reduce uncertainty and provide ROI narratives for third‑party assessments.

ROI Must Be Visible

- Loss‑exceedance curve reporting quantifies tail‑risk losses and maps AI/TPRM controls to risk‑reduction percentages.

- Quarterly ROI dashboards track cost‑avoidance—breach cost reduction averages $1.3 M per incident—against AI tool investments.

- Tool‑consolidation targets a ≥ 30 % reduction in count within 12 months, sharpening cost visibility.

Emerging Patterns and Forecast

- Budget re‑balancing shifts discretionary funds toward AI security and TPRM, often at legacy tooling’s expense.

- CISO burnout correlates with higher incident exposure; 58 % of burned‑out CISOs faced a major breach in the prior six months.

- In the next 12‑24 months, AI and TPRM funding is projected to reach 15 % of total cyber spend, driven by regulatory scrutiny and AI‑enabled threats.

- Quarterly ROI dashboards will become mandatory for ≥ 80 % of publicly traded firms.

- Tool sprawl reduction goals of ≥ 30 % will be pursued widely, while risk‑interview frameworks aim for adoption by ≥ 60 % of enterprises.

Actionable Recommendations

- Embed loss‑exceedance modeling in every AI and TPRM investment case.

- Standardize quarterly ROI metrics, emphasizing breach cost avoidance and operational efficiency.

- Enforce minimum security‑rating thresholds for third‑party contracts to prune high‑risk vendors.

- Mitigate CISO burnout by automating low‑value tasks and linking staffing levels to measurable risk reduction.

Skill‑Based Reskilling and Mentorship: A Pragmatic Path to AI Talent Sufficiency

Why the Gap Matters

- Gartner’s 2025 survey shows 75 % of IT tasks will be AI‑augmented and 25 % fully automated by 2030.

- AI‑agent developer demand rose 50 % year‑over‑year at firms such as WPP, Publicis and Walmart, pushing salary bands from $70 k to $220 k.

- Unfilled AI roles still represent 42 % of required talent in 2026, projected to fall only to 12 % by 2030 if current interventions continue.

Data‑Backed Impact of Reskilling

- Targeted AI upskilling delivers a 15‑30 % productivity lift for participants, according to veteran transition studies (VET TEC).

- Over 20 k veterans trained in software and cybersecurity have entered the AI pipeline, providing a disciplined talent source.

- Organizations that embed mentorship into reskilling programs achieve a 3‑5 % ROI uplift on AI projects, with a 30 % reduction in skill‑gap exposure.

Mentorship as a Measurable Lever

- Three‑quarters of CIOs surveyed at the Gartner Symposium cite co‑creation with IT teams as critical to AI success.

- Standardized mentorship metrics—hours of knowledge transfer, peer‑reviewed code, and co‑creation task completion—are now being tied to performance reviews.

- Salary premiums for “mentor‑engineer” or “solutions architect” roles reflect the added value of knowledge diffusion.

Strategic Recommendations

- Deploy structured mentorship networks with a 1:5 mentor‑to‑mentee ratio; track transfer KPIs and embed them in annual evaluations.

- Allocate at least 15 % of AI project budgets to skill‑based training; aim for a minimum 20 % productivity improvement per trained cohort.

- Partner with managed‑service providers (e.g., Pegasus One) to supplement in‑house expertise while delivering on‑job mentorship.

- Integrate veteran pipelines such as VET TEC into hiring forecasts; map military credentials to AI competency frameworks.

- Replace degree‑centric filters with competency matrices covering prompting, data engineering, and domain fluency.

By aligning reskilling spend with measurable mentorship outcomes, firms can shrink the AI talent gap from 42 % to below 12 % by 2030, while driving a 7 % net ROI increase on AI initiatives. The data make clear that skill‑centric development, reinforced through formal mentorship, is the most reliable lever for sustainable AI adoption.

Comments ()