AI Startups Secure Milestone Funding; Vistara Advances with $450M Capital Round

TL;DR

- New Pacific Northwest Fund Targets Startup Growth in Seattle and Portland

- Service Provider Capital Names Three GPs for New PNW Fund

- Series of AI Startups Secure Multi-Million Funding in Q3

- Vistara Growth Closes Fifth Structured-Capital Fund of $450M

- Pacific Northwest Regional Funds Shift Mirrors Broader Move to Local Startup Financing

AI Start‑ups Experienced Funding Surge in Q3 2025

Funding Overview

- 19 disclosed rounds raised >$1.3 billion.

- Three financing tiers dominate:

- Series C/Pre‑IPO (> $100 M): d‑Matrix ($275 M), Armis Security ($400 M).

- Series A/B ($30‑$100 M): Wonderful ($100 M), Sweet Security ($75 M), WisdomAI ($50 M), Foxglove ($40 M).

- Seed/early‑stage (< $10 M): Uare.ai ($10.3 M), Seismic ($1.7 M), Quickads ($1 M), Tensormesh ($4.5 M) plus ~30 M total in other early rounds.

- Hybrid structures appear in two deals (Theo Ai credit $3.4 M, BoomPop equity + debt $25 M).

Sectoral Highlights

- AI hardware & compute: d‑Matrix, Armis Security, Foxglove combined >$790 M, reflecting demand for specialized processors and secure hardware platforms.

- Cybersecurity: Sweet Security and Armis Security secured $475 M, underscoring market pressure for AI‑driven threat mitigation.

- Data infrastructure & automation: WisdomAI, Wonderful, Finnable attracted $105 M, aligning with enterprise AI rollout.

- Healthcare AI: Amae Health raised $25 M, indicating continued niche interest.

- Geographic spread: Investors from the U.S., Israel, Europe, and India; notable Indian round (Finnable ₹250 cr ≈ $30 M).

Emerging Trends

- Capital‑intensive domains (hardware, security) dominate >$100 M rounds, signalling strategic bets on compute scarcity and regulatory compliance.

- Increasing use of non‑equity financing (debt/credit) to preserve founder ownership while meeting capital‑heavy deployment schedules.

- Strategic investors (NVIDIA NVentures, Temasek) repeatedly back infrastructure‑focused start‑ups, mirroring industry moves toward in‑house compute capacity.

- Asian participation grows, as shown by Finnable’s sizable round, while U.S. venture capital remains the primary source for later‑stage deals.

Forecast (Q4 2025 – 2026)

- Expect ≥3 additional >$100 M rounds in AI hardware and cybersecurity, driven by ongoing compute constraints.

- Hybrid financing likely to rise 15 % as mid‑stage firms seek growth without dilution.

- Seed‑stage capital should stay within $30‑$40 M per quarter, supported by diversified syndicates.

- Corporate venture arms will deepen stakes in infrastructure start‑ups, aligning capital deployment with long‑term compute strategies.

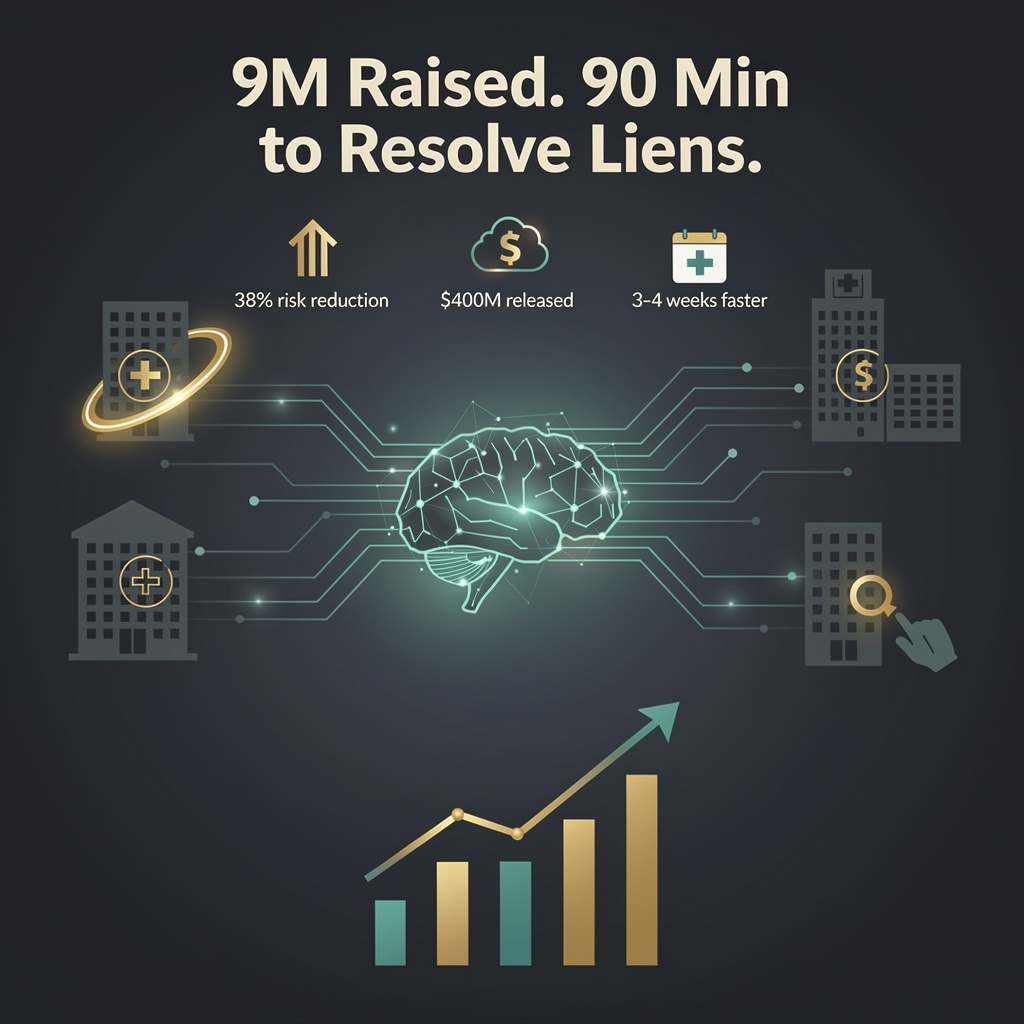

Structured‑Capital Funds Accelerate in Tech Finance

Fund‑Size Leap Signals LP Confidence

- Vistara Growth’s Fund V closed at $450 million, a 66 % increase over Fund IV.

- Approximately $700 million of commitments came from family offices, foundations, wealth managers and tech entrepreneurs.

- The fund targets 15‑18 portfolio companies over a ten‑year horizon, with eight “growth‑debt” deals completed during the raise.

Speed of Capital Deployment

The market now rewards rapid closures. Flagship Fund III secured more than two‑thirds of its target within seven weeks, mirroring Vistara’s ability to finalize a $450 million vehicle in roughly one month. Faster fundraising shortens the capital‑allocation lag, allowing investors to move alongside fast‑growing technology firms.

Diverse LP Base Reduces Concentration Risk

Family‑office capital has moved into structured‑debt vehicles, seeking predictable yields without surrendering equity upside. This shift broadens the traditional LP pool, diluting reliance on institutional investors and providing a steadier capital flow for founders who prefer to preserve control.

Sector Breadth Within a Single Fund

Vistara’s early investments span government technology, healthcare software, cybersecurity, and enterprise AI. Such cross‑segment exposure mitigates concentration risk while creating opportunities for synergy—AI capabilities can be layered onto cybersecurity platforms, for example, expanding the value chain for multiple portfolio companies.

Continuation Vehicles Reinforce the Trend

In Q1 2025, continuation‑fund transactions reached $41 billion, with 75 % of the top 50 private‑equity firms employing the structure. The prevalence of these vehicles underscores the market’s acceptance of hybrid debt‑equity solutions as a standard toolkit, reinforcing the strategic positioning of funds like Vistara’s.

Implications for Portfolio Companies

Growth‑debt financing preserves founder equity, aligning long‑term strategic goals with capital availability. A $450 million pool spread over ten years translates to roughly $30 million of quarterly deployment, enabling staged financing that matches scaling milestones while limiting cash‑flow strain.

12‑Month Outlook

Assuming linear drawdown, Vistara should reach its target portfolio size by Q4 2026. Family‑office allocations to structured‑capital funds are projected to grow 15‑20 % year‑over‑year, fueled by Fund V’s performance. If this trajectory continues, Fund VI could target $600‑$650 million, contingent on sustained LP appetite and sector demand. The convergence of rapid fund closures, diversified LP sources, and broad sector exposure marks a structural shift in technology financing—structured‑capital vehicles are becoming the preferred conduit for growth‑stage companies seeking capital without relinquishing control.

Comments ()